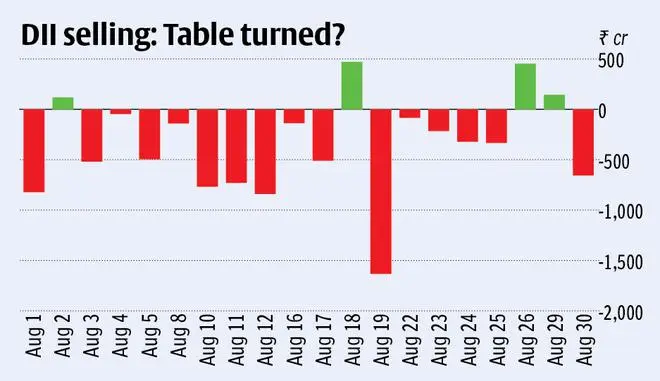

For the first time since February 2021, the domestic institutional investors (DIIs) have emerged as net sellers on a monthly basis in August.

Data from the stock exchanges show that DIIs were net sellers in the cash segment to the tune of ₹7,068 crore in August. The last time the DIIs had turned net sellers for the whole month was in February 2021 when they had offloaded stocks worth ₹16,358 crore.

Analysts say when the broader markets are stuck in a range for a long time, the DIIs are often seen pitching themselves against the might of foreign portfolio investors (FPIs). In August, the FPIs had turned net buyers for the first time since September 2021 with net purchases worth ₹22,025 crore. The Nifty index has been stuck in a range of 15,000 to 18,000 since October 2021.

A friend in need

“DIIs are known to support the markets in times of a crash of poor global sentiments. Hence, they are always seen keeping some money on the sidelines. So when FPIs were selling and the Nifty fell to around 15,200 earlier this year due to the Russia-Ukraine conflict, DIIs and retail investors were supporting the markets. Now when FPIs turned net buyers in August, DIIs booked some profits as the markets rose,” said a head of research at a south Mumbai brokerage house.

From October 2021 to July 2022, the FPIs had sold stocks worth $33 billion or more than ₹2.5-lakh crore. Still, the Nifty and Sensex declined only around 17 per cent. Analysts say that yet again there is scare and concern in the markets with regard to liquidity due to the move by the US Federal Reserve to curb dollar flows and hike lending rates, which can impact global market sentiments. So when FPIs turn net sellers again, DIIs may come to support the markets and avert a free fall in the benchmark indices, they said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.