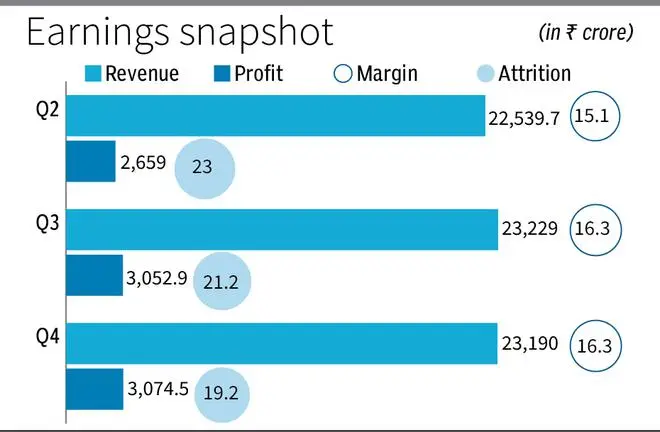

Wipro reported a 0.4 per cent year-on-year decline in net profit at ₹3,074.5 crore, owing to the worsening of the macro-environment. On a sequential basis, profit rose a meager 0.7 per cent from ₹3,052.9 crore last quarter, missing street expectations.

Revenue from operations stood at ₹23,190 crore, an 11 per cent y-o-y growth and 0.2 per cent q-o-q decline. The management attributed the decline to uncertainty in the market and slowdown in discretionary spending. Margins remained flat sequentially at 16.3 per cent, falling in line with market expectations.

Thierry Delaporte, MD & CEO, said, “We believe the macro environment will remain challenging as our clients in many sectors are impacted by the prolonged uncertainty in the economic environment. This has impacted our business and projections as well. Wipro is seeing some softness in the banking and financial space and in the consulting business, due to the current macro-environment. Additionally, some softness is also being seen in tech, CPG, and retail.”

The company has provided modest guidance for the next quarter at -3 per cent to -1 per cent in constant currency terms. The guidance, previous quarter was -0.6 per cent to 1.0 per cent. Total bookings for the quarter stood at over $4.1 billion, in contrast with $4.3 billion last quarter. On a y-o-y basis, bookings were up 29 per cent and large deal bookings were up 155 per cent.

Jatin Dalal, CFO, said, “We continue to maintain our focus on operational improvements and productivity enhancements which led to our IT services margin exit at 16.3 per cent in Q4 despite macro headwinds.”

Read: Badri Srinivasan to lead Wipro’s India and Southeast Asia businesses

Attrition has further moderated to 19.2 per cent from 21.2 per cent last quarter. The company’s total headcount was down by 1,823 employees in Q4 to 256,921. The company indicated that it has headroom for utilisation and hiring for demand-driven skills will continue. However, it has not provided any hiring targets for the next year.

Read more: How to tender shares in a buyback

Wipro also announced a share buyback worth ₹12,000 crore, which is about 4.91 per cent of total paid-up equity shares. The offer price has been set at ₹445, a premium of 19 per cent from the current stock price.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.