After relentlessly selling in both equity cash and derivatives segments for the entire month of January, the foreign portfolio investors (FPIs) on Monday covered a small portion of their short positions in index futures propelling Nifty and Sensex to close with 1.4 per cent gains ahead of the Budget. The Sensex gained 813 points or 1.42 per cent to close at 58,014. The Nifty index rose by 1.39 per cent or 237 points at 17,339. This is after declining by over 9 per cent between January 17 and 27t

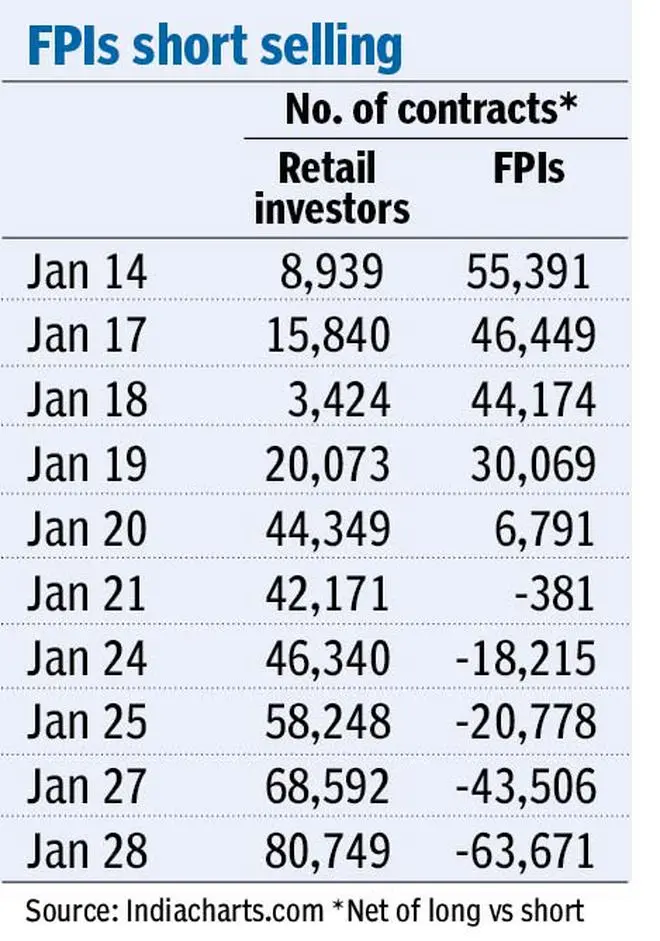

But the mood among the FPIs is highly bearish despite the Economic Survey forecasting 8 to 8.5 per cent GDP growth for FY23 . Data show that FPIs are holding the largest amount of net short positions in the Nifty Futures index since March 2020. But experts say that sentiments could change for a massive rally on the B-Day if no adverse taxes are announced by the Finance Minister on the stock markets, which has been widely rumoured. As of January 28, FPIs held a net short position of 63,671 contracts of Nifty index futures, exchange data showed. FPIs have sold index futures worth ₹10,957 crore and in the cash segment they have been net sellers to the tune of ₹41,346 crore, which is the highest in more than a year. There were rumours that government could raise capital gains tax. Short positions here is a net of net longs minus net shorts in Nifty futures. The NSE gives client-wise futures positions. Experts say the market mood currently is similar to September 2019 when FPIs were on a selling spree and suddenly the Finance Minister Nirmala Sitharaman announced a sharp cut on corporate tax rates resulting in a single day 5.32 per cent rally in Sensex and Nifty.

The Sitharaman Candle

“For the naive, the FPI selling and record short built-up ahead of the Budget could be scary. But technical charts are giving a contrary indication. If the Budget is good, markets could see a huge rally as FPIs will rush for cover. In September 2019, when the markets were struggling with extremely negative sentiment following a two-month correction the Finance Minister came loaded with corporate tax breaks resulting in what is now called by technical analysts the Sitharaman Candle.

Budget 2022 is set up with a similar extreme of negative sentiment, and the Finance Minister holds the bag of surprises that can give us another Sitharaman Candle that will defy the Sentiment and set the course for the coming months,” said Rohit Srivastava, chief strategist, Indiacharts. In September 2019, when the Finance Minister announced an over 10 per cent cut in the corporate tax rates, the Sensex and Nifty rose 5.32 per cent in a single trading session. That one day rise in stock markets came to be known as the ‘Nirmala Candle’ on the technical charts of the Nifty index.

Analysts say the Nifty chart has yet again formed a pattern that resembles the Nirmala Candle and if the Budget is good, it could be a record setting trend for the FM.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.