Despite healthy growth in earnings, credit disbursements and improvement in asset quality in the second quarter, foreign investors remain pessimistic on India’s banking and financial services sector.

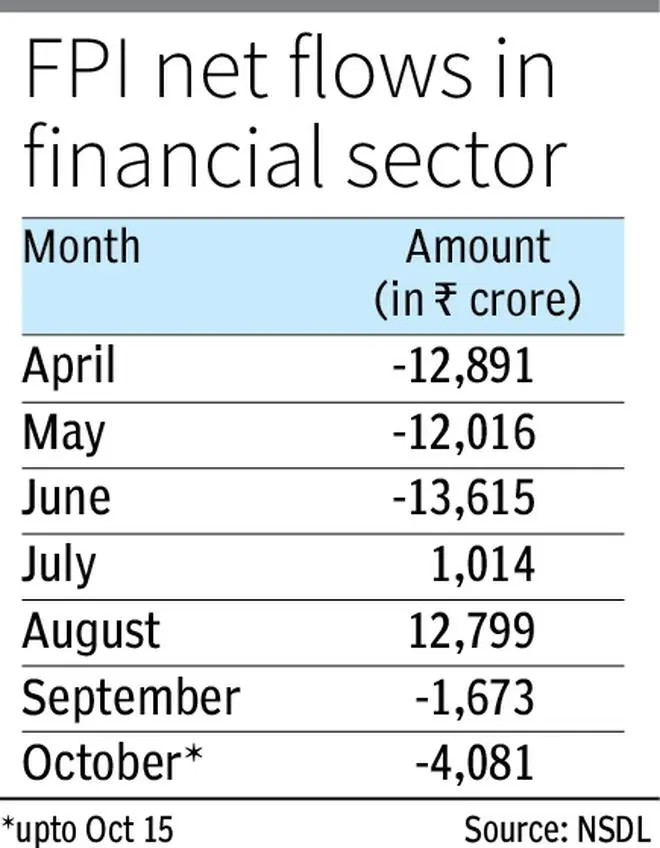

Foreign portfolio investors (FPIs), who pulled out ₹4,081 crore from the sector in the first fortnight of October, have been on a selling spree in Indian equities since October 2021, amid high inflation and aggressive monetary policy tightening by the US Fed and geopolitical tensions due to the Russia-Ukraine war.

Related Stories

FPIs selloff at slow pace; pull out ₹1,586 crore from equities in October

FPIs were net buyers of ₹51,200 crore in August.Their sell-off intensified at the beginning of the current fiscal as more global macro-economic challenges, including the Chinese slowdown and global growth downgrades by multilateral institutions, forced foreign investors to pull money from developing economies, including India, to safer asset classes in the domestic market.

After pulling out ₹38,522 crore in Q1FY 23, FPIs turned net buyers in the banking & financial services sector in July and August, with net investments of ₹1,014 crore and ₹12,799 crore respectively. In September, foreign investors again turned net sellers in the sector, with a marginal outflow of ₹1,673 crore.

Related Stories

Bears prowl as FPI selling spree triggers market rout

Sensex tanks 953 points, Nifty index loses 311 points“When FPIs go into the sell mode, they sell from their largest holding segment, which is the financial services sector. The 2-year US bond yield is currently at 4.4 per cent. If the safest asset in the world gives a risk-free return of 4.4 per cent, it is rational to sell and everything else becomes secondary,” said V.K. Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

He, however, added that from a medium to long-term perspective, it may be a short-sighted policy since the financial services sector, especially banking, is doing well in India and is set to continue its outperformance.

Healthy Q2 results

All major banks have posted healthy results in the second quarter of the current fiscal as they continue to emerge from the pandemic-led slowdown in credit growth and corporate deleveraging.

The country’s largest private sector lender HDFC Bank posted 20 per cent growth in Q2 net profit at ₹10,605.8 crore, while ICICI Bank posted 37 per cent growth in its net profit at ₹7,558 crore. Axis Bank’s Q2 net profit zoomed 70 per cent year-on-year to ₹5,330 crore during the July-September quarter.

These lenders have recorded robust growth in their loan book across retail, corporate, rural and MSME loans. While the asset quality of these lenders has also improved substantially, signaling a strong recovery and drop in fresh slippage.

FPIs cut exposure in private banks

FPI shareholding in many private sector banks has also come down due to a persistent sell-off in the sector. FPIs’ stake in Bandhan Bank dropped 4 per cent to 30.15 per cent between March and September 2022, while foreign investors’ holding in HDFC Bank fell by 3 per cent to 32.12 per cent. While Axis Bank and RBL Bank saw FPI holding come down by one per cent, their stake went up by 1 per cent in ICICI Bank, YES Bank and IndusInd Bank, between the March and September 2022 quarters.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.