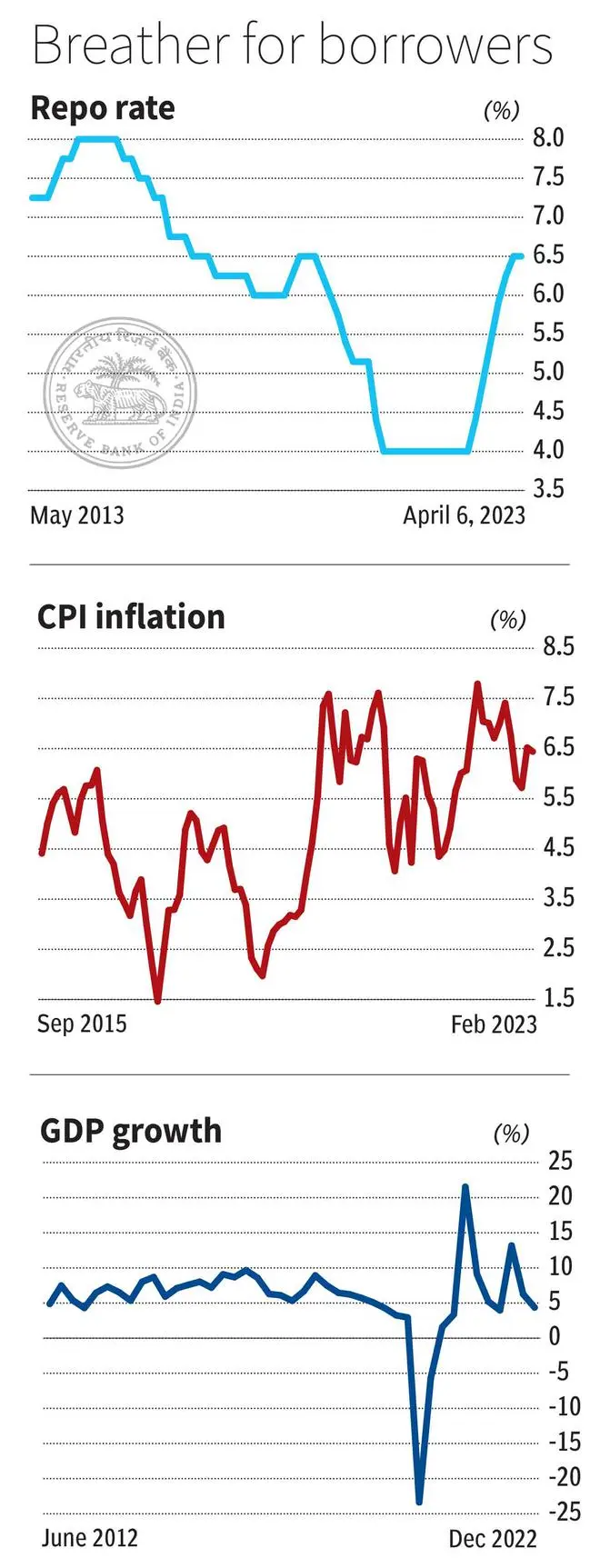

The six-member rate-setting Monetary Policy Committee (MPC), in a surprise decision, voted unanimously to put the brakes on the tightening cycle, even as RBI Governor Shaktikanta Das emphasised that the decision to pause on the repo rate is for this meeting only.

The decision to hold the policy repo rate at 6.50 per cent, with readiness to act should the situation so warrant, came in the backdrop of expectation that headline inflation (total inflation, including volatile components such as food and fuel, experienced throughout the economy) will moderate in 2023-24.

‘A pause, not a pivot’

Das underscored the necessity to evaluate the cumulative impact of 250 basis points rate hike since May 2022. He characterised today’s monetary policy as a pause, not a pivot.

The MPC, in its first meeting of FY24, also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target (4 per cent), while supporting growth.

Read also: RBI needn’t sneeze if the Fed is down with flu

Majority of the bankers, economists and bond market players were expecting MPC to up policy repo rate by 25 basis points (bps) as inflation prints have been in breach of the 6 per cent upper tolerance level in the past 10 of 12 months, with the January-February 2023 average at 6.4 per cent.

“Headline inflation is projected to moderate in 2023-24. The monetary policy actions taken since May 2022 are still working through the system.

“Accordingly, the MPC decided to keep the policy rate unchanged to assess the progress made so far, while closely monitoring the evolving inflation outlook. The MPC will not hesitate to take further action as may be required in its future meetings,” the Governor said.

Das noted that projections for 2023-24 point to a softening in inflation, though the disinflation is likely to be gradual and protracted, given the rigidity in core or underlying inflation pressures.

EditorialA pragmatic pause on rate hikes

“While we have kept the policy rate unchanged, it is important to bear in mind that this decision was taken on the basis of our assessment of the macroeconomic and financial conditions with reference to the information available up to today.

“MPC’s job is not yet finished and the war against inflation has to continue until it sees a durable decline in inflation closer to the target. We stand ready to act appropriately and in time. We are confident that we are on the right track to bring down inflation to the target rate over the medium term,” he said.

Experts believe MPC will remain on pause for an extended period as long as inflation does not rise materially above its forecast.

Focus on price stability

“Given that there is overall macroeconomic and financial stability, our priority continues to be price stability,” Das said.

The pause in repo rate hike could give a breather to existing retail and MSME borrowers from continuous increase in equated monthly instalments over the last 11 months.

Industry welcomes pause

Dinesh Kumar Khara, Chairman, State Bank of India, observed that the RBI’s decision to pause rate hike for now was a pleasant surprise given the market was expecting one more final rate hike.

“With uncertainty looming large, this decision was perfectly timed…Overall, RBI’s April policy guides the market in terms of expectations alignment,” he said.

Welcoming RBI’s move to decouple from the global tightening cycle and pause interest rate hike, Sanjiv Bajaj, President, CII, agreed with the central bank’s observation that the lagged impact of the past rate hikes should be allowed to percolate into the system, and not stifle demand by further rate hikes.

“Though the domestic demand impulses remain healthy, the headwinds from the global banking stress have gained pace, hence it was important for the Central Bank to remain cautious in its stance.

“This move by the RBI will help bolster business sentiments by containing the rise in borrowing costs which have constricted the pricing power of firms,” he said.

Revision in GDP and inflation projections

The central bank nudged up the FY24 real GDP growth projection to 6.5 per cent from its earlier projection of 6.4 per cent.

It also revised its FY24 retail inflation projection a shade lower to 5.2 per cent from its earlier projection of 5.3 per cent.

‘With unyielding core inflation, we remain firm and resolute in our pursuit of price stability which is the best guarantee for sustainable growth. The impact of our actions over the past 12 months is still playing out and would increasingly weigh on the future inflation trajectory,’ Das said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.