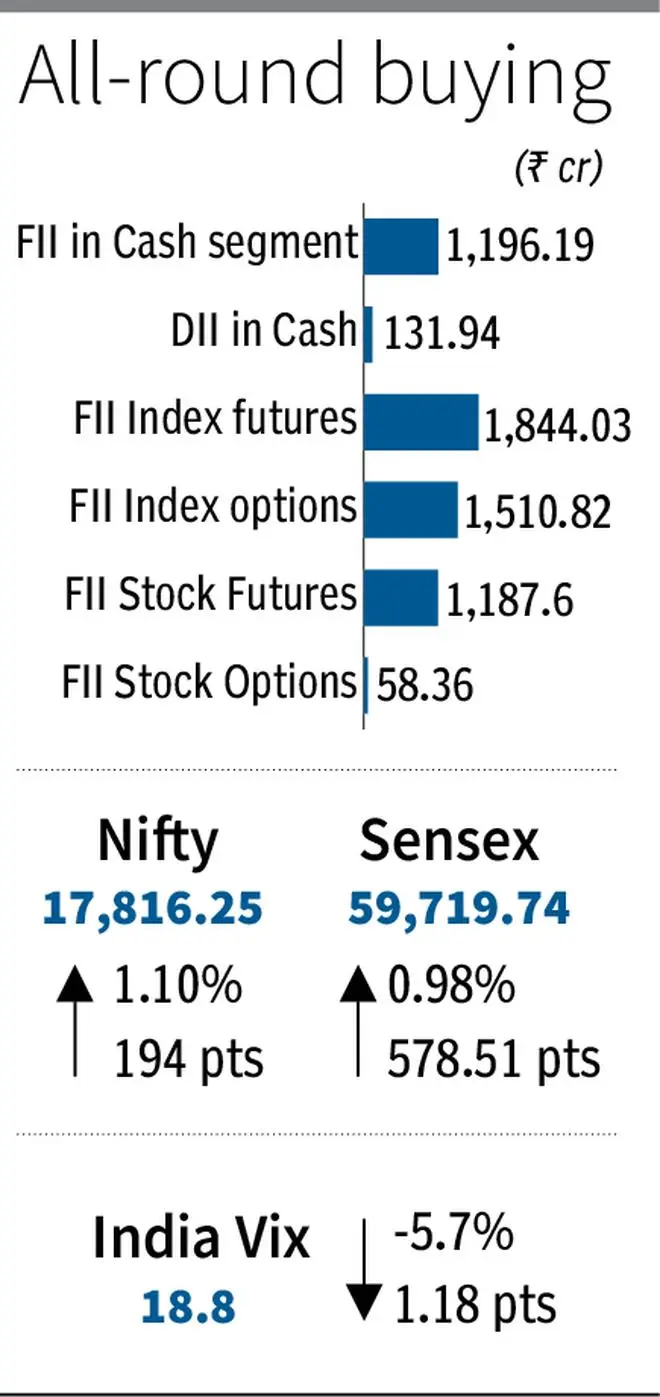

Markets maintained their momentum on Tuesday, despite fears of a steep rate hike in interest rate by the US Federal Reserve on Wednesday. Institutions resorted to heavy buying, and according to analysts, FPIs indulged in sector rotation. FPIs remained net buyers to the tune of ₹1,196.19 crore, while domestic institutions too were buyers (₹131.94 crore).

The BSE Sensex breached the 60,000-mark in intraday to hit a high of 60,105.79, but closed at 59,719.74, a gain of 578.51 points or 0.98 per cent, over the previous day's close. Nifty closed 194 points or 1.10 per cent higher at 17,816.25.

Thanks to institutions' backing, market breadth also turned positive with 2,071 shares advancing, while 1,402 shares declined on the BSE.

The Federal Reserve is likely to raise the federal funds’ target rate by 75 bps on September 21, global equity markets seem to have discounted this rate hike, said Devarsh Vakil, Deputy Head of Retail Research, HDFC Securities.

Resilient mid-caps

The BSE Midcap rallied 1.65 per cent outpacing benchmarks, while the BSE Smallcap jumped 1.01 per cent. All the BSE sectoral indices closed in the green, led by BSE Healthcare followed by Consumer Durables, Auto and Consumer Discretionary.

Emkay Global Wealth in a note said that on a closer look at the selling by overseas investors, it can be seen that much of it is in the large-cap space and not in the mid-cap or small-cap space. The market-cap preferences may be viewed or modified accordingly. “Any corrective downward movements should be utilised as opportunities to invest for the long-term portfolio,” it added.

Sensex gainers

Sun Pharma was the top gainer among the Sensex stocks, spurting 4.71 per cent, followed by IndusInd Bank, Dr Reddy's, Tata Steel, Titan, Bajaj Finserv, ICICI Bank and Asian Paints. Nestle India, PowerGrid, Infosys and Reliance Industries were the losers in the Sensex pack.

“India’s latest GDP data reflect a resilient and robust economy compared to any of the comparable economies in the emerging markets space. While the selling by overseas investors has been happening in all the emerging markets, the extent to which the currency depreciated is also comparatively less in case of the domestic economy,” Emkay Wealth said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.