Surging prices of battery-making commodities are likely to dent global hopes of increasing the production of electric vehicles (EVs) and set the clock back in meeting targets for green-energy vehicles, analysts say.

EVs run mainly on batteries that need lithium, cobalt, manganese and nickel. Barring manganese, prices of other commodities have increased sharply since the beginning of 2022.

Lithium continues bull run

Prices of lithium carbonate, a benchmark reference for lithium prices, have increased 75 per cent this year to currently rule at 497,500 yuan ($78293.47) a tonne. The battery material has been on a bull run since 2021 on projections of higher EV production and supply shortage.

According to the US Geological Survey Mineral Commodity Summaries 2022, batteries consume nearly three-fourths of the total lithium supplied in the world.

Nickel, a key element in green energy, witnessed volatile trading over the past three weeks with prices last week topping $100,000 a tonne before declining to levels of $45,000.

On Thursday, the metal hit the eight per cent lower limit as traders encashed their holdings, while a technical glitch affected trading on Tuesday. Still, nickel prices are more than double at $42,150 a tonne currently compared with $20,995 at the start of 2022.

‘Potential to slow transition’

Cobalt, another metal that surged sharply in 2021, has increased 16 per cent this year to $82,000 a tonne currently. Manganese prices have increased nearly three per cent in 2022 with the material being quoted at 34.50 Chinese yuan ($5.43) a tonne.

“A stronger price environment does have the potential to slow the pace of energy transition,” says ING Think, the economic and financial analysis arm of Dutch multinational financial services firm ING.

According to Fitch Solutions Country Research and Industry Research, a unit of Fitch, the ongoing surge in nickel and energy prices will translate into higher costs for EV battery manufacturers and EV automakers.

The Australian Resources and Investment website says miners are responding positively by producing more lithium than ever before as demand for EV “rises exponentially”.

Rise in operational costs

But Fitch Solutions said surging energy costs and rising inflation will translate into an increase in operational costs for battery manufacturers, who will pass on a part of the costs to consumers.

The energy sector has witnessed volatile trading since February 24, when the Russia-Ukraine conflict intensified with Kremlin troops entering the eastern Ukraine region.

Crude oil, coal, natural gas, ethanol and heating oil all flared to multi-year highs before easing on hopes of the situation coming under control. Russia is a key supplier of energy products such as crude oil and natural gas.

Concerns over supply from Moscow and sanctions imposed against it by the US, European Union and their allies have led to volatility in the market.

Besides, food commodities have also soared since Russia and Ukraine are key suppliers of wheat, corn, barley and vegetable oils.

Hike in EVs price

Fitch Solutions said nickel prices are expected to rule at elevated levels for the remainder of the year since nickel from Russia, which accounts for nine per cent of total global supply, could be rejected by buyers.

It said, in particular, countries that do not support purchases of EVs could see a hike in vehicle prices.

ING Think said the high raw material prices and supply shortage will force industries to look for alternatives. It said in the Chinese EV market, for example, lithium-ion phosphate batteries are popular in contrast to lithium-nickel-mangananese-cobalt batteries used in other countries.

Fitch Solutions concurred with the view saying it expects a surge in interest for alternative battery chemistries excluding nickel such as lithium-iron-phosphate chemistry.

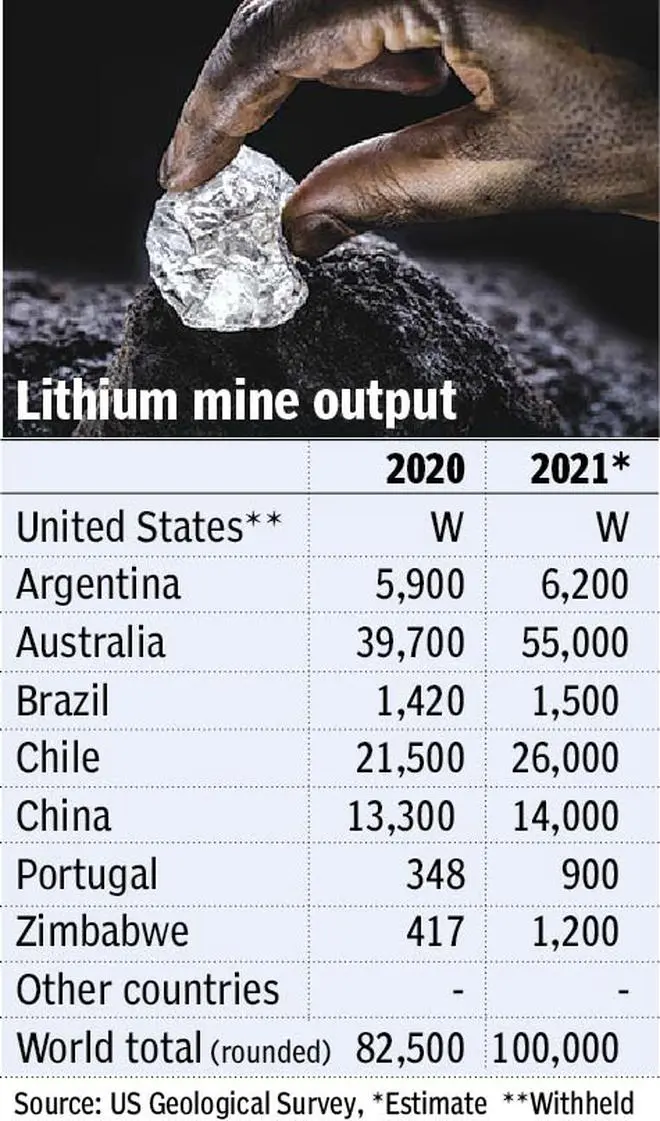

According to the US Geological Survey Mineral Commodity Summaries 2022, global lithium production, barring the US, increased by 21 per cent last year to about 100,000 tonnes. More production from various sources are in the pipeline with the price spike aiding the trend, it said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.