After analysing the massive data relating to agricultural marketing and trade policies in India, Ashok Gulati, former chairman of the Commission for Agricultural Costs and Prices (CACP), wrote in 2019 that “Indian farmers have been ‘implicitly taxed’ through restrictive marketing and trade policies that have an in-built consumer bias of controlling agri-prices. If one calculates the sums involved of this ‘implicit taxation’, it amounts to ₹2.65- lakh crore per annum, at 2017-18 prices, for 2000-01 to 2016-17...”

Despite this, the government wants to distort the market price of wheat now. For the first time, farmers have started getting ₹3,200 per quintal for wheat in some States, as against the MSP (minimum support price) of ₹2,125/quintal announced for the rabi marketing season 2023-24. Despite knowing that the price of wheat will come down after market arrivals start increasing from February onwards, the government is planning to sell about 30 lakh tonnes (lt) of wheat in the open market from its stocks under open market sales scheme (OMSS) to cool the price.

Is this move correct? Why should the government distort the market price of wheat when farmers get remunerative prices for their produce after a long time? Are the wheat farmers harvesting a big profit?

Minuscule profit

Wheat is the most important foodgrain crop after paddy, and it is cultivated predominantly during the rabi season in most of the northern States. Thanks to the Green Revolution, the area under wheat shot up from 12.57 million hectares (mha) in 1965-66 to 31.61 mha in 2020-21. With a significant increase in productivity, India’s gross wheat production also increased during this period — from 10.4 million tonnes (mt) to 109.52 mt.

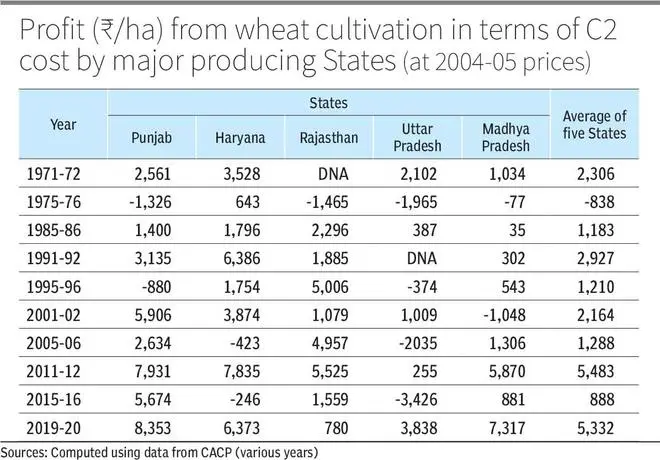

Has the increased production of wheat benefited the farmers in terms of higher profitability? To answer this, an analysis has been carried out using the Cost of Cultivation Survey data published by the CACP from 1971-72 to 2019-20 covering five important States — Uttar Pradesh, Madhya Pradesh, Punjab, Haryana and Rajasthan; these States together account for about 80 per cent of India’s total wheat area.

The analysis shows that the profit (at 2004-05 prices) computed based on cost C2 (which covers all the variable and fixed costs incurred by the farmers for crop cultivation) reaped by the farmers from these States is very low (see Table) and also has not increased consistently over time because of increased cost of cultivation (Chart 1).

Income instability

Though the average profit computed for the five States ranges from (-) ₹838 to ₹5,483/ha since 1971-72, farmers from UP and MP, which together contribute 48 per cent to India’s total production of wheat now, have not earned any big profit over time. Even though the procurement of wheat is historically very high in States like Punjab and Haryana, there too farmers have incurred losses a few times.

Given this, it is likely that the farmers from other less-productive States like Bihar, Gujarat, Maharashtra, West Bengal, Uttarakhand and Himachal Pradesh may not have earned any appreciable profit from wheat cultivation.

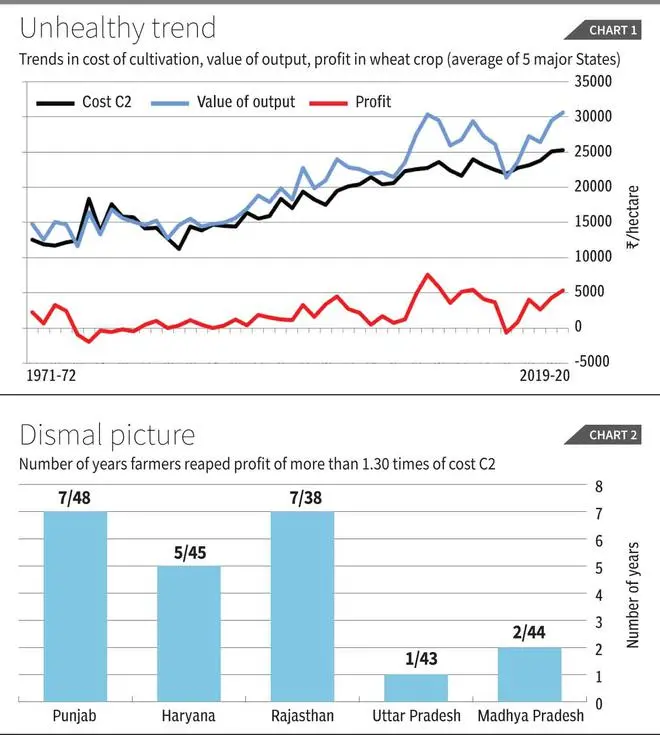

Further, the analysis on how many years out of the total (from 1971-72 to 2019-20) farmers earned a profit of 1.30 times of cost C2 reveals a pathetic picture in important wheat cultivating States (Chart 2).

Even in Punjab, farmers earned a decent profit only in seven out of 48 years for which data is available. Not even a single State earned profit of 1.30 times for more than seven years during the entire period, meaning that most of the time farmers have reaped a minuscule profit from wheat cultivation.

The wheat export ban imposed by the government from May 13, 2022, has already distorted the market price of wheat.

Now, if the government wants to sell about 30 lt of wheat in the open market under OMSS, it will further dent the market price and prevent the farmers from getting a reasonable profit from wheat cultivation.

The prevailing market price of ₹3,200/ quintal in some States is not abnormal. In fact, if MSP is fixed based on cost C2 plus 50 per cent formula, as has been demanded by the farmers, they would have got ₹3,150/quintal now, as the projected C2 cost of production of wheat for the marketing season is estimated at ₹1,575/quintal by the CACP. Therefore, policymakers should not take decisions that will hurt farmers’ interests.

The writer is former full-time Member (Official), Commission for Agricultural Costs and Prices, New Delhi. Views are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.