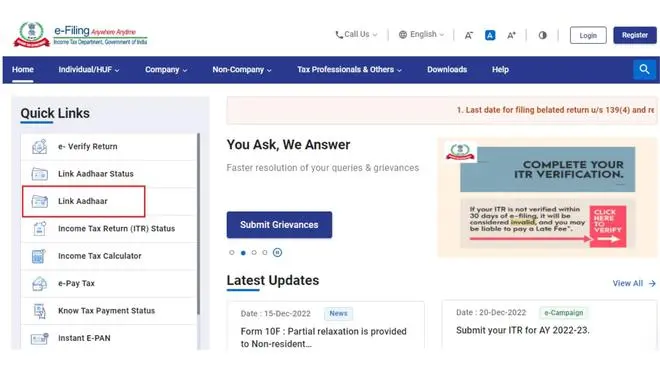

Step 1: Go to the official website of the Income Tax Department: https://www.incometax.gov.in/iec/foportal

Step 2: Go to the quick links section and select the ‘link Aadhaar’ option.

Click to link Aadhaar.

Also read: 5 steps to link your PAN card to your EPF account

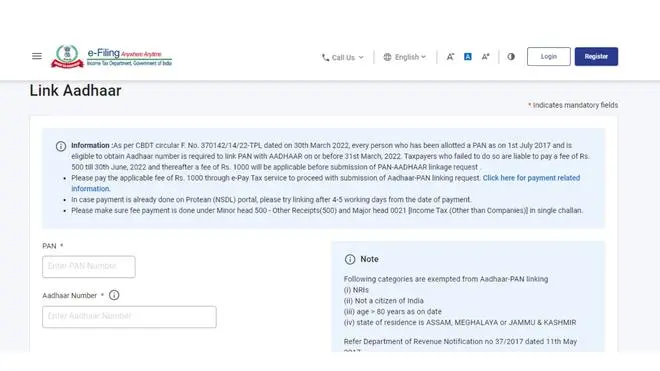

Step 3: Enter your PAN and Aadhaar number details and proceed to validate.

Enter PAN, Aadhaar and mobile number.

Step 4: An OTP will be sent to your registered mobile number. Enter the same and validate the process.

The platform also allows users to check the status. According to an advisory by the Income Tax department, PAN that is not linked with Aadhaar by the end of March 2023 will become inoperative.

The statement says, “As per Income-tax Act, 1961, it is mandatory for all PAN holders, who do not fall under the exempt category, to link their PAN with their Aadhaar before 31.3.2023. From 1.04.2023, the unlinked PAN shall become inoperative.”

Also read: How to find your UAN on EPFO portal?

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.