The Hurun Research Institute has unveiled the ASK Private Wealth Hurun India Future Unicorn Index 2022, a ranking of Indian start-ups founded in the 2000s and valued $200 million at least, but not listed on a public exchange. It classified companies as would-be unicorns (those founded after 2000 and valued $1 billion at least); gazelles (most likely to become unicorns in the following two years); and cheetahs (start-ups that could turn unicorn in the next four years).

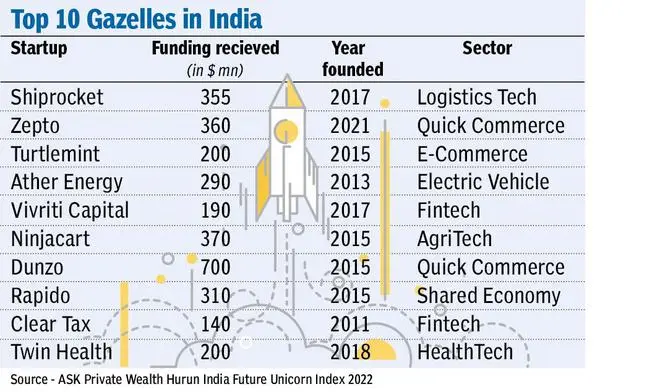

The gazelle in the wild is capable of outrunning the cheetah due to its agility and speed. The ‘gazelles’ on the index are projected to be worth between $500 million and $1bn. The gazelle pack is led by Shiprocket, a five-year-old logistics-tech start-up, followed by Zepto, Turtlemint, Ather Energy and Vivriti Capital.

The age factor

The Hurun classification has been validated by this year’s report, as six cheetahs from the previous index ‘skipped’ the gazelle-stage and entered the unicorn club, a spokesman said. This year, the cheetah pack is led by Pepperfry, followed by Bengaluru-based Juspay and Ratan Tata-backed fintech Mswipe Technologies. The youngest start-up founders are Kaivalya Vohra (19) and Aadit Palicha (20) of Zepto, a 10-minute grocery delivery company based out of Mumbai. The oldest founder in the index is K Satyanarayana, aged 61, of Ecom Express. The average age of start-up founders is 38. There are 18 founders aged under 30 and 19 aged above 50. Fifteen companies have a woman co-founder.

The fintech magnet

Among sectors, fintech contributed the most start-ups to the index at 27, followed by e-commerce at 14, and software-as-a-service (SaaS) at, with 11. Approximately half of the firms in the index are involved in fintech, e-commerce, SaaS, and edtech. Other potential fields in the start-up ecosystem include agri-tech, artificial intelligence, health-tech, and shared economy. The prospective unicorns were founded, on average, in 2015, with the great majority selling software and services and only 17 per cent selling physical goods. At least 37 per cent are business-to-business sellers, and 63 per cent are consumer-facing. The future unicorns have disrupted the financial services, logistics, healthcare, and education sectors.

Rising stars of tomorrow

Hurun Research identified 122 future unicorns in India from 25 cities. Bengaluru continues to be the unicorn capital with 46, and Delhi NCR and Mumbai follow with 25 and 16, respectively. Rajesh Saluja, Chief Executive Officer and Managing Director, ASK Wealth Advisors, said India has emerged as the third largest ecosystem for start-ups after the US and China, and saw a record 44 unicorns in 2021.

“The ASK Private Wealth Hurun India Future Unicorn list showcases the leaders of tomorrow today. We shine the spotlight on gazelles and cheetahs, the rising stars of the start-up ecosystem, and, possibly, future unicorns. As many as 17 gazelles and seven cheetahs from last year’s list hit unicorn valuation this year,” Saluja said.

Pandemic drives diruption

Anas Rahman Junaid, Managing Director and Chief Researcher, Hurun India, said the country’s start-up ecosystem is expanding at an unprecedented rate. In just one year, the number of unicorns has increased by 65 per cent, the number of gazelles by 59 per cent to 51, and cheetahs, 31 per cent to 71. “Probably, the pandemic has accelerated the disruption of traditional businesses and fostered the emergence of start-ups. The ecosystem is gradually attaining the requisite maturity and resilience,” he added.

‘Short-term blips’

Junaid, however, said global economic concerns could affect the valuations and capital-raising abilities of Indian start-ups. Additionally, some of them are seeing layoffs and cost-cutting measures, fuelling speculation of a downturn. “We believe there could be a short-term blip in the growth story, but the Indian start-up ecosystem’s long-term potential remains excellent and resilient. The pressure felt during the valuation process and the increased inspection of deliverables could help broaden the system’s foundation,” he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.