Even as foreign portfolio investors (FPIs) pumped in close to ₹45,000 crore in the equity markets in the last three weeks of August, they have once again turned sharply negative on India’s stock markets.

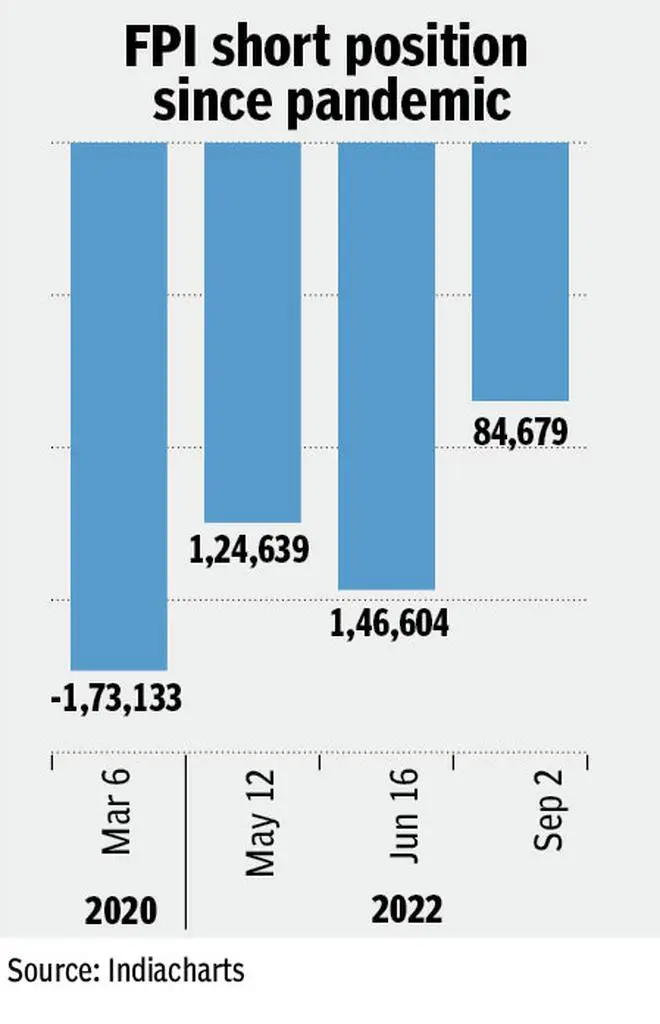

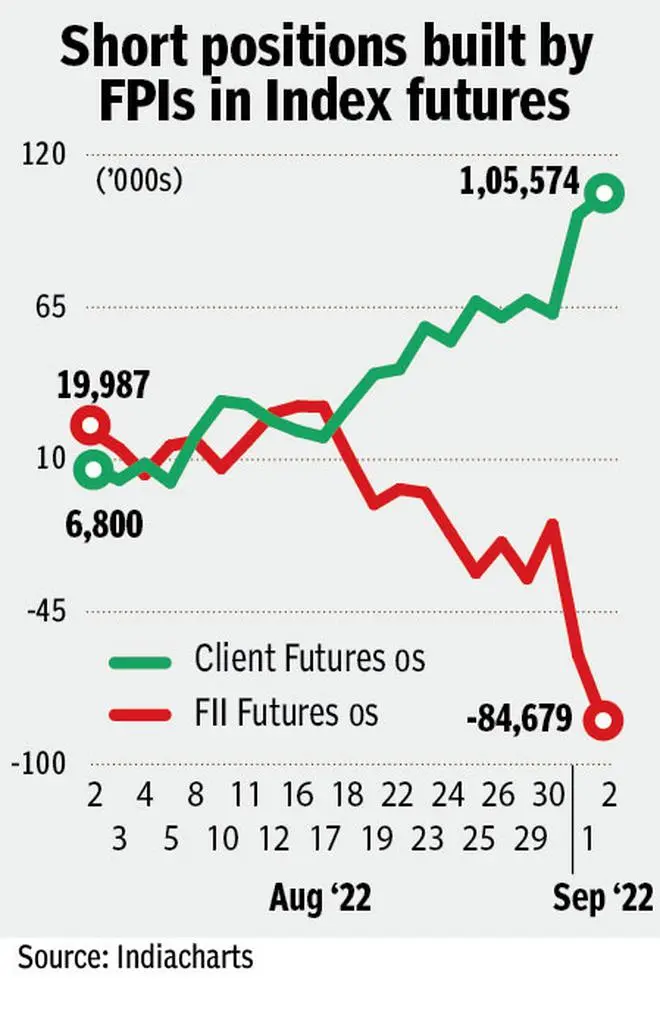

FPI net short position in index derivatives, comprising mainly of Nifty and Bank Nifty index, touched nearly 85,000 contracts on September 2, which is the third largest bearish bet on the Indian markets since March 2022 Covid pandemic, the data curated by Indiacharts shows. Analysts say the huge bearish bets that are still far away from the peak, suggest caution ahead in the stock markets.

On June 16, the peak FPI short position in index futures was 1,46,000 contracts and prior to that the highest was 1,73,000 contracts on March 6, 2020. It is at the peak that markets witnessed a change of direction. Data of net short positions is after deducting the longs from the total outstanding position in index derivatives, which is provided by the National Stock Exchange.

“FPIs have been buying in the cash market but their complete opposite behaviour in the futures segment signals fear and risk ahead. FPI shorts started rising since August 19 and are currently the third largest in terms of number of contracts. The increase in bearish bets signals downside risk that needs protection in the near term. The incessant decline in US equity markets may be one reason for such behaviour. If the trend of US equities lower and rising shorts continues at some point of time, it is going to hurt domestic sentiment and can cause price damage in the near term. Traders should not become complacent in this environment,” said Rohit Srivastava, chief strategist, IndiaCharts.

Markets in a tailspin

Stock markets in the US have been in a tailspin ever since Federal Reserve Chairman Jerome Powell gave the most aggressive speech since the operation twist (quantitative easing) era speech of the Fed chairman in 2009.

Powell, at the recently held Jackson Hole annual symposium on August 26, has pledged not to stop or pause with his rate hikes for several months ahead and cautioned of “far greater pain” ahead for the markets. He cut his speech unusually short to just around eight minutes, when he was expected to speak for thirty minutes.

In the days following Powell’s speech, the Dow Jones index in the US crashed by over 1,000 points and the tech-laden Nasdaq index lost 4.10 per cent by the time the market closed on Friday last week.

Fed aggressive interest rate hikes mean tightening of dollar liquidity, the abundance of which is known to drive the equity markets. It is a key reason for the FPIs to have built short positions on Indian markets, which have outperformed the world and declined the least this year in the aftermath of Russia-Ukraine conflict.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.