Mumbai, May 11

Though the BSE Sensex and NSE Nifty recovered part of their losses on Wednesday, the heat was on small-cap stocks that faced heavy selling pressure.

Amid positive global cues, the Sensex and Nifty began on a positive note, but turned extremely weak. The benchmarks, though off the day’s lows, closed in the red, dragged by IT, auto, FMCG and consumer durables.

However, the BSE Sensex closed at 54,088.39, down 276.46 points or 0.51 per cent. It recorded an intraday high of 54,598.55 and a low of 53,519.30. The Nifty 50 closed at 16,167.10, down 72.95 points or 0.45 per cent. It recorded an intraday high of 16,318.75 and a low of 15,992.60.

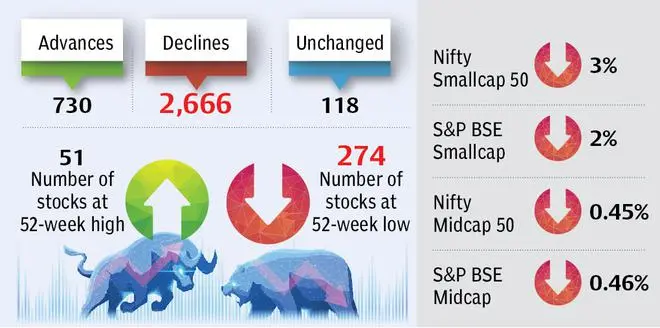

However, the Nifty Smallcap 50 closed nearly 3 per cent lower, while the S&P BSE Smallcap was down over 2 per cent.

The Nifty Midcap 50 was down 0.45 per cent, while the S&P BSE Midcap closed 0.46 per cent lower.

Nearly 2,600 stocks decline

The market breadth continued to remain in favour of the decliners with 2,594 stocks advancing on the BSE as against 801 that declined, while 119 remained unchanged. Furthermore, 11 stocks hit the upper circuit compared to two stocks locked in the lower circuit. Besides, 274 stocks touched a 52-week low, and 51 touched a 52-week high.

According to S Ranganathan, Head of Research at LKP Securities, “Indices displayed extreme volatility today ahead of the CPI & IIP data this week. While we did see a sharp recovery in Indices during afternoon trade, the market breadth was weak, with several stocks in the broader market taking a big knock-on selling pressure.”

Investors are awaiting inflation numbers for April in the US. According to analysts, volatility is likely to continue at both global and domestic levels owing to headwinds including inflation concerns, rising oil prices, uncertainty on account of the Russia-Ukraine crisis, and increasing Covid-19 cases.

The volatility index, which crossed the 23-mark intraday, was up 2.24 per cent, to close at 22.80.

According to Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd, “Markets displayed volatility but moved in a range before ending lower, as investors pruned their holding in IT, telecom & automobile stocks. Lack of fresh positive cues is forcing investors to dump equities and switch to safer havens like gold, etc. Although the larger texture of the market is still on the bearish side, we could see a sharp pullback rally in the near future due to markets being in oversold territory.”

From a technical perspective, according to Rupak De, Senior Technical Analyst at LKP Securities, “Nifty recovered smartly from the day’s low before closing with a marginal loss. On the lower end, it found support at 16,000 as it closed at 175 points off the day’s low. A large lower wick indicates buying at the lower level on the daily chart. On the higher end, the Nifty is likely to move towards 16,400. On the lower end, support is seen at 16,100/15,950.”

ONGC, Axis Bank, IndusInd Bank, Cipla and HDFC were the top gainers on the Nifty 50, while Shree Cement, Bajaj Finserv, L&T, NTPC and BPCL were the top losers

Banks, realty in focus

On the sectoral front, a majority of indices closed in the red. While private bank stocks and realty gained, IT, auto, FMCG and consumer durables dragged.

Nifty Bank and Nifty Private Bank closed 0.61 per cent and 0.53 per cent higher, respectively. Nifty Realty was up 0.73 per cent.

Meanwhile, Nifty IT closed over 1 per cent lower. Nifty Auto was down 0.91 per cent. Nifty FMCG and Nifty Consumer Durables were down 0.69 per cent and 0.70 per cent, respectively.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.