In its ‘India Equity Strategy Outlook’ report, Morgan Stanley predicted that the Sensex may touch 80,000 mark by end of December 2023 mainly due to higher capex, benign price level of commodities, and possible inclusion of India in global bond indices.

Out of these factors, capital expenditure (capex) holds the key since there are three major forms of investment — government, corporate, and household sectors — that facilitate long-term growth of an economy.

Classical economists have advocated that output in the economy can be enhanced by increasing either capital or labour, assuming no technological change. Neo-classical theorists propounded that economic growth will be driven by accumulation of capital, and enhancement of factor productivity through technological advancements. There are many studies which conclude that higher savings lead to larger investments, ultimately resulting in stronger economic growth.

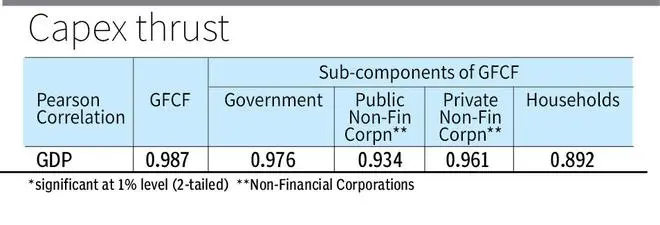

During the period between 2011-12 and 2020-21, India’s Gross Fixed Capital Formation (GFCF) increased by 75.58 per cent — from ₹29.98-lakh crore to ₹52.64-lakh crore. This led to an increase of 126.65 per cent in GDP from ₹87.36-lakh crore to ₹198-lakh crore during this period. Pearson correlation between GDP and sub-components of GFCF is found to be highly significant at 0.987 during 2011-21 as shown in the accompanying table. It is evident from the table that sub-components of GFCF too have significant correlation with GDP reflecting the investment-growth connect.

Public investments

With a view to leveraging investment-growth connect, the Centre has been focussing on capex in its recent Budgets. Accordingly, the government’s allocation for capex zoomed from ₹3.39-lakh crore for the FY2019-20, to ₹7.50-lakh crore for FY2022-23.

Essentially, the government has been focusing on investment in infrastructure — roads, Railways, airports, ports, mass transport, waterways, and logistics — to enhance ease of living for citizens and make growth more inclusive. By notifying 196 projects under PM Gati Shakti, the government hopes to put the economy on a high growth trajectory by reducing its expenditure on logistics by 5 per cent in the next five years, from the existing level of 13-14 per cent of Gross Domestic Product (GDP) as against 8-9 per cent in advanced economies.

Private investments: Also, the private sector has been encouraged to go for capex through the Production Linked Incentive (PLI) Scheme. An amount of ₹1.97-lakh crore was earmarked for 13 manufacturing sectors under PLI scheme to expand domestic production, enhance exports, and create 6 million jobs.

For instance, Vedanta and Foxconn are planning to invest ₹1.54-lakh crore for manufacturing of semiconductors under this scheme. Besides, the China-plus Strategy is a blessing in disguise for India since the West is looking at India as a manufacturing hub for textiles, electronic goods, automobiles, etc.

However, countries such as Bangladesh, Malaysia, Thailand and Vietnam are strong contenders to India. While Bangladesh has comparative advantage in terms of low labour costs, Vietnam has the most competitive electronics sector mainly due to its investor-friendly policies.

Household investments: Little and Joshi (1994), in their study, conclude that public investment pushes private investments including capex from corporate sector and households, especially in case of a slack in the economy. As such, the Centre has been incentivising households and farmers to invest in construction of homes, and accumulation of capital assets. It is observed that households own a major share of capital stock in many countries, including India.

Sustainable growth

Every year, the governments have been investing trillions of rupees on agriculture, education, rural development and other areas. However, there is lack of effective inter-Ministry and departmental coordination. Therefore, scarce capital resources need to be efficiently deployed in public sector to enhance accountability, transparency and above all sustainability.

Now, the entire world is focusing on ‘sustainable growth’ with a special emphasis on ESG — Environmental, Social, and Governance — matrix. Therefore, the private sector may be encouraged to go for environment friendly capex related to solar power, electric vehicles, and digital technologies.

Social businesses, and farmers producer organisations can be promoted by allowing them to mobilise equity capital from ‘Social Stock Exchange’. Essentially, capex for climate-smart technologies, water conservation, and organic farming may be supported.

Since most banks have cleaned up their balance sheets, and their non-performing assets in infrastructure segment in particular, they can revive capex in a calibrated manner to boost the sustainable triple bottomline (planet, people and profits).

In sum, the holy trinity — savings, investments, and growth — should be upheld to sustain the growth momentum in India and achieve $5 trillion economy while reaching the last mile in the journey towards Sustainable Development Goals.

Srikanth is Associate Professor, Registrar, and Director (Finance), DDU-GKY, NIRDPR, Hyderabad, and Suresh and Lagesh are Associate Professor and Assistant Professor respectively at IBS, Hyderabad.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.