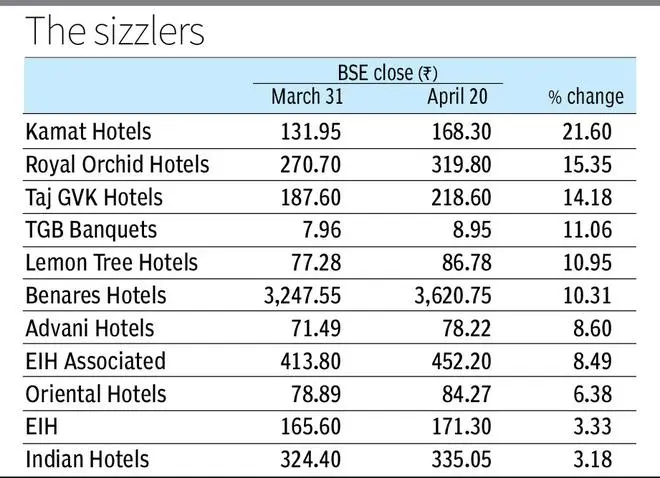

Most hotel stocks have been on the rise, especially since beginning of current fiscal, as analysts expect better Q4 results and strong outlook for FY24. Shares such as Royal Orchid Hotels and Benares Hotels have registered their all-time highs recently while some of them including Kamat Hotels have hit their 52-week high.

According to analysts, with international travel picking up and corporate events gradually gaining pace, domestic hotel players having strong hotel pipelines and healthy balance sheets are in a sweet spot to seize the opportunity.

Sonam Srivastava, Founder at Wright Research, said: The ongoing economic recovery and increasing demand from business and leisure travelers, coupled with a strong wedding season, have contributed to expectations of robust average room rates (ARR) in Q4-FY23.”

Strong Q4 results

Analysts also point out that Q4 results announced by Oriental Hotels and Benares Hotels were strong and expect others too to report a decent set of numbers.

Crisil in a recent release said that hotel revenues were expected to grow 98 per cent for FY23. Recovery is visible across categories – leisure, corporate, MICE (meetings, incentives, conferences, and exhibitions), as well as international travel, it said.

Better operations

Elizabeth Master, Associate Director- Research, Crisil Market Intelligence & Analytics, said owing to better operational parameters, revenue of the premium hotel industry is expected to surge about 80 per cent on-year in fiscal 2023, and a further 15-20 per cent in fiscal 2024.

“Also, employee cost as a per cent of net sales, which was 32 per cent in fiscal 2022, is projected at 21-22 per cent in fiscal 2023. These factors combined will translate into a new high for EBITDA margin at 30-32 per cent for fiscals 2023 and 2024,” she added.

However, Crisil said the current recovery is largely “K” shaped. “Whereas premium hotels are expected to report decadal-high ARRs and occupancy rates, the budget hotels segment is likely to see ARR trend of about 20 per cent higher than pre-pandemic (fiscal 2020) level, but occupancies are at approximately 90 per cent of the pre-pandemic level.”

Hotel stocks like Kamat Hotels and Oriental Hotels have reached their 52-week highs, indicating strong investor confidence in the sector. As the hotel industry continues to benefit from the ongoing economic upswing and improved operating leverage, it is expected to maintain a promising trajectory in the coming years, Sonam Srivastava said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.