A warning by iPhone maker that it would manufacture fewer devices due to slackening demand and an alert sounded by credit rating agency Standard & Poor’s (S&P) about the UK already being in the throes of recession hit global stock markets again on Wednesday. Analysts said pressure is also building on the Reserve Bank of India to manage its foreign reserves. Sensex and Nifty fell for the sixth straight session as foreign portfolio investors (FPIs) continued offloading stocks.

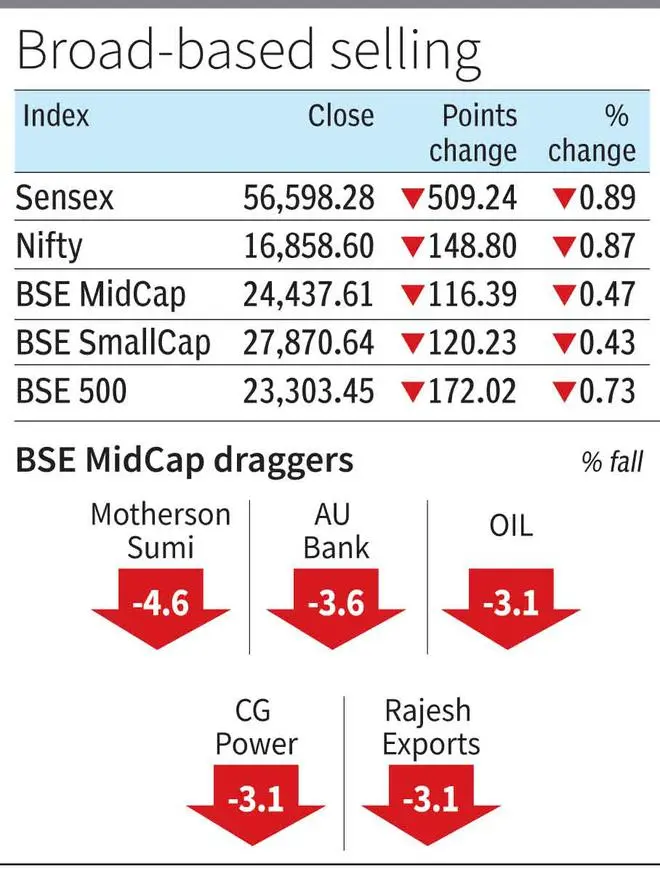

The Sensex fell 509 points, or 0.89 per cent, to close at 56,598 and the Nifty declined by 0.87 per cent, or 148 points, at 16,858. Markets in Japan, China, Hong Kong, and Taiwan were down between 1.5 and 3.5 per cent, and US index futures were witnessing huge volatility. The share price of Apple, the iPhone maker, was down by 3 per cent in pre-market trading in the US.

Rupee is now trading close to the 82 mark against the dollar. On Wednesday, the rupee depreciated by 40 paise to an all-time low of 81.93 against the dollar. The dollar index, at a 20-year high, has led to a sharp depreciation in the Indian rupee over the last week. Despite this, the rupee has outperformed other global currencies as the RBI has supported it by selling dollars.

More pressure on rupee

“We can expect more pressure on the rupee due to global sentiments. It will be difficult for the RBI to continue selling dollars aggressively any further. Remaining forex reserves are around 9–10 months of import cover only. Most likely, the RBI will have to increase repo rates (post the recent US Fed outcome) to defend the rupee from further downside. Nevertheless, in the medium term, the outperformance of the Indian rupee will be supported by lower external debt (below 20 percent as on March 2022), robust inflows (FDI+FPI), a resilient economy, and an adequate forex reserve of $540 billion.

The data reveals that the UK’s forex reserves can bear only one and a half months of its export expenses, while Bangladesh’s reserves can cover six months of import bills.

It is the reason that global investors are selling stocks. In cash markets, FPIs net sold stocks worth ₹2,772 crore. Their total sales in September so far stood at ₹13,143. Domestic institutional investors (DIIs), a counter force to FPIs, were net buyers to the tune of ₹2,544. Their net purchases stood at Rs 7712 crore this month so far. In the derivatives, FPIs have net sold index futures worth Rs 7593 crore this month. On Wednesday, they were buyers of index futures for ₹103.8 crore. In stock futures, FPIs were net sellers of Rs 21,577 crore in the month so far.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.