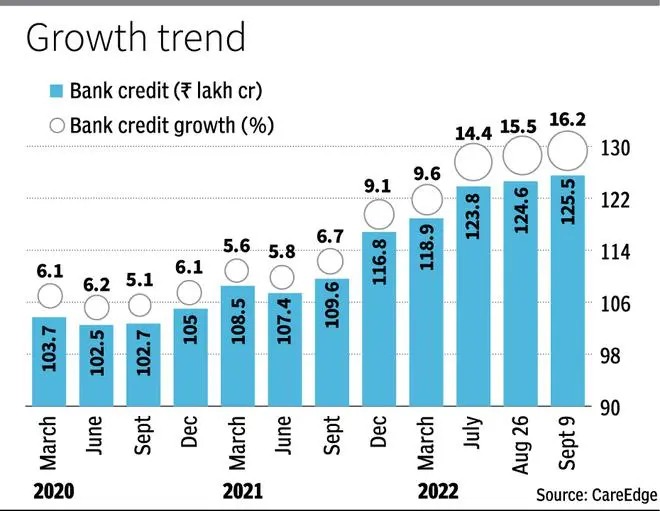

Credit offtake recorded a robust growth of 16.2 per cent year-on-year (y-o-y) for the fortnight ended September 9, driven by sustained retail and improving wholesale credit, which is likely to continue in this fiscal.

The growth is nearly the highest in the last 9 years (similar growth was witnessed during the fortnight that ended October 18, 2013), says a report by CareEdge.

Credit offtake increased sequentially by 0.7 per cent from the immediate fortnight (ended August 26, 2022). In absolute terms, credit outstanding crossed the benchmark of ₹125 lakh crore as of September 9, rising by ₹17.5 lakh crore over the last 12 months.

However, the momentum in the credit growth may be impacted if there are further rate hikes on account of due to elevated inflation and depreciating currency.

The growth has been on an upward trajectory since the latter half of FY22 and witnessing a double-digit since April 2022. Retail credit growth has been strong due to underlying demand, as credit outstanding saw a robust growth at 18.8 per cent y-o-y in July driven by the miniaturisation of credit, housing, and vehicle loans. Corporate loans indicate a shift from the capital market to bank borrowings as hardening bond yields have prompted companies to optimise their borrowing cost.

Credit outstanding up

The credit outstanding of the industry segment registered a growth of 10.5 per cent y-o-y in July 2022 from 0.4 per cent in the year-ago period due to inflation-induced higher working capital demand, commodity prices, and improvement in capacity utilisation ratio. The rise was on account of robust growth in the micro and small (28.3 per cent), and medium (36.8 per cent) enterprise segments, while the large segment too showed a growth of 5.2 per cent from a drop of 3.8 per cent in the year-ago period.

Credit for the services sector also accelerated by 16.5 per cent y-o-y in July, from a growth of 3.8 per cent in the year-ago period primarily due to a rise in NBFCs and trade segments.

Festival cheer

Given the approaching festival season, the credit growth is likely to remain elevated in the near term. After a modest credit growth in recent years, the outlook for bank credit offtake is positive due to the economic expansion tracking nominal GDP growth, strong demand for small-size (ticket) loans, rise in government & private capital expenditure, commodity prices, higher demand for working capital, increase in capacity utilisation ratio, implementation of the PLI scheme, and ECLGS for MSME.

The medium-term prospects look promising with diminished corporate stress and a substantial buffer for provisions. However, inflation remains a key risk. Even as RBI has managed domestic inflation to some extent, global inflation has remained high despite hawkish policies. This may lead to demand issues globally causing second-order effects in India. Hence, credit growth is expected to be in the range of 12-13 per cent in FY23.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.