A sharp jump in the provisioning for bad loans saw Bank of Baroda’s net profit slide 60 per cent to ₹424 crore in the first quarter ended June 30 against ₹1,052 core in the year-ago quarter.

With the public sector bank witnessing a sharp jump in bad loans during the quarter amounting to ₹6,096 crore (₹1,908 crore in the year-ago period), its stock took a beating, closing at ₹145.95 apiece, down 8.95 per cent (or ₹14.35) over the previous close on the BSE.

However, vis-à-vis the preceding quarter, the bank reported a turnaround in performance. In the January-March 2016 quarter, it had recorded a loss of ₹3,230 crore.

The bank attributed its profitability to a host of factors, including running off high-cost liabilities, improvement in yield on advances, lower interest expenses, and robust trading gains.

Gross non-performing assets (GNPAs) soared to ₹42,991 crore as at June-end 2016 against ₹17,274 crore as at June-end 2015. The GNPA ratio deteriorated to 11.15 per cent from 4.13 per cent.

The provisions for NPAs and bad debts written-off were up ₹1,986 crore (₹568 crore in the year-ago quarter).

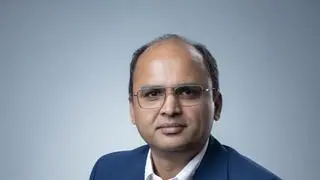

Highest operating profit PS Jayakumar, MD and CEO, observed that despite the bank making the highest operating profit in the last five quarters, the focus was on NPAs.

“…And yes, the NPA problem is there. It is there for everybody and it is within a range… We don’t see the guidance of ₹45,000-50,000 crore, with a bias towards the lower number, given earlier for NPAs going worse,” he explained.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.