The earnest money deposits (EMD) submitted by mobile operators for the upcoming spectrum auction indicate that India’s telecom market is moving towards a duopoly. According to the data released by the Department of Telecom, only Reliance Jio and Bharti Airtel have submitted EMD that will enable them to buy pan-India 5G spectrum. A telecom operator can spend up to 9X the EMD in the auctions. For example, Reliance Jio has deposited ₹14,000 crore and that allows it to acquire spectrum worth ₹1.26 lakh crore. Airtel has submitted an EMD of ₹5,500 crore which enables it to buy airwaves worth ₹49,500 crore. In comparison, Vodafone Idea, struggling under a huge debt pile, has positioned itself to buy spectrum worth only ₹19,800 crore which will be enough to acquire 5G airwaves in a few circles. The new entrant Adani group, despite having massive financial clout, is looking to spend a maximum of only ₹900 crore dampening expectations of a big foray into the mobile telephony space. For public sector telecom major Bharat Sanchar Nigam Ltd, 5G is not even in the plan because it is yet to launch 4G services.

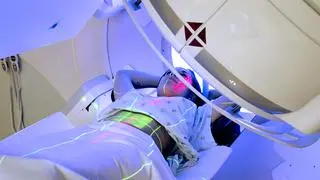

This is a worrisome situation that does not augur well for both the consumers and the future of the Digital India vision. One of the hallmarks of India’s telecom market has been the intense competition, which hitherto ensured consumers got the best deals on tariffs. Telecom networks are at the heart of our digital future and affordable services are a key factor to enable the democratisation of data. In contrast, consumers now have limited options with Reliance Jio and Airtel cornering majority share in the telecom market. Tariffs have increased by 30-40 per cent since November 2021. Millions of users, especially in the lower end of the spectrum, have had to give up their mobile connections. Consumers may well have to face tariff increases in the future as there will be only two pan-India 5G operators. The upcoming spectrum auction will be a turning point for India’s telecom market. In addition to improving mobile broadband, 5G technology will enable the delivery of critical services such as telesurgery and the Internet of Things over a mobile network with unprecedented efficiency, in addition to opening the floodgates for innovative applications that require a massive amount of high-speed bandwidth.

But it is important to ensure that the industry is well-positioned to put the infrastructure in place to bring the benefits of this new technology to consumers. In this context, the Centre must do three things to ensure that the telecom market does not become a duopoly. First, bring down levies on telecom companies. While the Centre has recently brought down spectrum usage charges and allowed a moratorium on payments for four years, more needs to be done to help the sector overcome financial stress. Second, appoint a robust, independent management to run BSNL. The once-dominant public sector company has been reduced to a mere footnote. A strong BSNL that can compete with Jio and Airtel will be good for consumers. Third, speed up the entry of private network operators. Allowing companies and institutions to own spectrum and run private networks will be a gamechanger in enterprise communications. Compared to a public telecom network, a private 5G network can deliver higher efficiencies. This will be critical as enterprises are increasingly digitising their processes.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.