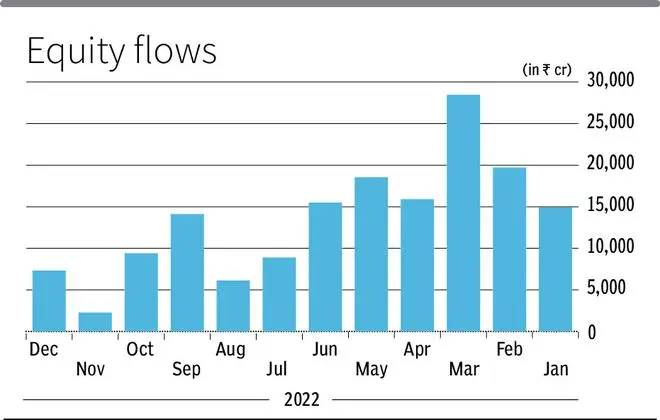

Inflows into equity mutual fund schemes more than tripled last month to ₹7,303 crore against ₹2,258 crore logged in November as investors used the sharp fall in equity markets to make fresh investments.

Small and mid-cap funds witnessed the highest inflow of ₹2,245 crore (₹1,378 crore) and ₹1,962 crore (₹1,176 crore), out while large and mid-cap fund logged an inflow of ₹1,189 crore (₹593 crore), according to the Association of Mutual Funds in India released on Tuesday.

NS Venkatesh, Chief Executive, AMFI said investors continue bet on India growth story through mutual fund as they are expecting a growth-oriented Budget which should have a positive impact on the markets.

Thematic and focused funds saw a net outflow of Rs ₹204 crore and ₹164 crore while outflows from large-cap funds continued at ₹26 crore last month.

Equity AUM shrinks

Despite the positive inflow the overall equity asset under management fell to ₹15.25-lakh crore (₹15.58 lakh crore) as benchmark Sensex dipped 2,259 points last month. The overall asset under management of MF industry increased 5.75 per cent last year to ₹39.89-lakh crore from ₹37.72 lakh crore.

Kavitha Krishnan, Senior Analyst, Morningstar India said most sectors witnessed a negative return in December, except for PSU banks and metals. The performance in PSU banks were driven by the central bank’s measures to improve liquidity and reduce NPA’s in the banking sector, she said.

Hybrid schemes saw an overall inflow of ₹2,255 crore (outflow of ₹6,477 crore) largely due to investment of ₹1,711 crore (₹86 crore) in multi asset allocation as investors preferred to hedge the equity risk across other asset class.

SIPs shine

Systematic Investment Plan contribution increased further to ₹13,573 crore against ₹13,306 crore in November even while SIP asset fell to ₹6.75-lakh crore (₹6.84 lakh crore).

Akhil Chaturvedi, Chief Business Officer, Motilal Oswal AMC, said SIPs continue to create new milestones with inflows staying above ₹13,000 crore-mark for third straight month and this helped negate the impact of recent selling by FIIs.

Debt funds continued to face headwinds on the uncertainty over interest rate hike cycle and saw an overall outflow of ₹21,947 crore (inflow of ₹3,669 crore). Liquid funds saw a net outflow of ₹13,852 crore (inflow of ₹34,276 crore).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.