Income Tax Department has said that VG Siddhartha and his firm Coffee Day Enterprises owe nearly ₹ 650 crore in tax and shares were attached to protect the revenue.

The Department reacted to the letter purpotedly written by the missing founder of Café Coffee Day chain. In a letter dated July 27 to the Board of Directors of his company and Coffee Day family, Siddhartha had written, “There was lot of harassment from the previous DG (Director General), Income tax in the form of attaching our shares on two separate occasions to block out Mindtree deal and then taking position of our coffee day shares, although the revised returns have been filed by us. This was very unfair and has led to a serious liquidity crunch.”

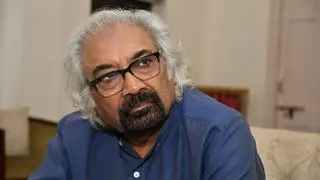

Siddhartha is missing from Sunday night.

In a rather strong statement the Tax Department questioned the authenticity of the letter. Also, it said that signature was different from that in annual reports. The Department also gave the sequence of events which led to attachment of Coffee Day Enterprises shares.

“The provisional attachment was made to protect the interest of revenue out of the income admitted by assessees (Siddhartha and Coffee Day Enterprises) based on credible evidence gathered in search action,” the Department said while reaffirming the fact that it acted as per provision of law.

The chain of events started with the investigation in the case of Siddhartha and Café Coffee day with searches in the case of a prominent political leader of Karnataka. “In the search action, after considering evidence gathered by the department, Siddhartha admitted the unaccounted income of ₹362.11 crore and ₹118.02 crore, in the hands of Siddhartha and Coffee Day Enterprises in the sworn statement,” the Department said while adding that Income Tax return was filed but did not mention the undisclosed income as admitted in the sworn statement in both the cases except the sum of ₹ 35 crore in his individual cases.

Based on newspaper reports and on its verification, taxmen came to know that Siddhartha and his two firms – Coffee Day Enterprises and Coffee Day Trading planning to sell their holding in Mindtree Limited. “The tax effect along with interest and penalty based on the outcome of the search action runs to hundreds of crores. On the other hand, there was no application filed by the assessees concerned before the assessing officer as required under the statutory provision before transferring any assets when the income tax proceedings are pending,” the Department said.

Taxmen attached the shares of Mindtree owned by Siddhartha and his firm, An offer was made by Siddhartha to release Mindtree shares against the security of shares of Coffee Day Enterprises. This was accepted by the Income Tax Department on a condition that the sale proceed will be deposited in an escrow account which will be used to repay the loan and tax liability.

Share sales of Mindtree fetched around ₹3,200 crore. Siddhartha repaid a loan of ₹ 3000 crore. Some amount used to bear the transfer cost of shares and balance of ₹46 crore was paid towards the first instalment of Advance Tax of estimated MAT (Minimum Alternative Tax) liability in the case of shares of Coffee Day Enterprises.

“As against the balance MAT liability of ₹250 crore and tax liability arising based on search findings to the tune of approximately ₹400 crore, the provisional attachment made by the department is less than 40 per cent of the likely tax liability,” the Department said while shrugging off the allegation of tax terrorism.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.