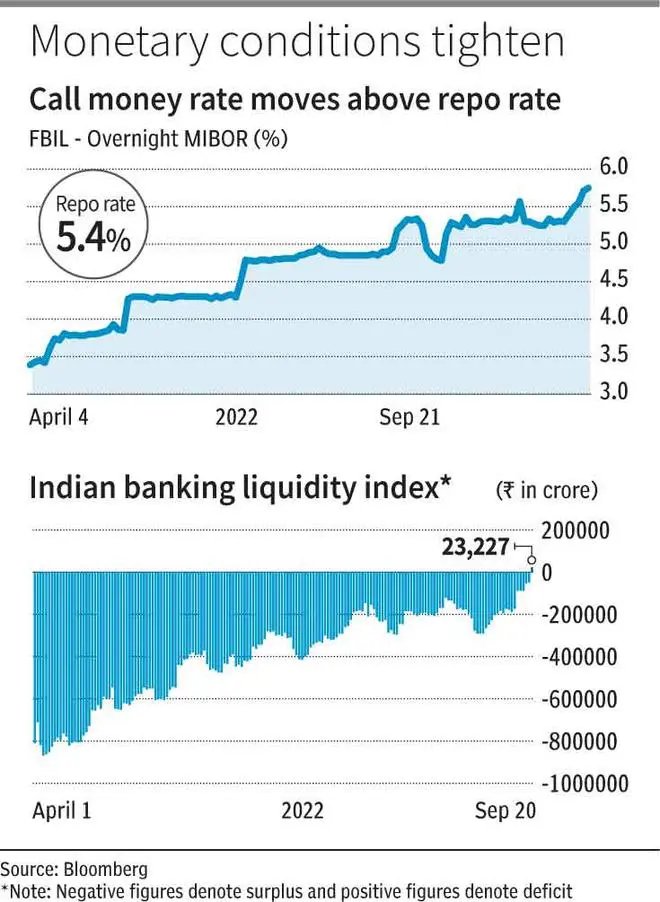

Liquidity in the banking system has swung into deficit after remaining in surplus for almost 40 months.

The change in the liquidity situation is due to advance tax outflows for the second quarter. This also nudged up the call money rate temporarily above the repo rate.

The liquidity deficit in the banking system was estimated at ₹23,227 crore as on Wednesday against the previous day’s surplus of ₹47,936 crore, per Bloomberg data.

Call money rate up

Consequently, the interbank call money rate rose above the repo rate (of 5.40 per cent) to touch a high of 5.85 per cent, before cooling off to last trade at 5 per cent (previous day’s last traded rate: 4.40 per cent), according to Clearing Corporation of India data.

To help the banking system tide over the liquidity deficit and also soften call money rates, the Reserve Bank of India said it will conduct a ₹50,000-crore Variable Rate Repo (VRR) auction of one-day tenor under the Liquidity Adjustment Facility on Thursday.

According to V Lakshmanan, Head of Treasury, Federal Bank, “Right now there is a bit of a deficit situation. In the last one week, advance tax outflows have happened. Further, Goods and Service Tax related outflows will be happening. When this money comes back into the system, the situation will get reversed. The liquidity deficit is a transient situation at this particular point in time.”

Dipanwita Mazumdar, Economist, Bank of Baroda, said that in the coming months, the pressure on liquidity would continue because of the RBI’s forex intervention, capital spending of the government, and a pick-up in currency demand.

“With credit growth already running at double digits, it would add further pressure on the liquidity numbers. Short-term rates thus will increase at a faster pace as the direct reflection of tighter liquidity and the RBI’s rate hike would be on these papers,” she said.

On short-term rates, Mazumdar said that Treasury Bill rates have started inching up since the RBI’s rate hike cycle started.

T-Bill rates rise

“With the frontloading of the RBI’s 140 basis points rate hike till date, T-Bill yields have started rising. In comparison to April 2022 cut-off yield, the average cut-off yield across all (T-Bill) tenors rose 179 bps, while the 10-Year G-Sec yields increased by only 31 bps,” she said. Thus, the borrowing cost for short-term paper is increasing at a faster pace than longer tenor securities.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.