In recent months, the issue of internationalisation of the Rupee has been in focus. In early March, Minister of State for Finance Bhagwat Kishanrao Karad informed the Rajya Sabha that the Reserve Bank of India (RBI) has put in place the mechanism for rupee trade settlement with as many as 18 countries.

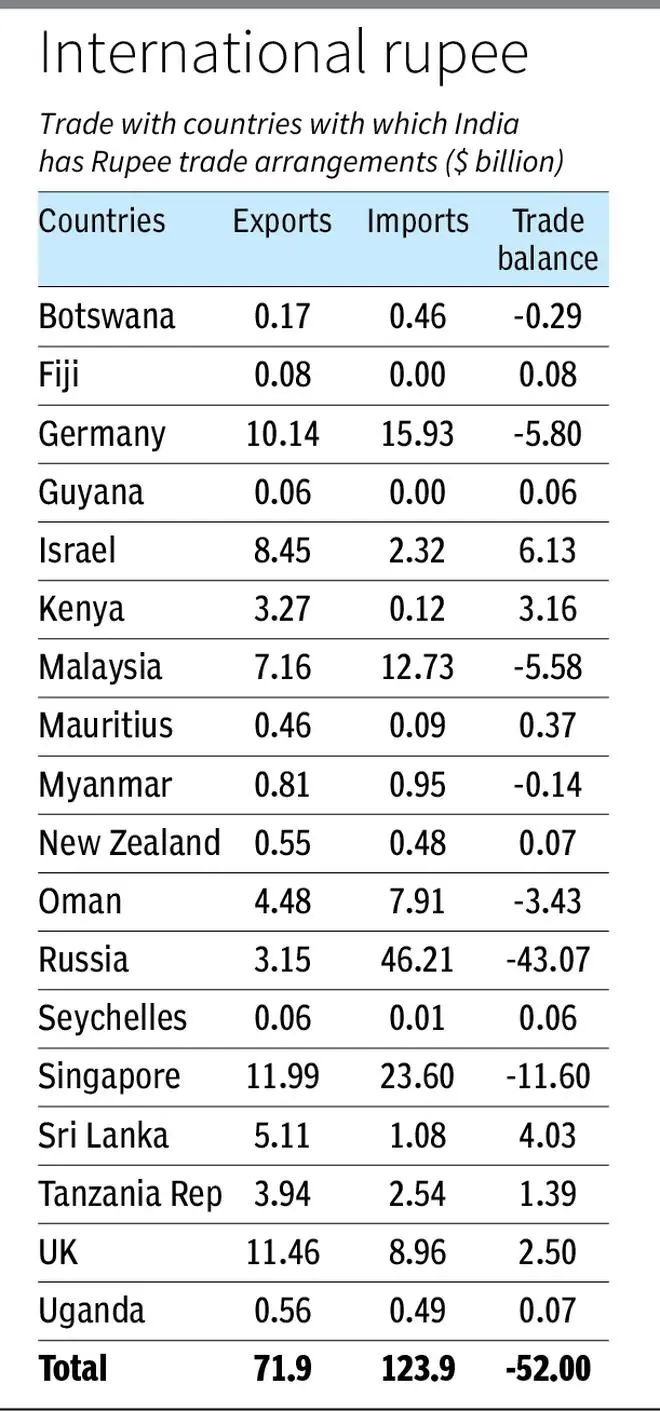

Banks from 18 countries are allowed to open Special Vostro Rupee Accounts (SVRAs) for settling payments in Indian Rupees. Approval has been granted to domestic and authorised foreign banks in 60 cases for opening SRVAs of banks from Botswana, Fiji, Germany, Guyana, Israel, Kenya, Malaysia, Mauritius, Myanmar, New Zealand, Oman, Russia, Seychelles, Singapore, Sri Lanka, Tanzania, Uganda, and the UK.

The Rupee trade arrangement with Malaysia was operationalised in early April with India International Bank of Malaysia opening a SVRA through its corresponding bank in India — Union Bank of India.

