The rupee hit a historic low, breaching ₹80 to the US dollar intraday on Tuesday. The market is nervous as the US Fed is set to raise the rate by at least another 75 basis points (bps) despite the negative growth in 2022 first quarter. This would definitely impact not only asset prices but also exchange rates around the world.

The US Fed has hardly any option but to hike the policy rate in large magnitude to tame retail inflation, which is at a 40-year high.

The large and rapid increase in the Fed rate and more quantitative tightening expected going forward would sustain flight to safety for some more time as the Fed is still at the early stage of the rate hike cycle.

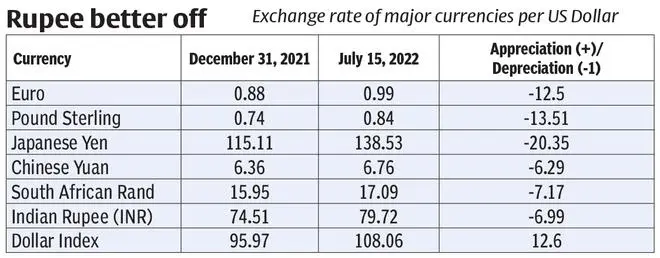

But there a no need to panic. During calendar 2022, up to mid-July, while the dollar index appreciated by more than 12.6 per cent, the rupee depreciated by 7 per cent against the greenback. Compared to many other currencies, the rupee’s depreciation vis-à-vis the dollar has been much less (See table).

Incidentally, the rupee appreciated against many other currencies during the same period such as the euro (5 per cent), the British pound (6.1 per cent), and the Japanese yen (10.8 per cent). Consequently, India’s trade-weighted Real Effective Exchange Rate (both 6- and 40-country REER, Base: 1915-16=100) remained around 104 in June. The rupee’s exchange rate seems to be reaching its medium-term equilibrium level. As uncertainty remains high, the rupee’s further depreciation cannot be ruled out.

The RBI and the government have taken several measures to arrest the rupee’s fall. Besides market intervention as and when required, on July 6, the RBI announced five measures to encourage capital inflows for a limited period.

RBI’s measures

These are: (a) exemption from Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) on incremental FCNR(B) and NRE term deposits up to November 4, 2022; (b) removal of interest rate restrictions on FCNR(B) and NRE deposits up to October 31, 2022; (c) relaxation on foreign portfolio investment (FPI) on debt instruments up to October 31, 2022; (d) allowing authorised dealers to utilise overseas foreign currency borrowing for lending to domestic borrowers in foreign currency for multiple purposes up to October 31, 2022, subject to certain restrictions; and (e) increasing the amount of external commercial borrowing (ECB) under the automatic route from $750 million to $1.5 billion and raising the all-in-cost interest rate ceiling on ECB by 100 bps until December 31, 2022.

Besides these quick-fixes, the RBI has allowed authorised dealers to open Special Rupee Vostro Accounts for invoicing, payment, and settlement of exports/imports in rupees, effective July 11. The exchange rate between trading partners shall be market determined. The surplus balance in such accounts can be invested in government Treasury Bills and dated securities. This measure will immediately promote Indo-Russian trade and bypass the US’ sanctions on Russia.

In the long run, it would be a multilateral trade arrangement subject to mutual agreement among the trading partners. Moreover, the RBI’s dollar sales is likely to be lower to the extent that international trade settled in rupees would reduce the dollar demand.

As a part of supply management, the government has also taken several measures, including: (a) reduction in excise duty on petrol and diesel in May; (b) cut in import duty on certain key raw materials and inputs; (c) export duty on certain steel products; (d) duty-free import of crude soybean and sunflower oil till the next year; (e) limit on sugar export; and (f) temporary ban of wheat export.

As experimented earlier, there is an option to reduce bulk dollar demand by releasing foreign exchange exclusively for oil marketing companies (OMCs) through their banks.

Barring temporary ups and downs in rupee exchange rates, the rupee’s underlying strength depends on medium-term fundamentals — low fiscal deficit, inflation close to target, sustainable external current account deficit (CAD), and a manageable debt-GDP ratio. Therefore, there is a need for a holistic approach to impart exchange rate stability to the rupee in the medium term.

While the RBI should not lose focus on price stability, the government should revert to fiscal discipline as early as possible under the FRBM Act.

However, structural reforms and investment in infrastructure should continue to improve productivity, which would sustain a reasonably high rate of GDP growth.

If the general government debt-GDP ratio remains below 80 per cent, the pressure on the exchange rate would be less. Similarly, the CAD, not more than 2.5 per cent of GDP, would significantly reduce exchange rate pressures on the rupee.

Public policy should achieve these targets as early as possible to make the economy resilient against global headwinds. Even under global uncertainty and consequent outflow of the greenback with FPI exits, other components of capital inflows should impart reasonable stability to the rupee exchange rate around its medium-term equilibrium.

The writer is currently RBI Chair Professor, Utkal University, and former Principal Advisor/Head of the Monetary Policy Department, RBI

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.