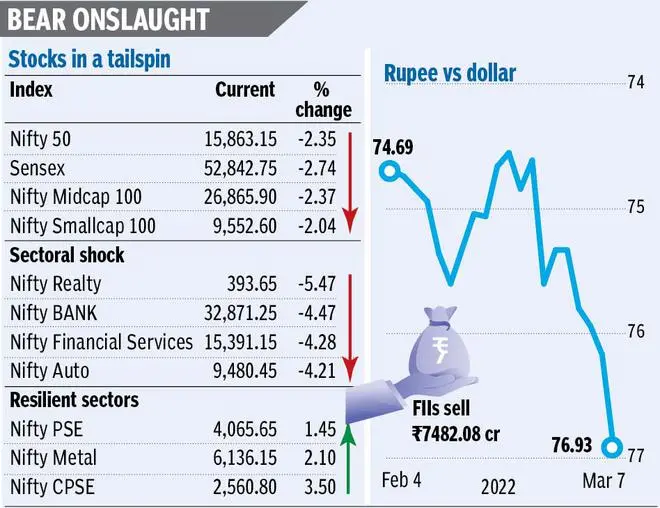

With global crude oil prices hitting $130 per barrel and other fallout of the escalating conflict between Russia and Ukraine, equity and financial market sentiments were further spooked on Monday. The rupee closed at a life-time low of 76.96 to the US Dollar (USD), and the two benchmark stock indices, Sensex and Nifty, fell by 2.74 per cent and 2.35 per cent, respectively, as foreign portfolio investors (FPIs) pressed the exit button.

Dollar sales by the Reserve Bank of India through public sector banks at the ₹76.97/98-per-USD level prevented the Indian unit from breaching the 77-mark, according to currency traders. The rupee closed 80 paise weaker against the previous close of 76.16. Intraday, After market hours, it breached the 77-mark and tested 77.11 per USD.

“Brent crude oil touched $130 a barrel. FPIs are pulling out their money from Indian markets and oil marketing companies are buying dollars for their imports. Hence, there is a lot of demand for dollars. However, dollar supplies are insignificant. Very few exporters sold dollar at 76.97 levels. The expectation among exporters is that the rupee may go beyond 77 in the coming days. So, all these factors are weighing down the rupee,” said a chief dealer of a private sector bank.

Moreover, the dollar index has gone beyond 99, making that currency very strong.

Money calls

ICRA, in a report, noted that while elevated commodity prices and pessimistic sentiments in global markets will impart a depreciating bias to the INR, large forex reserves are likely to avert a sudden sharp depreciation. “We expect the USD-INR cross rate to trade in a range of 76.0-79.0/USD until the conflict subsides. Going forward, elevated crude oil and commodity prices, ongoing geopolitical tensions between Russia and Ukraine, and pessimistic sentiments in global markets, along with a stronger USD, could further have a negative impact on the INR,” per the report.

The rating agency said the rupee has been among the worst performing Emerging Market (EM) currencies so far in CY2022, after the Russian Rouble and the Turkish Lira, led by the heavy dependence on imports for meeting its energy needs.

Given that the rupee is showing a depreciating bias and with the likely delay of LIC’s IPO , experts opined that market participants may quote a higher premium for placing their bids to participate in the upcoming USD/INR 2-year Sell/Buy Swap auction for $5 billion, scheduled for Tuesday.

Meanwhile, high crude oil prices had an impact on the Government Securities (G-Secs) market, too, with yield on the benchmark 10-year G-Sec (coupon rate: 6.54 per cent) jumping to close about 7 basis points higher and its price declining about 52 paise. Yield of this paper closed at 6.8877 per cent (previous close: 6.8136 per cent). The last traded price of this paper was ₹97.53 (₹98.0475).

Deep cuts in equities

While the Sensex closed at 52,842, down 1,491 points, hitting an eight-month low, the Nifty closed at 15,863, down 382 points. Experts said the markets will be eyeing the Federal Reserve policy meet this month, wherein an aggressive rate hike is expected. However, there is a changing view among the analysts who now believe that the Russia-Ukraine conflict has altered the scenario and such a hike may be postponed.

The Nifty is near its key levels of 15,800 and 15,500, which may be tough to break unless the news worsens, analysts said.

In a few hours after the markets closed for the day, the Brent crude prices were seen retreating from the highs. Any long term ceasefire in the Russia-Ukraine war could lead to a short term market rally, analysts said. Along with oil, even the global stock futures were off the lows hit during the day after reports suggested that Russia had offered some conditions to immediately end military operations.

Pankaj Pandey, Head – Research, ICICIdirect, said, “If crude prices sustain at higher levels, it is likely to impact India’s current account deficit as well as fiscal deficit as the country imports more than 80 per cent of its total requirement.”

FPIs scoot

In just four trading sessions of the current month, FPIs have sold stocks worth nearly ₹20,000 crore in the cash segment. In the index futures, the FPI selling so far, in March has been to the tune of ₹4,506 crore and ₹1,778 crore in stock futures. Last Friday, in a single session, the FPIs sold stocks worth more than ₹7,600 crore in the cash segment alone indicating panic.

Reportedly, amid the ongoing war, Peter Oppenheimer, chief global equity strategist at Goldman Sachs, has predicted that equity markets looked oversold to him. Some of the markets in Europe were trading near multi-year lows.

“Nifty is close to being oversold at 15,800. There is a 300-point risk with the risk reward favourable to the upside toward 16,800. The rising USD and commodity prices have created bullish opportunities in IT stocks, metals, and oil and gas,” said Rohit Srivastava, chief strategist, Indiacharts.

Ruchit Jain, lead researcher at 5paise.com, said traders should avoid aggressive market bets as of now. “Today’s low of 15,700 will be important support to watch and if that gets breached, 15,300 will be the next level. On the flipside, 16,200 and 16,400 will be seen as immediate resistances.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.