A Budget is judged by the role the government plays in the development of the economy. This means that the total expenditure incurred by the government should be substantially high.

An achievement of sorts however is that fiscal deficit has been coming down since the Covid period. This is a reflection of prudent financial management as expenditure in terms of percentage of GDP has been going down. Capital expenditure shows substantial y-o-y growth.

Who pays for the government expenditure? The share of individual income tax in direct taxes stood at 51.6 per cent in FY21, that of indirect taxes stood at 53.4 per cent.

Per Budget estimates, GST provided for ₹7.8-lakh crore in FY23 (out of net central tax revenues of ₹19.3 lakh crore and customs revenue of ₹2.13 lakh crore). This was against ₹7.2-lakh crore from corporate tax and ₹7-lakh crore from income tax (personal tax) for 2022-23. It is tempting to call the system as regressive in the language of the economists. Corporate tax rates have been coming down from 50 per cent in the 1990s to 30 per cent or less.

It is basic common sense that same incomes should suffer the same rate of tax. This is not so in India. Firms are taxed at a uniform rate of 30 per cent. Corporate houses are taxed at a lower rate, as the government prefers corporatisation of business houses.

Effective corporate tax rates have been going down from 29.49 per cent in FY18 to 27.81 per cent in FY19, 22.54 per cent in FY20 and 22.2 per cent in FY21. (This is taken from a sample of 2,740 listed non-government, non- financial companies.)

The biggest talking point of the Budget is the slew of concessions announced for tax payers in the new tax regime. Standard deduction has been re-introduced. Those with income up to ₹7 lakh need not pay tax. Five different tax slabs have been introduced. Exemption limit goes up to ₹3 lakh from ₹2.5 lakh.

The new tax regime applies to those who don’t claim deductions. In the revised tax structure in this year’s Budget, it is expected that at least one crore individuals will opt for the new tax regime without concessions. Probably the government is right. Simultaneously, government has also announced reduction in the top tax rate from 42 per cent to 39 per cent by reducing the surcharge from 37 per cent to 25 per cent. This is a concession to the higher income groups.

Is India heavily taxed?

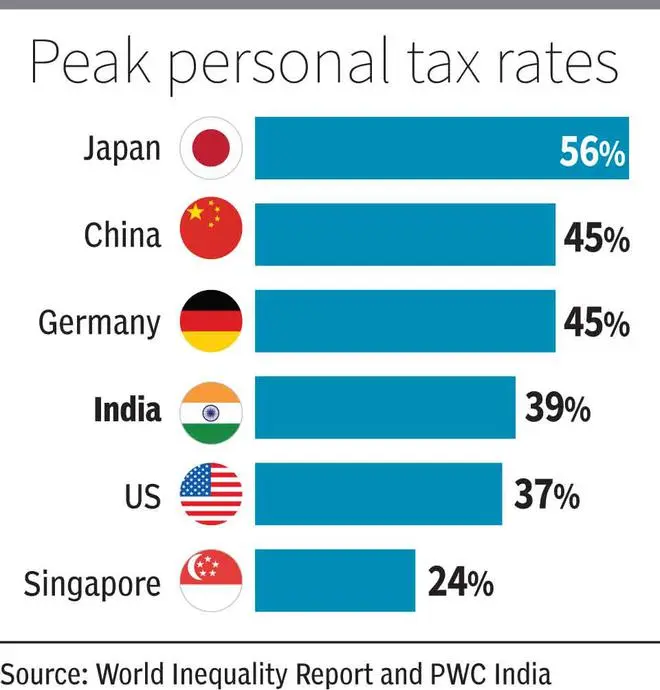

Perceptions differ. It is a cardinal principle of taxation that those with ability to pay must be taxed at rates higher than those with lesser incomes. The peak personal income tax rate in India is 42.7 per cent. A comparison with other nations is given in the table.

Can we not ask for a little more from our top industrialists? The only pressure point for the rich is the provision for taxing proceeds of insurance policies exceeding ₹5 lakh.

The best part of the Budget is the thrust on encouraging the digital economy. Digitalisation has ensured that government subsidies reached the rural sector employees through bank accounts, eliminating the need for intermediaries. The Budget provides for building digital public infrastructure for agriculture, a national digital library for children and adolescents etc.

This is the last contribution of TCA Ramanujam, former Chief Commissioner of Income Tax, who passed away on February 21. TCA Sangeetha is an advocate

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.