Promoters of Lloyds Metals and Energy, and Happiest Minds created fresh pledging in October-December 2022 quarter, a study by Kotak Institutional Equities revealed. Motherson Sumi Wiring saw its promoters releasing their entire quantity from pledge with financial institutions, it said. However, Happiest Minds’ promoters pledged just 5.5 per cent of their holding, while Lloyds Meals encumbered 11.9 per cent of their holdings.

“Promoters of major Indian companies raised their share pledges in the December quarter, as equity markets experienced volatility due to global policy tightening in response to rising inflation,” the report said.

According to the study, the percentage of shares pledged in companies listed on the BSE 500 Index increased to 1.61 per cent of promoter holdings during the December quarter, up from 1.57 per cent in the previous quarter.

The total value of shares pledged by promoters amounted to ₹2.2-lakh crore, which represented about 0.83 per cent of the BSE 500 Index’s total market capitalisation.

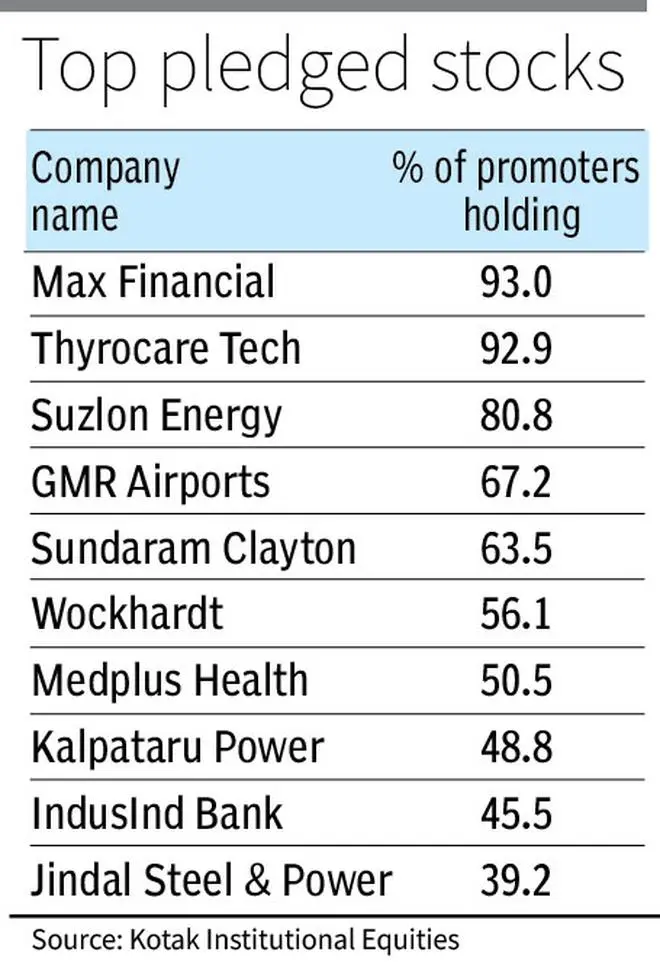

According to the study, companies whose promoters pledged more than 90 per cent of their holdings were Max Financial Services and Thyrocare Technologies.

Nifty-50 stocks

Among the others, companies such as LloydsMetals, Happiest Minds, Wockhardt, Emami and Ajanta Pharma saw a substantial increase in pledged shares by promoter holdings.

Companies in the Nifty-50 with more than 5 per cent of pledged promoter holdings included Adani Ports & SEZ (17.3 per cent), Apollo Hospitals (16.4 per cent), Asian Paints (7.6 per cent), IndusInd Bank (45.5 per cent) and JSW Steel (17.6 per cent), the study revealed.

“Pledging of shares does not necessarily imply that a company or a promoter is under financial stress; banks (lenders) could have sought additional security in the form of promoter shares,” Kotak Institutional Equities clarified.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.