India has emerged the largest importer of seaborne Russian crude oil, surpassing China, in the first fortnight of this month with private refiners such as Reliance Industries and Nayara Energy accounting for more than half of the total in-bound shipments.

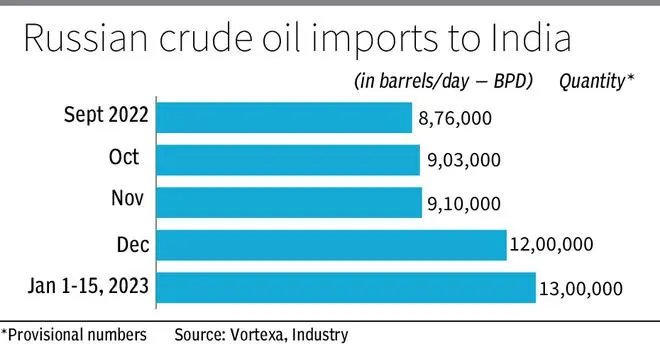

According to energy intelligence firm, Vortexa, Indian refiners cumulatively imported around 1.3 million barrels per day (mbpd) of crude oil during January 1-15, 2023. Private refiners accounted for 60 per cent of the imports in the same period.

Another record

Serena Huang, Head of APAC Analysis at Vortexa, said Russia has done well in enticing Indian refiners to increase purchases of its crude as the European Union pivots away. “Arrivals of Russian crude into India rose by 260,000 bpd m-o-m in December to reach a record 1.2 million bpd, while January arrivals are on track to set another record with nearly 1.3 million bpd of Russian crude discharged in the first two weeks of this month,” Huang told businessline.

In contrast, around 770,000 bpd of seaborne Russian crude was discharged to China in December 2022, down nearly 27 per cent m-o-m, with a slight rebound to 890,000 bpd seen in January first half. Market participants have cited possible delays in loadings of ESPO (East Siberia Pacific Ocean) blend from Russia’s Kozmino port in December due to heavy storms and limited vessel availability affecting deliveries to China that month, she added.

Expanding basket

Indian refiners have also expanded their basket of Russian crude by adding blends such as ESPO, Arctic Oil (ARCO), Sakhalin, Sokol and Varandey, a senior official with an oil marketing company (OMC) said.

Private refiners, such as Reliance Industries and Rosneft-backed Nayara Energy, have been aggressively expanding their contracts of crude from Russia in the last few months. Vortexa data on discharge volume by destination ports in India show that private refiners led the increase in oil purchases.

“Their share of India’s crude imports from Russia increased from 40 per cent during July-November last year, to 48 per cent in December, rising further to 60 per cent in January 1-15. Crude imports, excluding Russia, by the private refiners have also risen by over 25 per cent from November to January first half, with only a marginal increase in crude inventories, implying rising private refinery runs,” Huang explained.

Diesel exports

Reliance Industries and Nayara Energy have also increased their exports of diesel to Europe.

“As the February 5 EU ban on Russian oil products’ import approaches, India’s diesel exports to Europe have rebounded to 260,000 bpd in the first two weeks of January, reversing the trend of slowing exports over the last three months,” Huang said.

Export-oriented private refiners will further edify themselves as key diesel suppliers to the EU after the ban kicks in, giving them more incentives to slurp up Russian crude, as long as it remains attractively priced, she added.

When asked about the share of private refiners in India’s diesel exports to Europe, she said “100 per cent”.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.