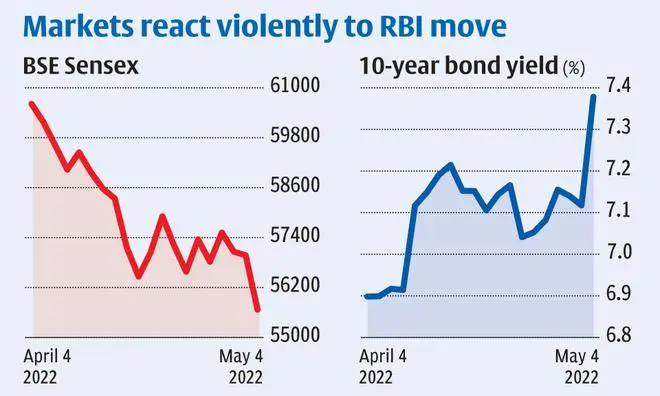

Mumbai, May 4 It was a blood bath on the Indian equity market with Sensex, Nifty closing over 2 per cent lower after the Reserve Bank of India’s announcement of interest rate hike on Wednesday.

Market opened on a postive note, tracking global cues, but soon turned volatile. Indices slumped as across the board selling continued after the RBI announced repo rate hike by 40 basis points amid inflationary pressures.

The BSE Sensex closed at 55,669.03, down 1,306.96 points or 2.29 per cent. It recorded an intraday high of 57,184.21 and a low of 55,501.60. The Nifty 50 closed at 16,677.60, down 391.50 points or 2.29 per cent. It recorded an intraday high of 17,132.85 and a low of 16,623.95.

The volatility index jumped 7.86 per cent to close at 21.88.

Over 2,500 stocks decline

The market breadth favoured decliners with 2,548 stocks declining on the BSE as against 826 that advanced, while 101 remained unchanged. Furthermore, 16 stocks hit the upper circuit as compared to the two stocks that were locked in the lower circuit. Besides, 103 stocks touched a 52-week high level and 48 touched a 52-week low.

ONGC, Britannia, Powegrid, NTPC and Kotak Bank were the top gainers on the Nifty 50 while Apollo Hospitals, Adani Ports, Hindalco, Titan and Bajaj Finance were the top losers.

RBI hikes repo rate, CRR

Market slipped further after monetary policy committee on Wednesday unanimously voted to raise the repo rate by 40 basis points to 4.40 per cent while continuing with the accommodative policy stance, deciding to focusing on calibrated withdrawal of liquidity accommodation amid concerns on the sharp uptick in inflation.

Following the hike in repo rate, the standing deposit facility stands increased to 4.15 per cent (from 3.75 per cent) and the marginal standing facility to 4.65 per cent (from 4.25 per cent).

The Cash reserve ratio has been raised by 50 basis points from 4 per cent to 4.50 per cent.

The announcement comes ahead of the outcome of the US Federal Reserve Meeting. Markets already has discounted a 50 bps rate hike by US Fed, as per analysts.

According to Dr. VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, “The MPC’s decision, in an unscheduled meeting, to raise the repo rate by 40bp and CRR by 50 bp is a surprise since it came on the LIC IPO opening date. MPC’s proactive move is justified from the perspective of inflation management, but the timing leaves a lot to be desired.”

“The above 1000 point crash in Sensex has soured the sentiments on the opening day of India’s largest IPO. The 10-year bond yield has spiked to above 7.39 per cent indicating an imminent rise in the cost of funds,” said Dr Vjayakumar.

Sujan Hajra, Chief Economist and Executive Director, Anand Rathi Shares & Stock Brokers said, “We expect immediate increase in money market rate, some transmission in the long-term bond market and also credit market (both lending and deposit rates). The impact on the equity market is likely to be negative in the short-term.”

As per Abhishek Goenka , Founder CEO IFA Global , “ Inflation and rate hikes are in the air. RBI did feel the heat lately and they took the markets by surprise by hiking rates across repo and CRR. The market was expecting a rate hike by RBI but in a slower pace Sucking of liquidity through CRR is very hawkish and it opens up room for RBI to do OMOs.”

“We had already started seeing transmission of interest rates but since most of the loans are linked to repo we may see impact on corporate and retail credit soon. Equity markets went into bloodbath post hikes since it’s a double whammy for companies (increasing costs across inputs and now in interest rates). Oil needs to be watched closely in the next few months , any drastic price increases will significantly impact our rate hike trajectory, balance of payments and foreigners interest towards Indian assets which is already in trouble lately,” added Goenka.

All in red

All sectoral indices closed in red.

Nifty Consumer Durables was down nearly 4 per cent at closing while Nifty Realty, Nifty Metal and Nifty Healthcare Index were down over 3 per cent each. Nifty PSU Bank, Nifty Financial Services and Nifty Pharma were down nearly 3 per cent. Nifty Auto and Nifty Bank were down 2.5 per cent each while Nifty Private Bank was down 2.4 per cent.

Broader market under pressure

Broader indices closed in the red. Nifty Midcap 50 was down 2.30 per cent while Nifty Smallcap 50 was down 2.49 per cent. The S&P BSE Midcap was down 2.63 per cent while the S&P BSE Smallcap was down 2.11 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.