Benchmark equity indices Sensex and Nifty closed at 1-month highs on the back of declining international crude oil prices. Government bond yields, global market cues and buying by foreign portfolio investors (FPIs) also supported the markets.

Sensex gained 1.12 per cent or 659 points to close at 59,699 while the Nifty-50 rose 174 points or 1 per cent to close at 17,799.

Boosting the rally

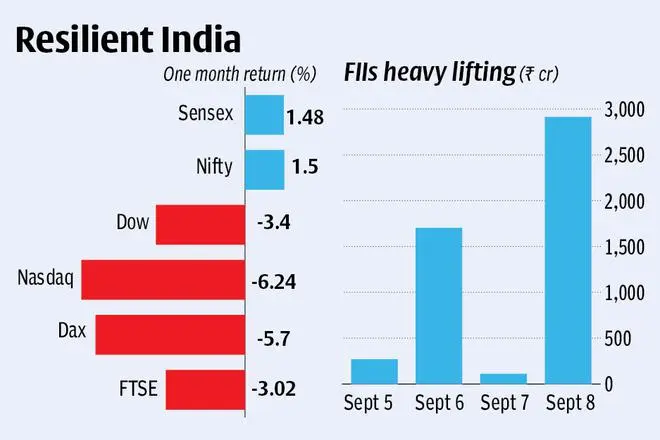

Indian markets have outperformed major world markets since mid-August due to an improving macroeconomic outlook and easing commodity prices. Markets in the US and Europe have been under pressure in anticipation of an aggressive US Federal Reserve rate hike. Since mid-August, Dow Jones lost 8.8 per cent, S&P 500 fell 9.22 per cent and Nasdaq erased 12 per cent, while FTSE100, CAC and DAX fell 3.2 per cent, 7.4 per cent and 7.5 per cent, respectively.. In Asia, the Nikkei dropped 4.3 per cent and Hang Seng index fell 3.2 per cent.

Reportedly, India is likely to be included in the global bond index that would bring in more than $20 billion worth of direct FPI flows. The anticipation of this event has kept the Indian markets buoyant, experts said.

Experts say currently a huge amount of global money flow is being directed to India instead of China since the latter is still facing Covid woes. Reports also suggest the country is facing problems such as weak demand, uncertainties over its zero-Covid policy, and property price among other things. Recently, it was announced that Apple plans to make its iPhone 14 in India. All of these facts have led the outperformance by Indian markets.

FPIs continue buying

On Thursday, the FPIs net purchased stocks worth ₹2,913 crore in the cash segment, according to provisional figures. There is a caution note from experts at these market levels. “The FII’s data in the derivatives segment continues to be bearish as they have majority of positions on the short side. Hence, one should keep a watch on the same and avoid aggressive index based trades. The intraday support for the coming session are placed around 17,694 and 17,610 while resistances will be seen around 17,880 and 18,000,” said Ruchit Jain, Lead Researcher at 5paisa.com.

“The Nifty took support near 17,690 and reversed thereafter. On daily charts, the index has formed a small bullish candle and has reclaimed the 20-day SMA (simple moving average) level as well. For the trend-following traders, now the 20-day SMA or 17,650 would act as a key support level. Above this, the index could rally till 17,900-18,000. On the flip side, below 17,650, bulls may prefer to exit from the long positions,” said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

Money market

The rupee appreciated 19 paise on the day due to dollar inflows on account of FPI investment in equity markets, the Dollar Index (DXY) easing from two-decade highs, and a decline in crude oil prices. The Indian unit (INR) closed at 79.71 per dollar against the previous close of 79.90. INR had opened stronger at 79.68 per Dollar as slowdown in China’s economy has resulted in a thaw in crude oil prices.

“The rupee has remained the best performer for the past three weeks as the pair has weakened merely by 0.80 per cent compared to other global and Asian peers. RBI’s currency intervention, inflows and subdued oil prices have prevented the USD-INR pair to flow in line with global fundamentals so far,” CR Forex Advisor said in a report.

Meanwhile, the drop in crude oil prices had a salubrious impact on Government Securities (GS), with price of the most traded 10-year GS (coupon rate: 6.65 per cent) rising about 32 paise and its yield declining about 5 basis points. The aforementioned paper’s last traded price (LTP) was ₹95.975 (Wednesday’s LTP: ₹95.6525). This paper’s last traded yield was 7.1353 per cent (7.1844 per cent).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.