Global equity markets in Asia and Europe were on a crash course on Monday as the share price of yet another US bank, First Republic Bank, crashed by another 60 per cent in futures trading, days after the collapse of the Silicon Valley Bank. The US Federal Reserve’s emergency programme on Sunday also failed to calm investor nerves roiling the sentiments further in the global markets.

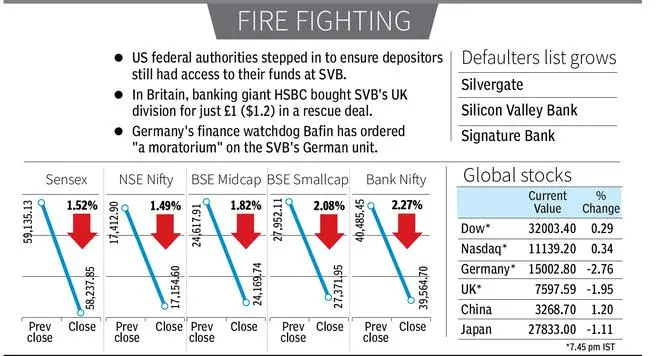

Sensex fell by 900 points or 1.52 per cent to close at 58,237. The Nifty index declined 260 points or 1.49 per cent at 17,154.

Fed watch

Analysts are of the view that the only ray of hope now was any signal by the Fed of a pause or a cut in its interest rates. The Fed would meet on March 21 and 22 to decide on its rates.

“Goldman Sachs Group Inc. economists said they no longer expect the Fed to deliver a rate increase next week. The risk of a banking crisis highlights the tension between Fed efforts to cool the economy and tame inflation with increasing concerns that 4.5 percentage points of rate hikes in the space of a year will trigger a recession and a collapse in riskier assets,” said Deepak Jasani, Head of Retail Research, HDFC Securities.

The fall in the European markets was worse than in Asia. Germany’s Dax fell more than 3 per cent and UK’s FTSE was down 2.2 per cent. Foreign portfolio investor (FPI) short position in index futures segment reached 1,20,000 contracts as on Friday last week. FPIs sold stocks worth ₹1,546 crore on Monday in the cash segment. Derivative data for the day was not published till the time of going to press.

The US futures rose sharply when the Asian markets opened for trading as the Federal Reserve and Treasury said it would increase the availability of funds to meet bank withdrawals and prevent runs on other banks. Despite this, the other regional banks continued to experience significant pressure.

“The market broke all important support levels and closed below the 17,250-level, which is negative. The Nifty has a major support between 17,000 and 16,900. On the upside, the index will find resistance at 17,250 and 17,450 levels,” said Shrikant Chouhan, Head of Equity Research, Kotak Securities.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.