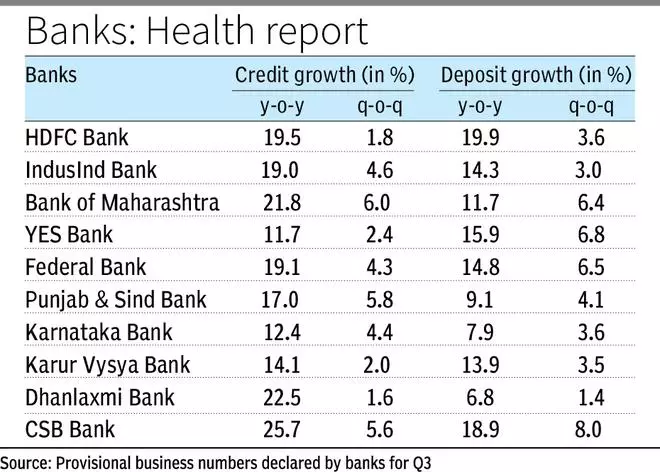

Provisional numbers shared by select banks for Q3 FY23 so far, reflect strong credit growth across private and public sector lenders and a pick up in deposit accretion.

Most banks that have declared numbers posted loan growth of over 15 per cent year-on-year, with leading banks such as HDFC Bank, Federal Bank and IndusInd Bank seeing credit growth of over 19 per cent for the quarter ended December. On the other hand, deposit growth, too, picked pace, with most mid-sized and large private sector banks seeing deposits grow over 14 per cent from the previous year.

However, smaller banks reported muted deposit growth, indicative of the challenges they could face in their liability book as deposit accretion becomes more competitive in the coming quarters.

HDFC Bank and YES Bank were the outliers, with deposits growing more than credit, both for the quarter and year ended December.

Sequential performance

Over the last 12 months, credit offtake has grown 17.5 per cent or ₹19.5-lakh crore in absolute terms, whereas deposits have grown 9.9 per cent or ₹15.7-lakh crore as of December 2, as per latest data by the RBI. On a sequential basis, loan growth was benign, especially for private banks. Of the numbers declared so far, most posted languishing loan growth of 2-5 per cent despite this quarter seeing festival season-led demand.

Credit growth likely slowed down sequentially due to a high base in the previous quarter and as banks turned more cautious amid tightening liquidity conditions and concerns of a slowdown, industry participants said. Deposit growth remained steady sequentially, with most banks posting 4-7 per cent growth q-o-q, except for Dhanlaxmi Bank.

The outliers were Bank of Maharashtra and Federal Bank, both of which saw deposits growing faster than advances over the quarter ended December. The faster deposit growth by mid-sized banks reflects an increase in their market share as they hiked deposit rates faster than peers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.