The India-Australia Economic Cooperation and Trade Agreement (ECTA) will come into force today (December 29). ECTA offers many concessions to exporters and importers of both countries. But, the concessions are product-specific, and firms must check if their products benefit from the ECTA.

Utilisation rate of India’s FTAs is low. One factor is low awareness about the process and its benefits. We present a seven-step process to ensure that the firms do not miss critical details while exporting or importing under ECTA.

Seven steps

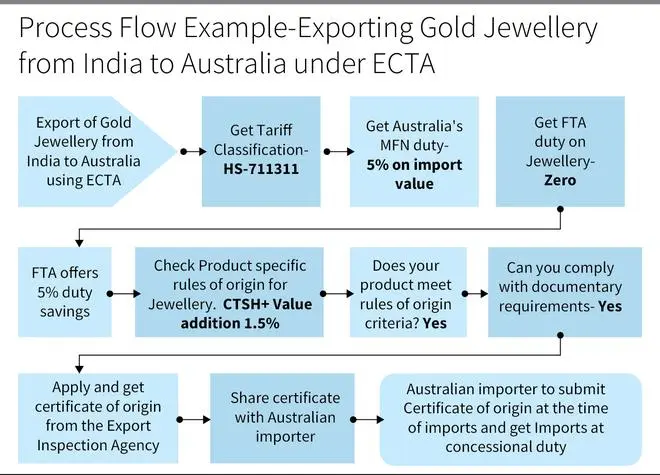

Step 1: Know the tariff classification for your product. Both India and Australia use 8-digit numeric codes to represent a product. It is critical to use the correct code as governments notify all import duties and policies using this code.

The tariff classification of the same product may differ in India and Australia. For example, the Tariff classification for the product ‘Embroidered girls’ suits made of silk’ is HS 62041911 for India. For Australia, the code is HS 62041900. The firms must use their country codes in the trade documents.

Step 2: Know the export and import policy for your product. FTAs merely provide duty concession and do not give relaxation on export or import policy provisions. Indian exporters must know the export policy of India and the import policy in Australia for their products. No imports are allowed if a product falls under the prohibited list of imports. The happy news is more than 98 per cent of products can be freely exported from/imported into India.

Step 3: Compare your product’s MFN and FTA duties in the destination country. MFN (Most Favoured Nation) is a WTO term indicating that a country must charge the same import duty from all countries for a product. When two countries do an FTA, they decide to cut such duties on most products.

Under ECTA, all Indian products will enter Australia duty-free. Australian products covered under 70 per cent tariff lines will enter India duty-free. Yet, the product level details will decide if the FTA is beneficial for a product. FTAs are of no use if MFN duty is zero for a particular product.

A firm must compare the MFN and FTA duties for a product. A firm benefits from the FTA only when the FTA duty is lower than the MFN duty. Let us use a few examples: Since MFN duty on ‘Cut and Polished Diamonds’ is zero in Australia, Indian diamond exporters will not use ECTA. But many Indian labour-intensive products will benefit as Australia has reduced the duty from 4-5 per cent (MFN duty) to zero under ECTA. The key sectors are textiles and apparel, agricultural and fish products, leather, footwear, furniture and sports goods, gems and jewellery, machinery, electrical goods, railway wagons, pharmaceuticals, and medical devices.

Australia’s exports of coal, LNG, alumina, manganese and tungsten ores, pharma products, and rare earths will gain as India cuts duty to zero. Australian exports of almonds, oranges, and mandarins will also gain as India cuts duty on limited quantities. Australian wine valued at $5 for a 750ml bottle will gain from reduced-duty access. There is no benefit to Australian dairy products, walnut, wheat, rice, bajra, apple, sunflower seed oil, sugar, oil cake, gold, silver, platinum, jewellery, or iron ore. India offered no concessions on these. Exporters and importers must check the benefits provided for their products.

Zero duty under an FTA means zero basic customs duty. Other duties like ‘IGST’ and ‘Special welfare cess’, which are primarily in nature of domestic taxes, still need to be paid.

Step 4: Check if your product satisfies the rules of origin. A product must qualify as originating goods of exporting Party to get FTA duty concessions. Rules of origin set specific and clear conditions on the level of processing an imported item from a non-FTA partner country must undergo. Rules of origin prevent FTA benefits to third-country products transhipped from FTA partner countries.

Rules of Origin is a work in progress of the ECTA. Both sides have framed product-specific rules of origin for essential products. For the rest, they have agreed to negotiate rules at the earliest. Both countries would use a general rule for products where a product-specific rule is not agreed upon. It is based on the twin criteria of value addition and product transformation. Firms must check the rules of origin for their products and ensure they can meet the requirements.

Step 5: Get a Certificate of Origin. Once a firm is sure that its product meets the rules of origin criteria, it applies for issuing a Certificate of origin (COO) to the agency nominated by the Indian or Australian governments. The agency may issue the certificate after verifying the documents or visiting the factory per the norms. The Indian firm shares the certificate of origin with the importer in Australia.

Step 6: Export your product. No additional customs formalities are carried out while exporting Goods under an FTA. FTAs for merchandise trade is about granting concessions on imports.

Step 7: Importer presents COO and claims duty benefits. The Australian importer uses COO issued by the Indian agency while claiming the tariff concessions at the Australian Customs if requested. The process applies in reverse to imports into India.

Current bilateral trade between India and Australia exceeds $27 billion. It is expected to double in next five years due to buoyant trade relations. Using the above process, Indian and Australian firms can make full use of ECTA concessions.

The writer is co-founder of Global Trade Research Initiative.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.