The share of the manufacturing sector in the gross value added in the Indian economy has hovere,d at 17-18 per cent for the decade 2011 to 2021. In comparison, China had 27 per cent, South Korea 25 per cent and Bangladesh 18.5 per cent for 2020.

Higher growth of manufacturing activities in the economy assumes importance for two reasons. First, the sector provides employment and can absorb workers of varying skill-sets. Second, the ability to export manufactured products plays a crucial role in maintaining the external balance of an economy and influences global trading prowess.

A vibrant and growing manufacturing sector is crucial for the Indian economy on both these counts. However, the emergence of the manufacturing sector as the engine of growth, with higher share in the gross value added or national income, is hampered by a structural feature of the sector, that is, the preponderance of a large number of small firms, enterprises and factories.

While these firms are contributors in providing employment, their growth and transition to big firms is hampered by a variety of factors. Addressing these factors needs a comprehensive policy approach which also takes into account the links between the small and large firms.

Composition of manufacturing

Data published by the Central Statistical Office in the Annual Survey of Industries for 2017-18, the most recent year for which the final results are available, reveal some important features on the manufacturing sector — 55.3 per cent of the total factories in operation produce output less than ₹5 crore annually and 31.2 per cent of the factories produce output in the range of ₹5-50 crore annually.

This classification, based on output, corresponds to the recent definition of micro and small enterprises based on annual turnover. Thus, 86.5 per cent of factories correspond to the definition of micro and small enterprises. However, in terms of share in employment and output, this group accounts for 40 and 14.4 per cent, respectively. The big factories, having output of more than ₹500 crore annually, account for just 1.89 per cent of the total factories, but have 22 per cent share in employment and generate 54 per cent of the total output.

In terms of capital invested, we find that 66 per cent of the factories have a capital investment of less than ₹0.25 crore and they contribute to 13.5 per cent of the total output. Only 11 per cent of factories have a capital of more than ₹10 crore and their share in output is 73.5 per cent. This imbalance is what we allude to earlier.

That is, within the manufacturing sector we find that a large number of small factories contribute only a small share to the total output of the sector and less than 2 per cent of big factories account for more than 50 per cent of the output of the sector. This skewed structure, in our view, needs to be addressed for the sector to grow at a faster pace.

Data on MSMEs

Given the unique position that micro, small and medium enterprises (MSMEs) occupy, as an important segment in terms of absorbing workers, their share in the overall value added is often stated as one-third. This at best is an approximation given the range of activities undertaken by MSMEs and the extent of informality present in the sector. Further, non-availability of data also hampers realistic assessment of the extent of linkages that MSMEs have within the economy.

In a manufacturing ecosystem, MSMEs have crucial linkages with large firms through subcontracting arrangements and provision of inputs. Encouraging and supporting such linkages is as an important ingredient in the models of business development that can change the landscape of the manufacturing sector.

Integrating MSMEs

Attempts to integrate MSMEs with the larger firms have been the focus industrial policy reforms in many industrialising economies for some years. For example, in Malaysia in 2019, as part of its aim to increase the contribution of SMEs to reach 41 per cent of the national GDP, its Ministry of Entrepreneur Development (MED) devised new strategies to drive SME growth, particularly in key industries with high multiplier and linkages. In this context the efforts were intensified to further enhance and strengthen the business linkages particularly between SMEs and large firms.

With the availability of relevant data pertaining to SMEs in Malaysia it was found that in terms of output consumption by other industries and final consumers, 48.5 per cent of the total output of SMEs flows back into the economy as intermediate input, indicating that SMEs are highly domestically integrated with other industries. A similar analysis in the Indian context is hindered by absence of data.

However, given the multitude of activities MSMEs undertake in India, it would not be entirely inappropriate to assume similar strong linkage between MSMES and other firms, which underscores the need to view MSMEs in conjuncture with the large firms and that their growth is influenced by the growth of large firms.

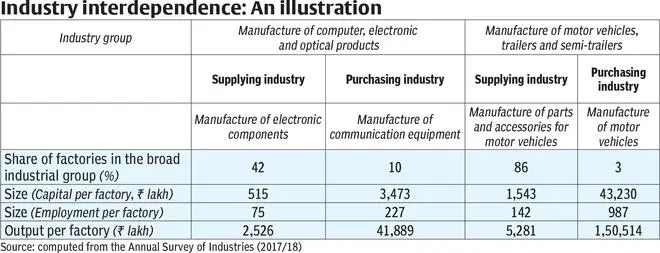

Plagued by the absence of consistent data on MSMEs, we assess the importance of linkages through an indirect method, which is illustrated in the table. We classify industrial sub-groups (within a broad group) into two sets of industries on the basis of the nature of the products produced.

The first set of industries is termed as ‘supplying’ industries, that is, they produce parts and components and intermediate products and the second set is termed as ‘purchasing’ industries, which produce final goods.

Consider the broad industrial group of ‘Manufacture of motor vehicles, trailers and semi-trailers’, within which we identify ‘Manufacture of parts and accessories for motor vehicles as supply industry’ and ‘Manufacture of motor vehicles as purchasing industry’; 86 per cent of factories are in supplying industry, only 3 per cent in purchasing industry.

The differences in size and scale is also striking. As the market for 86 per cent of the firms (which are in the supplying category) depends on 3 per cent of the factories (essentially larger ones) in the purchasing category, the growth of the former is hugely dependent on the latter. Growth slowdown of the large firms would then be transmitted with an amplified effect to the small firms.

Strengthening links

There is ample research evidence to confirm that forming alliances and networking help small firms to grow, cooperate and compete with big firms. The policy approach needs to focus on facilitating firms working together so that they can reap the benefits of collective efficiency. The key to success would be the ability to develop a mutually supportive approach with cumulative effort and continuous improvements rather than viewing the small and big differently.

Perceiving small and large firms in separate silos might prove costly in the long term, as slower growth of large firms might act as a drag on the growth of the other.

Rangarajan is former Chairman, PMEAC and former Governor, RBI; Babu is Professor, IIT-Madras

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.