The disbursal of small business loans under Pradhan Mantri Mudra Yojana (PMMY) logged a record 30 per cent growth in the first half of the current financial year ended September compared to the same period last year. As on September 2022, banks and other institutions disbursed over ₹1,37,785 crore under PMMY, while in the year-ago period, the same was at about ₹1.06 lakh crore, according to government data.

“The disbursement in the first half of the current fiscal is the highest growth in the last three years and indicates not only complete normalisation of economic activity but also a higher appetite for small business loans,’‘ a senior Mudra official told businessline.

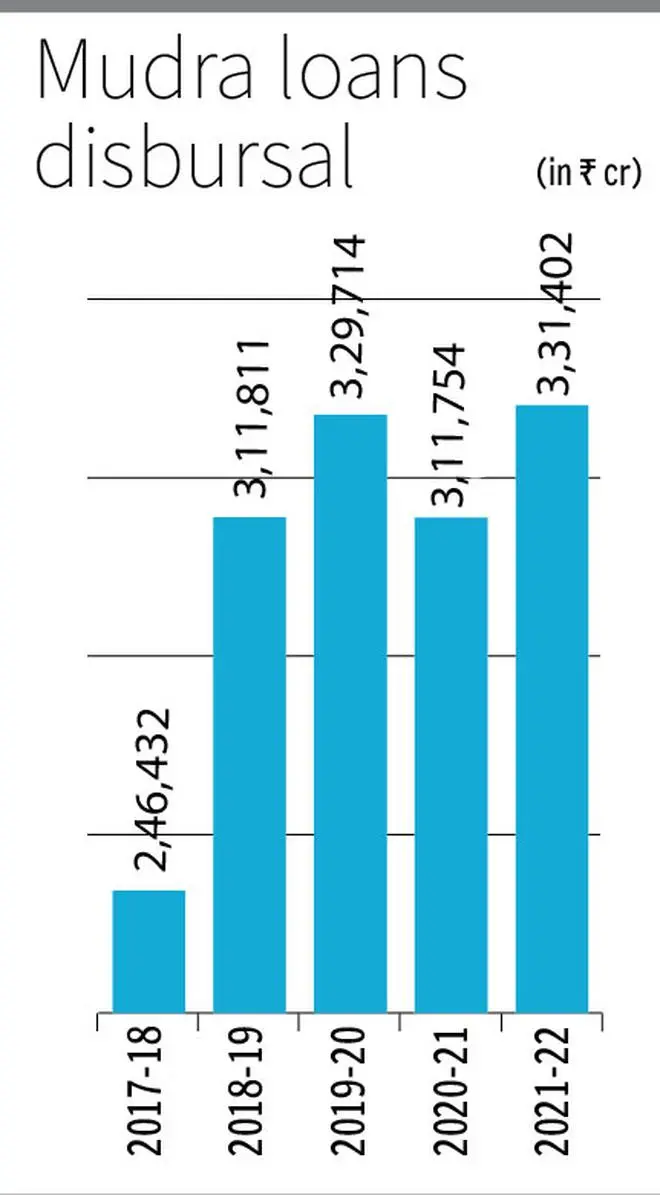

The data on the performance of PMMY showed a decline in total disbursals to ₹3.11 lakh crore in 2020-21 (from ₹3.29 lakh crore) largely due to the impact of Covid-19. However, the growth returned back during 2021-22 with total disbursals reaching ₹3.31 lakh crore. The bankers are expecting to close the current fiscal with disbursals higher than the previous year given the current run rate.

According to Prasanna Tantri, Executive Director, Centre For Analytical Finance, Indian School of Business, the growth trend reflects the overall credit growth in the economy.

“To the extent Mudra loans support entrepreneurs and create jobs, an increase in credit growth is welcome. These loans are likely supporting small businesses to recover from the Covid shock,’‘ he said.

There is a need for caution too. “However, one needs to be mindful of the NPAs. A higher level of NPAs is expected, given the profile of the borrowers. Unfortunately, we do not know the exact ratio of NPAs and outstanding loans. In the next phase, banks should focus more on screening and monitoring and try to bring down the level of NPAs,’‘ Tantri added.

Mudra loans are extended in three categories — Shishu (up to ₹50,000), Kishor (above ₹50,000 and up to ₹5 lakh) and Tarun (above ₹5 lakh and up to ₹10 lakh).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.