The first week of 2023 began on a dull note for domestic markets amid fears that the interest rates will remain at elevated levels. Foreign portfolio investors (FPIs) remained net sellers throughout the week, putting pressure on Indian equities.

In the near term, the markets seem to be running into a few headwinds — record high valuation premium to EMs (although the valuations are only slightly above their own historical averages) which may attract some tactical shifts to other EMs, potential slowdown in exports on the back of global slowdown, and fixed income emerging as a viable investment option, said Milind Muchhala, Executive Director, Julius Baer India.

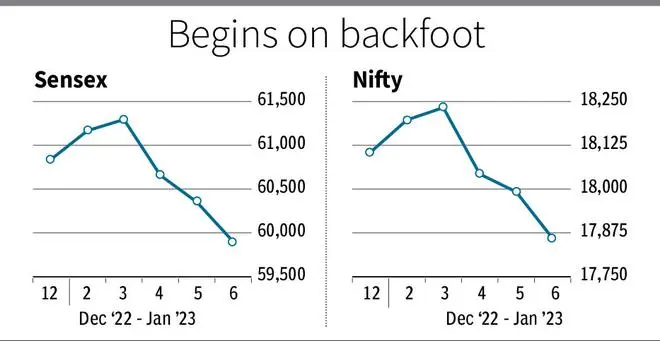

The BSE Sensex, which opened the year on a positive note, tumbled for the third straight session to close below the 60,000-mark on Friday. Including Friday’s fall of 452.90 points or 0.75 per cent, the benchmark declined 940.37 points or 1.55 per cent for the week to close at 59,900.37. The Nifty50 logged a weekly loss of 245.85 points or 1.36 per cent to close on Friday at 17,859.45.

FPIs turn sellers

For the week, FPIs were net sellers to the tune of ₹4,955.37 crore in the cash segment.

“The FIIs selling in the index futures and cash segment has been the main reason for the market slide,” said Ruchit Jain, Lead - Research, 5paisa.com, and added: “their long-short ratio below 50 per cent indicates their bearish stance on the indices.”

Analysts said domestic funds preferred to wait and watch ahead of quarterly results that will start trickling in from next week.

Apurva Sheth, Head of Market Perspectives, Samco Securities, said: Next week, market participants will keenly watch the inflation numbers of US and China. With the Fed still maintaining its hawkish tone, the US inflation numbers will be highly significant.”

Onset of results season

The result season of Q3FY23 will kick off with major IT companies reporting their quarterly numbers.

The attrition rates of IT companies will be closely looked at after they reached the peaks in Q2, she said, adding that “stock-specific movements will be prominent and as investors react to earnings misses and beats, they are advised to assess the company’s long-term potential rather than basing their investment decisions solely on quarterly performance.”

Muchhala said: “We believe there could be several interim opportunities in the near term as the markets adjust to the headwinds.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.