The new total expense ratio (TER) structure, proposed for mutual funds (MFs) by SEBI, will lead to lower GST and tax collection from the industry as the overall spend and profitability will come down.

In a bid to bring down the cost for investors, SEBI has proposed to shift the TER of MFs from scheme level to the overall asset under management (AUM) of AMC including all costs such as GST on management fees, brokerage and transaction costs and B-30 incentive.

.

Impact report

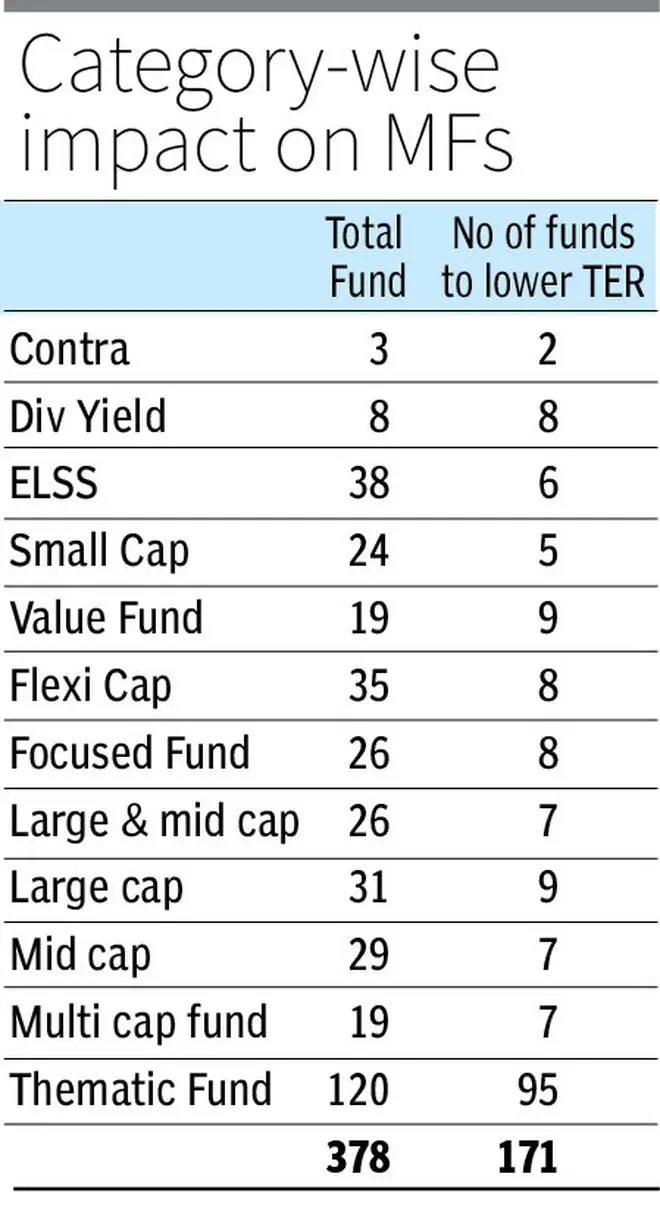

If the SEBI recommendations are implemented, of the total 378 equity schemes, 45 per cent or 171 schemes will have to lower their TERs to align with the suggested TER ceilings, according to the recent study by Fisdom.

Of the 31 aggressive hybrid schemes, 22 have to lower their expense ratio. Similarly, of the 28 schemes in the dynamic asset allocation category, 11 have to trim down their TER, it said. In debt fund category, 89 schemes of the total 284 have to cut the TERs to meet the new norms, it added.

Lower GST

With the MFs cutting down the management fee to align with the lower TER, the GST levied on the management fee will also come down, said a CEO of leading fund house. Moreover, the profitability of fund houses will come down leading to lower tax collection, he added.

The higher TER allowed for smaller fund houses will also not help them gain market share as investors would always prefer investing in schemes delivering better returns with lower expense ratio, he explained. Instead of creating a level-playing field, the new norms will only lead to consolidation in the industry, he said.

Ketan Dalal, Managing Director, Katalyst Advisors, said if GST is charged by a service provider, the payer normally can claim credit of the GST as an input against his output. However, in the case of AMC fees, the investor cannot claim the GST part of the AMC fees and hence, it becomes a dead cost to him, he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.