Capacity building and market linkages of farmer producer companies (FPCs) should gain traction in Union Budget 2023-24. It has been over two decades since FPCs came into existence as a hybrid legal entity by blending the altruistic co-operation principles and enterprising spirit of a limited company.

The mobilisation of equity grants (EGs) and credit guarantee schemes (CGSs) or produce funds by apex institutions (SFAC and NABARD) seeks to strengthen FPCs’ health and operations. However, they continue to suffer from marketing challenges, compelling them to operate on a thin margin. As a recourse, they run their show as an intermediary between the suppliers and member farmers, like other farmer organisations.

Against this backdrop, Budget 2023-24 is critical to boosting farmer enterprises following a segmented performance-linked budgeting-size or assets, member base, paid-up and social capital.

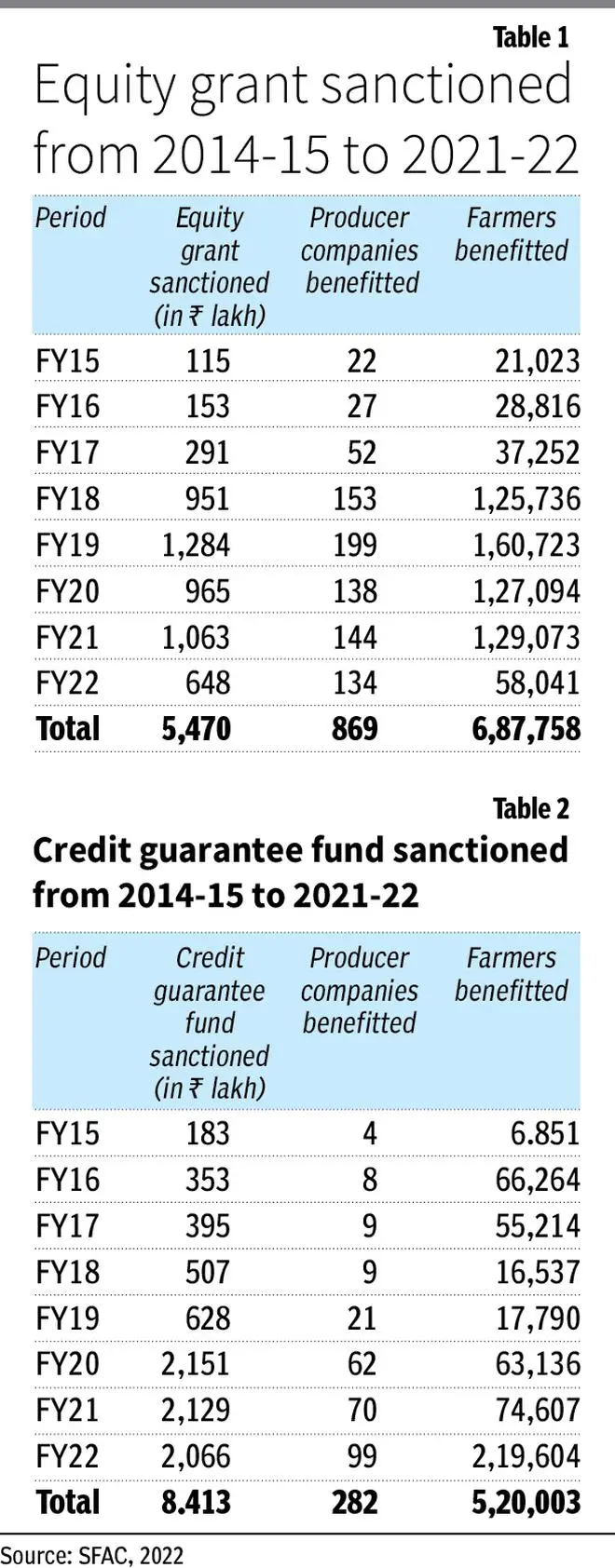

SFAC’s EG and CGS are worth mentioning here since Budget provision is directly linked with these funds. Tables 1 and 2 show the EG and CGS statistics on scheme sanctioned and beneficiaries, including FPCs and member producers, from 2014-15 to 2021-22. A cumulative ₹54.70 crore EG had been disbursed to 869 FPCs benefiting about seven lakh member-producers, while a cumulative ₹84.13 crore CGS helped 282 FPCs having about 5.2 lakh member-producers.

CGS sanctioned has registered a CAGR of 41 per cent from 2014-15 to 2021-22, while the EG sanctioned observed a CAGR of 28 per cent during the corresponding period.

EG and CGS-sanctioned cases (number of FPOs/farmers benefited) are skewed towards southern and western States, with farmers who benefited from the CGS registering a CAGR of 64 per cent. Nonetheless, a two-period moving average shows a declining trend of EG and CGS.

Performance-linked budget

Performance-linked budgeting is necessary for categories of FPCs. For example, among the top 20 FPCs in accumulated paid-up capital of ₹551.68 crore, 60 per cent of the FPOs are in dairy businesses; hence, they draw more attention from donors and funding agencies.

The dairy FPCs ensure the regular engagement of their members in selling liquid milk to dairy processing units. The price paid to members shows a daily or weekly cycle based on the fat (3.5-4.5 per cent) and solid-not-fat (8.5-9.5 per cent) in the supplied milk.

Dairy FPCs have commodified the liquid milk business to stabilise the market prices and reduce the production risks for their members. Commoditisation offers products at different price points or different products at similar price points — for example, the price difference between AMUL and non-AMUL or State-owned milk and milk product brands.

Dairy FPCs seek to integrate their value chains by providing cattle feed, veterinary and AI services, credit, insurance facilities for cattle purchases, etc. Procuring processing and bulk milk-chilling units and refrigerated vans can improve the operating effectiveness of dairy FPCs.

Second, FPCs dealing with horticulture produce, especially fruits and vegetables, could attract funds if they focus on providing good quality certified seeds and planting materials, fertilisers and pesticides, technology appropriate for smallholders, and crop advisories to ensure good quality production and regular supply.

They should develop production clusters where production intensity is higher. It will be logistically feasible for buyers to procure commodities from a production hub or aggregation centre.

Third, agriculture FPCs deal with inputs business where profit margins are low, say, 3-5 per cent. These FPCs need to understand the markets and gradually shift from input to output business.

Unlike dairy, where the business transaction occurs daily, members of agriculture FPCs encounter transactions two to four times annually, like input procurement and crop sales. Therefore, FPCs must deal with multiple commodities to increase their turnover and profitability, by enhancing member economic participation.

They need to clean, grade, or assort the produce before they sell to buyers to realise a 10-15 per cent increase in sales prices.

Further, curation of potential buyer databases, business and market planning, demand assessment, traceability adoption along the supply chain, sustainable practices for product differentiation, and labelling can induce profitability for agri FPCs.

While policymakers should take stock of the utilisation of EG and CGS by categories of FPCs, their repayment and credit behaviour, scale for grading of FPCs may be revised considering ESG dimensions.

A “one-size-fits-all” Budget cannot firm up FPC business metrics and the Budget allocation may be linked to a balanced score card of FPCs which have been transacting and transcending through the life-cycle stages.

Dey is faculty of the Agribusiness Management Group of IIM Lucknow, and Chamola is Advisor, Deutsche Gesellschaft für Internationale Zusammenarbeit GmbH, New Delhi. Views are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.