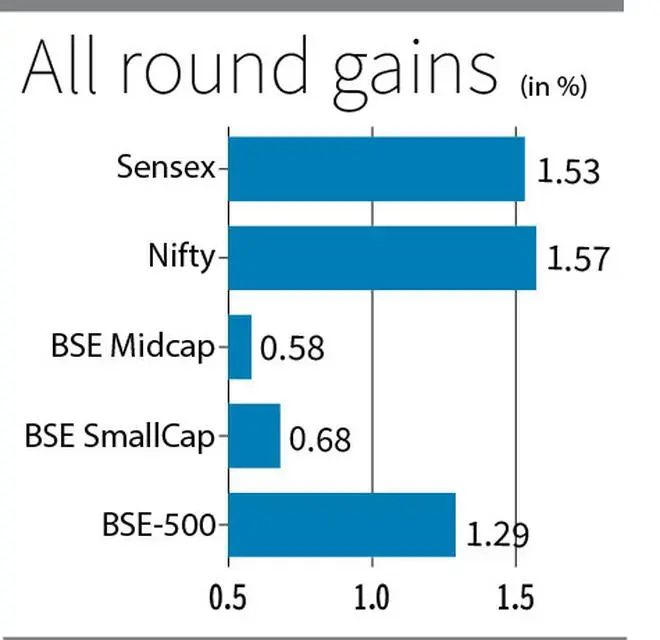

The return of traction in Adani group shares, added with massive buying from domestic institutional investors (DIIs) and overnight sharp gains in the US stock markets, cheered the Sensex and Nifty on Friday. While the BSE benchmark index rose 900 points to close at 59,808, the Nifty, too, rose 1.5 per cent to 17,594.

Most Adani group shares were locked in an upper circuit. The Group’s flagship company, Adani Enterprises, was up 17 per cent and cement firms ACC and Ambuja, both gained 5 per cent. The rally comes on the back of over ₹15,000-crore ($1.87 billion) investment by the US-based GQG partners in the Adani Group companies.

On Friday, DIIs bought shares worth ₹2,089 crore in the cash segment. Buying from the foreign portfolio investors (FPIs) was tepid at ₹246 crore in cash market. FPIs had held more than 120,000 short contracts in index futures this week.

Naveen Kulkarni, Chief Investment Officer, Axis Securities, said, “Markets has heaved a sigh of relief, creating a kind of floor for Adani Group stocks since a marquee investor has invested. Also, promoters can use the money raised through the transaction to infuse capital in any Group company requiring the funds through warrants, rights issues, or any other instrument. The development will also increase retail participation, which was hit by uncertainty,” Kulkarni said.

“The investment signifies that the Adani Group can raise capital at current prices. Such a development is positive for bank stocks, which were hammered recently due to their exposure to the Group. There is optimism in markets now even though usual global concerns may remain,” he added.

Nagaraj Shetti, Technical Research Analyst at HDFC Securities, said: “Nifty on the weekly chart formed a reasonable bullish candle with minor lower shadow. Formation of such a pattern after the weakness of previous few days signals a chance of further upside ahead. Immediate support is placed at 17,450 levels.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.