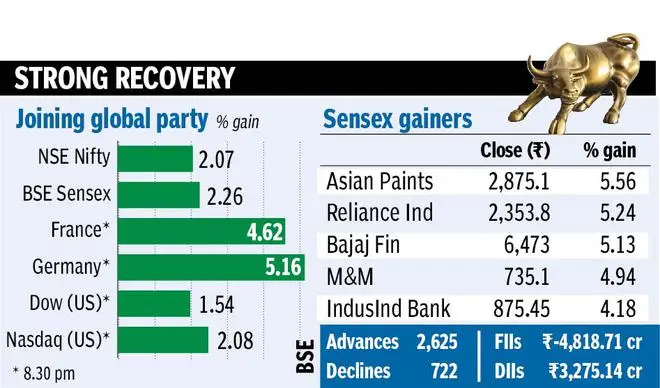

Stock markets around the world recovered some ground on Wednesday as the rally in commodity prices, mainly oil, cooled off. Even though foreign portfolio investors remained heavy sellers in the cash segment in India, short-covering and buying from domestic funds saw Sensex and Nifty gain 2.29 per cent and 2.07 per cent, respectively.

Sensex rose by 1,223 points to close at 54,647. The Nifty gained 331 points at 16,345. Brent crude oil prices fell to $121 per barrel after hitting a high of $139 this week. The rupee gained further strength against the US dollar, closing 38 paise up on Wednesday amid hopes that some progress will be made in talks between warring neighbours Russia and Ukraine.

FPIs on selling spree

In the equity markets, FPIs were net sellers to the tune of ₹4,818 crore in the cash segment while domestic institutions bought shares worth ₹3,275 crore. In the derivative segment, FPIs bought index futures worth ₹677 crore and sold stock futures worth ₹178 crore. Overall, FPIs have sold stocks worth ₹39,000 crore in the cash segment so far in March.

Global crude oil prices are being watched as the key catalysts for stock market traders. Brent crude had touched a decade high of $139 per barrel on Tuesday and cooled off from there, leading to a market rally. As long as oil prices remain elevated above the $100 per barrel mark, stock markets would find it hard to hit new highs since the inflation scenario would distort the low interest rate regime, experts say. Russia Ukraine situation and also US decision to curb oil imports from Russia should be watched for any cues global prices.

MFs for February, despite the geopolitical tensions and their impact on the global equity, commodity, and currency market, mutual funds invested ₹19,645 cr in equity-focused funds. The consistency remains impressive,” said Vikaas M Sachdeva, CEO, Emkay Investment Managers.

According to Sachdeva also the stable SIP flows of ₹11,438 crore, as well as passive investment options show the keenness of a large segment to stick to the knitting in terms of asset allocation. “This continues to act as an effective counterweight to FPI outflows and is helping stabilise the markets more robustly than before,” Sachdeva said.

Bitcoin and other cryptocurrencies were higher on Wednesday after US President Joe Biden announced a executive order on the digital assets. Biden’s executive order attempts to address the lack of a framework for the development of cryptocurrencies in the U.S.

T

INR closed at 76.62 per USD against the previous close of 77. On Monday, the rupee had ended at an all time low of 76.96.

“Reports that Ukraine is no longer insisting on NATO membership also raised hopes of a de-escalation in conflict with Russia ahead of talks between foreign ministers of the two countries on Thursday.

“The USDINR pair also slipped because some banks stepped in to sell the dollar on behalf of exporters at relatively higher USDINR levels,” IFA Global said in a report.

Prices of G-Secs rose as market players stepped up purchases on expectations that there will be no more fresh supply of G-secs this month.

Price of the 10-year benchmark G-Sec (coupon rate: 6.54 per cent) was up 35 paise, closing at ₹97.83 (previous close: ₹97.48). Yield of this paper declined about 5 basis points to 6.8448 per cent (6.8949 per cent).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.