India’s stock market rally got a further boost on the back of signals from the US that the Federal Reserve may slow down on the pace of interest rate hikes. It simply means there would not be a massive squeeze on the global money liquidity and foreign portfolio flows could continue for India, analysts said.

As per US Fed minutes, substantial members favoured slow down in rate hikes. The next Fed meeting for rate hikes is in December.

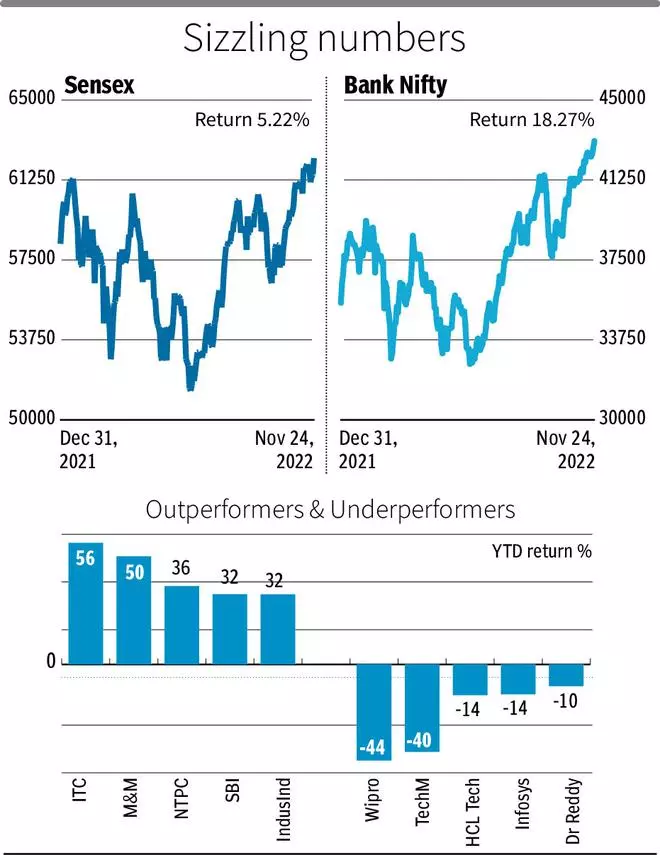

The Sensex closed at a new lifetime high of 62,272 with gains of 1.24 per cent or 762 points. The Nifty, which is now around 1 per cent away from hitting a new high, closed at 18,484 with gains of 1.19 per cent or 216 points. The Nifty Bank, too, hit a new high, which was an indication that broader market participation was picking up.

Thursday’s rally in effect was also due to a swift rise in IT stocks led by Infosys, as a foreign bank issued its positive outlook on the company. Majority of the market gains came in the last 45 minutes of the trading session as the indices witnessed a sudden spurt.

Vinod Nair, Head of Research at Geojit Financial Services, said, “The optimism was further boosted by falling crude prices and the declining dollar index. Crude oil prices dropped over talks of a possible price cap on Russian oil and a rise in US product stockpiles.”

A slowdown in rate hikes implies that fears related to fast running inflation were subsiding. Global Brent crude prices have now declined to around $84 per barrel. Prices above $100 had caused worry among central bankers about runaway inflation. But analysts say if the prices fall below $50, it could spark a worry over a drastic fall in global trade and demand.

Since the Rupee has come off from its lows, it leaves a lot of room for the RBI to put a temporary halt to its monetary tightening activity. Also, the fact that the benchmark Nifty was trading at a price to earnings multiple of less than 21 shows that a major downfall was not in the offing.

“Until we see a breakout in the midcap index, one should continue to focus on stock specific moves in the sectors which are participating along with the uptrend in the index and avoid the under performing ones,” said Ruchit Jain, lead researcher, 5paisa.com.

“Buying has finally emerged in the market and since the immediate resistance of 18,400 has been taken out on the upside, Nifty is expected to move above 18,606 levels. Now the immediate support is placed at 18,400,” said Nagaraj Shetti, Technical Research Analyst, HDFC Securities.

FPIs buy stocks

Meanwhile, foreign portfolio investors (FPIs) purchased stocks worth ₹1,231 crore in the cash segment on Thursday and the domestic institutional investors were net sellers to the tune of ₹235 crore. So far in November, FPIs purchased stocks worth ₹11,000 crore in the cash segments.

“Technically, on daily charts, the Nifty has now formed a long bullish candle and is also holding higher high and higher low formation on daily and intraday charts which is broadly positive. For traders, as long as the index holds the support of 18,400, there are chances it could hit 18,600-18,700 levels. On the other hand, below 18,400, the uptrend would be vulnerable,” said Shrikant chouhan, Head of Equity Research ( Retail), Kotak Securities Ltd.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.