The trigger, of course, was the removal of seven Russian banks from ‘Swift’, the global financial artery that allows smooth transfer of funds across borders, as part of the Ukraine-induced economic sanctions against Russia. This payment arrangement assumed greater importance in 2022-23 as India increased its dependence on discounted Russian oil, making it the second largest source of crude oil, which in turn has an 18 per cent share of imports. India’s relies on Russia for crude oil and fertilisers, besides military hardware.

What does rupee internationalisation entail? In July 2022, the RBI issued a circular on “International Trade Settlement in Indian Rupees”, which underlined the terms not only for trade settlement but also for cross-border transactions in Rupees.

An important component of this arrangement is that Rupee surplus balance can be used for capital and current account transactions in accordance with mutual agreement, that include, payments for projects and investments and investment in Government Treasury Bills, Government securities, among others. Thus, foreign entities holding Rupee balances are allowed to invest in assets in India.

It is interesting to note that the RBI has seriously considered internationalisation of the Rupee for more at least a decade. In 2013, Raghuram Rajan, the then Governor of the RBI, had argued that as India’s trade expands, there would be “push for more settlement in rupees”.

More recently, RBI’s Report on Currency and Finance discussed this issue in 2021 and had expressed confidence that the “emergence of INR as an international currency appears inevitable”. The Report had argued that “greater internationalisation of the INR can lower transaction costs of cross-border trade and investment operations by mitigating exchange rate risk”.

Increased use of the Rupee for trade settlement can have at least two sets of advantages. First, it reduces currency risk for Indian businesses by eliminating their exposure to currency volatility. This can reduce the cost of doing business and can hence help in making exports more competitive in the global market. Secondly, the need to maintain foreign exchange reserves can drastically reduce if a sizeable share of India’s trade can be settled in terms of the domestic currency.

Pain points

Despite these advantages, the process of internationalisation of the Rupee can run up against several imponderables. First, Rupee-trade arrangements have not been easy implement. In fact, this arrangement with Russia is not yet fully operational even after a year-long engagement between the two partner countries. Trade settlement between the two countries continues through third countries, including the UAE.

A key factor stymieing the process could be the large trade deficit that India has via-a-vis Russia, which implies that the latter would be saddled with large Rupee balances. This was one of the key sticking points in the erstwhile Rupee-Rouble trade; in fact Russia took more than a decade and a half after the collapse of the Soviet Union to liquidate its Rupee balances. The problem has resurfaced. (https://tinyurl.com/rupeetrade)

A second problem in this regard, which the RBI is quite aware of, is that internationalisation of a currency could make simultaneous pursuit of exchange rate stability and a domestically oriented monetary policy challenging, unless this process is supported by large and deep domestic financial markets that could effectively absorb external shocks.

As both residents and non-residents can buy and sell domestic currency denominated financial instruments, internationalisation can limit the ability of the RBI to control domestic money supply and influence interest rates in accordance with the requirements of domestic macroeconomic conditions.

And finally, effective internationalisation of a currency would require its government to remove restrictions on any entity, either domestic or foreign, to buy or sell its country’s currency, whether in the spot or forward market. This would, in effect, imply a sharp turn towards full convertibility on the capital account, a move that successive governments have avoided to prevent global financial contagion from reaching Indian shores.

It may be pointed out here that among the emerging economies, China is the only country that has been able to steadily internationalise its currency, while maintaining controls on its capital account. It has done so using two mechanisms.

One, by finalising currency swap agreements between the People’s Bank of China and the central banks of 43 countries, which are agreements between two central banks to exchange currencies that assure the markets that there would not be oversupply of the renminbi. And two, by creating an offshore market for its domestic currency that allows foreign entities to sell renminbi for dollars.

But a crucial reason for China’s success in managing currency internationalisation with capital controls is its trade surplus with the rest of the world. The record levels of foreign exchange reserves that China accumulated as a result acted as an insurance against the risk of a run on its currency.

Thus, the Indian government may have taken steps towards internationalisation of the Rupee but considerable thinking and planning would be required to make it function in a manner that does not adversely affect the economy’s fundamentals.

The writer is Vice-President, Council for Social Development; and former Professor, JNU

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.