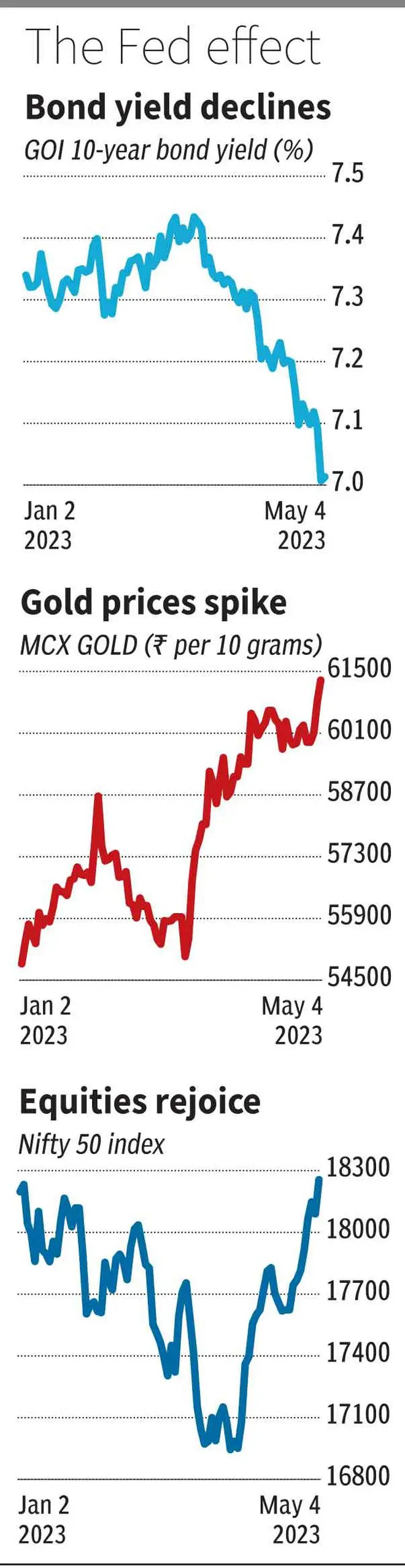

The US Federal Reserve’s decision to hike interest rates by 25 basis points even as it hinted at a pause going forward impacted sentiments in India’s financial, equity, and bullion markets on Thursday. While gold prices on MCX hit a new high with the June contract touching ₹61,490 per 10 grams, the 10-year benchmark government bond yield briefly dipped below 7 per cent on Thursday morning.

Meanwhile, the equity market bounced back, with the NSE Nifty 50 ending the day at 18,255.80, up 165.95 points or 0.92 per cent, and the BSE Sensex moving up 555.95 points or 0.91 per cent to 61,749.25.

This comes after the US Federal Open Market Committee meeting on Wednesday raised the Fed fund rates by 25 bps to a range between 5 per cent and 5.25 per cent, the highest since September 2007. Fed Chair Jerome Powell said it is now an open question whether further increases will be warranted in an economy still facing high inflation but also showing signs of a slowdown and with risks of a tough credit crackdown by banks on the horizon.

Gold glitters

While gold prices gave in some of the gains to close at ₹61,366, the yellow metal prices in the spot market also gained ₹602 per 10 grams to ₹61,646 against ₹61,044 logged on Wednesday, as per the Indian Bullion and Jewellers Association data. Gold on the Comex spot market had touched a high of $2,082 an ounce late Wednesday night.

Read: Bullion Cues: Gold and silver lacks trend

Ravindra V Rao, VP-Head Commodity Research, Kotak Securities, said gold prices might continue to edge higher amid prospects of a looming US recession, stress in the banking sector, and debt ceiling uncertainty.

Read: Gold shines as inflation reigns

G-Secs rally

In the financial market, Government Securities (G-Secs) continued to rally, with yields of the benchmark 10-year bond on Thursday briefly dipping below 7 per cent before pulling back even as the spread between the repo rate got compressed below 50 basis points, albeit only for a short while.

Read: How good is G-Sec as an investment option

Though the yield on the benchmark 7.26 per cent 2033 G-Secs dipped to 6.9786 per cent, the lowest level in almost 13 months, it could not be sustained as market players felt that investor appetite would be restricted at current levels. G-Sec has been rallying over the last month, with the yields closing at their lowest level in 13 months on Wednesday, in sync with the movement in US Treasury yields. Since April 6, when the monetary policy committee unanimously voted to keep the policy repo rate unchanged at 6.50 per cent, the yield of the benchmark 10-year G-Sec has slumped 27 bps, with its price shooting up ₹1.91. The yield of the benchmark GSec ended on Thursday a tad higher at 7.014 per cent (previous close: 7.0057 per cent. The price of this security was down 6 paise at ₹101.70 (₹101.76).

At the weekly auction of GSecs, 10-year benchmark paper was sold at a slightly higher yield of 7.0381 per cent against the previous closing yield of 7.0057 per cent. Market players attributed this to weaker-than-expected demand.

In the equity markets, the US Fed’s softening of its stance over future rate hike prospects cheered investors’ mood, which triggered a fresh bout of buying in banking stocks. “With India’s growth indicators showing good signs of revival and crude oil prices staying lower, investors are betting big on local equities even as the haze over global economic growth persists. Technically, the Nifty cleared the 18150 resistance mark, and post-breakout, it intensified the positive momentum. The index has also formed a long bullish candle, which supports a further uptrend from the current levels. As long as the index is trading above 18150, the uptrend wave is likely to continue up to 18350-18400.” said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.