As part of increasing caution amidst growing macro-economic uncertainties and bank collapses in the US and Europe, India’s central bank is asking banks back home to be watchful over their retail portfolios, particularly the unsecured loans. These include personal loans, credit cards, small business loans and micro finance loans.

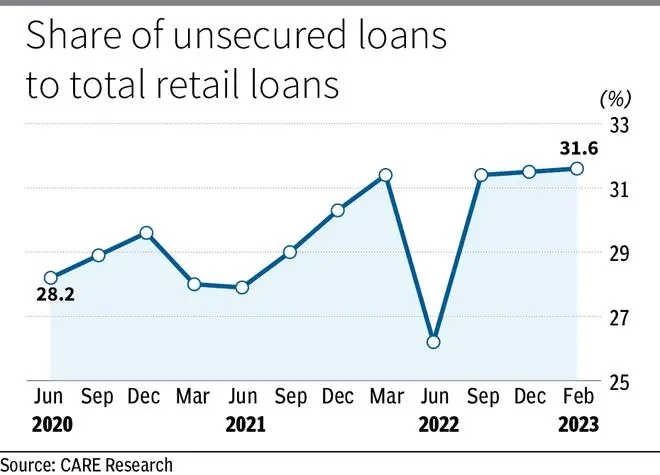

The overall share of unsecured loans as an average across private banks has increased by over 300 basis points since June 2020 and this hasn’t gone down well with the central bank.

“As a measure of prudence, the RBI has asked banks to stay within the limits seen in FY23 with respect to unsecured loans,” said a CEO of a private bank.

- Also read: RBI looks askance at co-lending arrangements

Credit deployment

To be sure, as per the latest credit deployment data published by the RBI, unsecured loans lent between February 2022 to February 2023 stood at ₹2.2-lakh crore, higher than the deployment towards large corporates at ₹1.18-lakh crore.

The size of the home loan market during this period was ₹2.49-lakh crore just marginally larger than the unsecured loans market. A report by CARE Ratings pegs the unsecured loans market at ₹13.2-lakh crore, almost equal to the total exposure of the banking sector towards NBFCs (at ₹13.1-lakh crore).

In 2019, the risk weight on unsecured loans excluding credit cards was reduced from 125 per cent to 100 per cent to place them at par with other retail loans. It was also done to harmonise the risk weights to Basel-III requirements.

“Despite repeated warning to banks, especially private banks, these loans growing faster than the secured retail loans. If the trend continues for longer, the regulator may once again increase the risk weights,” said a senior executive of a leading private bank.

No proper checks

With sachetisation of personal loans and 30-minutes sanctioning becoming a common practice among banks, the regulator is of the view that adequate credit checks may not be in place.

“Right now with rapid growth in this space, at a micro level it is becoming difficult to assess the exact asset quality of these loans,” said a highly placed source. “The best way to avert a systemic risk is to reduce the pace of growth in the unsecured space,” said another top executive of a private bank.

Apparently, even on the micro finance side banks have been sounded off informally not to overdo growth.

“Even though demand for MFI loans and collection efficiencies have improved since mid-2022, it warrants for caution given the increasing from small finance banks and NBFCs,” said a person aware of the matter.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.