The Development of Enterprise and Service Hubs (DESH) Bill, seeking to revamp the existing SEZs, proposes a new set of concessions. DESH will be an addition to four existing schemes promoting manufacturing.

Generally, any scheme with a more attractive feature diminishes the competitiveness of existing schemes. Let us understand the impact of different incentives and concessions offered under various schemes on a firm’s performance. How can the concession ecosystem for manufacturing be improved ?

The four major schemes for promoting manufacturing in India are: Special Economic Zones (SEZs); 100 per cent export-oriented units (EOU); Manufacturing & Other Operation in Warehouse Regulation (MOOWR); and Domestic Tariff Area (DTA) units.

SEZ units are located within a physical wall. Any unit can opt for the EOU or MOOWR scheme irrespective of location. A unit outside the SEZ, EOU or MOOWR framework can be considered a DTA unit.

Features of major schemes

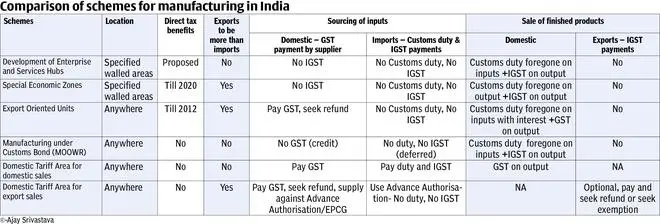

A firm willing to set up manufacturing in India has to choose from these. For this, it needs to understand how concessions under various schemes compare. Most schemes differ in the parameters like location choice, tax benefits, payment of import duty, GST on imports, exports, domestic sales, and purchases. The Table highlights the scheme-wise concessions.

The Table shows that SEZs offered more incentives than EPZs and EOUs. A MOOWR provides more than what SEZs or EOUs offer. Now DESH proposes to offer more than everyone else.

A firm opts for a scheme that offers the most concessions. But the change from one scheme to another involves cost. In the past, thousands of units have been shut down or crippled because they could not move to schemes that offer better concessions.

The Export Oriented Units scheme is an example of how a successful scheme fades when new schemes offer better terms.

A case study

Introduced in 1981, the EOU scheme produced thousands of export-focused units across the country. Textiles/garments, food processing, chemicals, pharmaceuticals, gems and jewellery, engineering goods, and electrical/electronics were the key sectors.

In 2009, exports under EOUs at $39 billion were higher than SEZ exports, at $22 billion. The EOUs faced discrimination as the government offered more incentives to new schemes since 2011.

For example, direct tax exemptions were withdrawn from the EOU scheme in 2011 even though they continued for 10 more years for the SEZ scheme. To benefit from tax exemption, a few large EOUs converted into SEZs. Many EOUs shut shop as relocation was not easy.

The EOUs faced the next shock in 2017, when the GST regime refused to allow continuation of exemption of taxes on domestic procurement of inputs and capital goods. It, however, allowed such exemptions to the SEZ and subsequently to the MOOWR schemes.

Also, sale in the domestic market was conditional for EOUs, while SEZ or MOOWR units have no such restrictions. More incentives to other schemes made the EOU units less competitive and maimed them.

A raw deal

Firms that contribute most to exports and manufacturing have got a raw deal. Lakhs of small and thousands of medium/large units functioning in the DTA contribute to 80 per cent of merchandise exports and much of the domestic manufacturing turnover.

The 10,000 units under the SEZ, EOU and MOOWR regimes contribute to an estimated 20 per cent of merchandise exports from India. DTA units are thus the bedrock of manufacturing and exports. But compared to other schemes, the DTA units get the lowest concessions.

A few examples: (i) A DTA unit pays both the Basic Customs Duty and IGST on the import of machinery for making products for domestic sale.

But a unit under MOOWR or SEZ can import machinery duty-free. This affects the DTA units and machinery makers.

(ii) A DTA unit must use government-approved raw materials to make an export product. No such limitation under SEZ or MOOWR.

(iii) No GST exemption for domestic sourcing of raw materials for the export product. Such a facility is available to MOOWR and SEZ units.

The way out

A three-step plan will harmonise the concessions under various schemes and strengthen the manufacturing framework:

DESH must subsume only large SEZs/industrial parks, so the zone becomes competitive and self-contained.

MOOWR is EOU plus more concessions. The two may be merged or the government should allow the EOUs to get all MOOWR features. But this is unlikely as the Finance Ministry — the owner of MOOWR — may not agree with the Commerce Ministry — the owner of the EOU scheme.

Create a cohesive policy framework for the DTA units. There is none now. They work under different schemes and frameworks. DTA units must not be getting lower concessions than SEZ or MOOWR units as they are India’s best hope of becoming a manufacturing powerhouse and job creator.

The writer is a former Indian Trade Service Officer

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.