Notwithstanding the huge volatility in the equity market, investors pumped in fresh money across equity mutual fund schemes taking advantage of the intermittent bearish trend.

Inflow into equity schemes increased 17 per cent last month to ₹18,529 crore against ₹15,890 crore logged in April. Flexi-cap and large-cap funds saw the highest inflow of ₹2,939 crore (₹1,709 crore) and ₹2,485 crore (₹1,259 crore), while large and mid cap schemes and sectoral funds attracted investment of ₹2,485 crore (₹2,050 crore) and ₹2,292 crore (₹3,844 crore).

Investment in hybrid schemes was down at ₹5,123 crore (₹7,240 crore) with dynamic asset allocation and balanced hybrid funds registering a net inflow of ₹2,248 crore (₹1,543 crore) and ₹1,371 crore (₹701 crore).

Kavita Krishnan, Senior Analyst, Morningstar India, said equity-oriented schemes registered a net inflow for the 15th consecutive month in May as investors reposed their faith in equity markets.

The Indian equity market remains an attractive choice for investors across emerging markets despite valuations still being at a premium, she said.

SIP flows

Monthly SIP investments increased to ₹12,286 crore last month against ₹11,863 crore in April with all-time high SIP accounts of at 5.48 crore.

Akhil Chaturvedi, Chief Business Officer, Motilal Oswal AMC, said the consistent SIP flows are supporting the net positive sales numbers in equities and the spread of new flows is well diversified across categories which reflects that retail investors are managing the risk and volatility well.

Passively managed funds have been gaining prominence among investors over recent times as inflows in other ETFs and index funds touched ₹6,056 crore (₹8,663 crore) and ₹5,723 crore (₹6,062 crore).

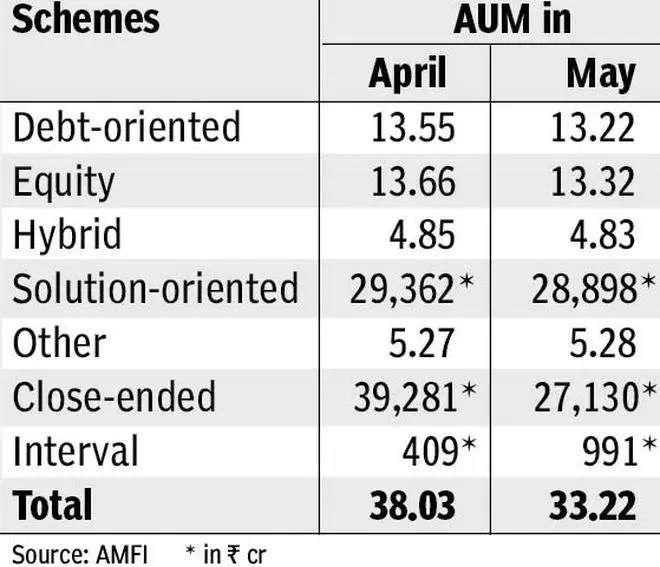

However, the sharp outflow of ₹37,722 crore from debt-oriented schemes has dragged the asset under management of mutual funds by two per cent to ₹37.22-lakh crore (₹38.03-lakh crore).

NS Venkatesh, Chief Executive, AMFI, said the rise in key bank rates by RBI has resulted in net outflow from debt-oriented schemes and this may continue for next two month as interest rates are expected to go up further.

Retail investor confidence into equity asset class stems from the fact that India growth story continues to be promising as RBI has pegged the GDP forecast at 7.2 per cent despite rising inflation and interest rates, challenging macro-economic scenario, he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.