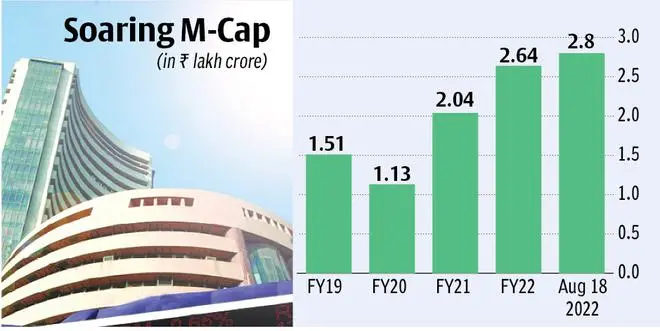

The market capitalisation of companies listed on the BSE rose to a record ₹280.50-lakh crore on Thursday, as the market displayed a strong recovery during closing hours, surpassing earlier ₹280.02-lakh crore recorded on January 17.

Sensex, Nifty yet to breach

Though BSE Sensex and Nifty are still a good 4 per cent away from their all-time peaks of 62,245 and 18,604 respectively (recorded on October 19, 2021), market-cap of BSE-listed stocks surpassed its previous high.

The 30-share BSE Sensex closed 37.87 points or 0.06 per cent higher at 60,298 after starting the day on a weak note and hit a low of 59,946.44. The NSE Nifty 50 gained 12.25 points or 0.07 per cent to settle at 17,956.50, recovering from day's low of 17,852.05.

Reliance Industries tops the list with a market-cap of ₹17.99-lakh crore followed by TCS ₹12.37-lakh crore, HDFC Bank (₹8.40-lakh crore), Infosys (₹6.66-lakh crore) and Hindustan Unilever (₹6.3-lakh crore).

IPO stocks recover

According to analysts, besides the recent momentum, listing of high-profile companies such as LIC India, Adani Wilmar, Delhivery and Vedant Fashions helped lift the market cap, as some of the stocks are showing resilient post tepid listing.

For instance, LIC, after hitting a low of ₹650 as against IPO price of ₹949, recovered to ₹696 currently; similarly, Adani Wilmar recovered from a recent low of around ₹660-level (last week) to ₹732.75; and Vedant Fashions hit an all-time high on Thursday at ₹1,207.

Dhiraj Relli, MD and CEO, HDFC Securities, said: “Recent gains in Indian indices have been helped by a combination of factors including encouraging macro data, fall in commodity prices, slowing inflation that may lead to central banks globally softening their monetary policy stance earlier than expected.”

FPIs’ change of mood

Return to buying by FPIs has also helped, he said, and added, that the “steepness of the rally from the lows of June 2022 without any major correction on the way has been beyond the expectations of most investors.”

Foreign portfolio investors (FPIs) have pumped over ₹37,000 crore. However, on Thursday, FPIs turned sellers to the tune of ₹1,706 crore. Despite August fund flow, FPIs total net sale stands at ₹1.86-lakh crore, reveals NSDL data.

Ajit Mishra, VP - Research, Religare Broking, said: "We’re in the fifth successive week of advance and rotational buying across sectors helping the index maintain the prevailing trend. We’re eyeing 18,100 in Nifty and reiterate our view to continue with the 'buy on dips' approach."

Participants should focus more on stock selection after the recent surge, he advised.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.