At the beginning of the pandemic, when many Western countries began with unprecedented fiscal stimuli, a few economists had warned about the inflationary consequences of such spending. About two-and-a-half years later, these prophecies seem to have come true — most countries are experiencing historically high inflation levels.

Jerome Powell, Chairman of the Board of Governors, Federal Reserve System, in his recent Jackson Hole Economic Policy Symposium 2022 speech, warned that households and businesses must be prepared to endure more pain to bring inflation under control.

In this context, we evaluate India’s performance on the inflation front with the rest of the world. The spike in inflation in India appears to be driven primarily due to the supply shock of the Ukraine war. Therefore, contrary to the critics of the RBI being “behind the curve” in monetary tightening, the RBI’s policies seem to have been appropriate.

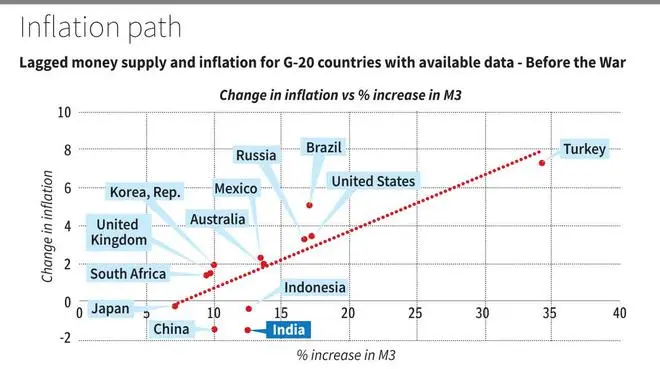

Using IMF data on money supply and inflation we restrict the analysis to G-20 countries with available inflation and money supply data to maintain comparability. Our first test relates to the change in money supply in 2020 to the change in inflation in 2021. Note that most of the expansionary policy responses to the shock were implemented in 2020. And inflation usually manifests with a lag after monetary expansion. These two facts motivate the choice of our sample period.

Global experience

Figure 1 depicts our findings. We show the percentage change in the broad measure of money supply known as M3 (it includes currency, demand, and time deposits) on the horizontal axis. The percentage change in money supply is for 2020 compared to 2019. The change in inflation in terms of percentage points on the vertical axis. The change in inflation is the difference in average inflation rates between 2021 and 2020. It is crucial to note that we measure the change in inflation at the end of December 2021, before the Russia-Ukraine war. Thus, the war impacts our analysis only to the extent that the expectations of war influenced commodity prices before December 2021.

There is a clear pattern in the data. Countries that expanded money supply more rapidly in 2020 experienced higher inflation in 2021. The right extreme is Turkey, which expanded the money supply by 34.24 per cent and experienced a 7.3 percentage points increase in inflation.

The US also shows a similar pattern: a 17.19 per cent increase in money supply in 2020, followed by a 3.46 percentage points increase in inflation. Inflation in the US nearly tripled much before the war. While Turkey appears to be an outlier, the relationship between the increase in money supply and change in inflation remains visually similar, even excluding Turkey.

India’s path

How does India fare in this analysis? India lies significantly below the trend line and relatively closer to the origin in the horizontal axis. India’s money supply grew by 12.47 per cent, and inflation declined by 1.49 percentage points. On a relative basis, both the growth in money supply and the change in inflation in India were lower than the global average and the median.

In other words, India did not expand its money supply disproportionately during the crisis and did not experience an inflation shock in 2021. Of course, some would argue that India should have, instead, expanded its money supply by giving cash transfers to the poor and borne the inflation consequences today.

First, the same people would, most probably, be blaming the government for even higher inflation today. And second, even from a welfarist perspective, this view does not pass muster, given the Centre’s policy of free rations to the poor for two years and counting. We believe that India’s relatively better performance on inflation, despite increasing its money supply, could be because it used the Covid crisis for financing capex and utilised its PDS grain stock as insurance for the poor.

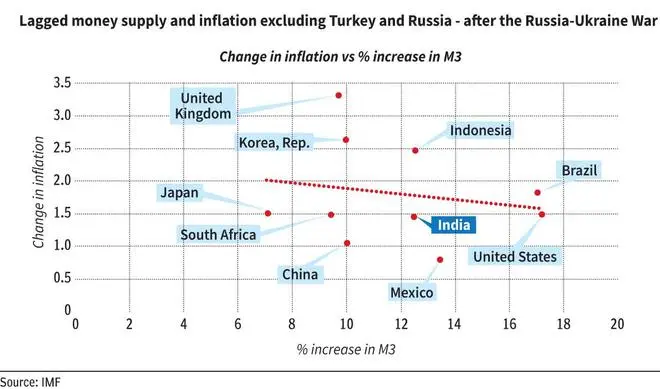

We next focus on the situation after the war broke out. As before, we compare the association between the additional money pumped and the incremental inflation. The inflation we consider in the second analysis is the change in the inflation rate between December 2021 and June 2022. We exclude Russia due to the extraordinary circumstance the country faced after the declaration of war. We also exclude Turkey as it continued to expand money at an extraordinary pace even after the Covid shock receded.

Supply shocks

There doesn’t seem to be any significant association between the increase in money supply during 2020 and inflation after the war. Also, even in the post-war period, India lies below the trend line. More importantly, a significant part of India’s recent inflation increase happened during this phase. Therefore, the inflation in this phase seems to be driven more by a supply shock rather than lower unemployment caused by increased money supply.

Given our analysis’ preliminary and summary nature, one needs to be careful before drawing strong conclusions. Given the evidence, it is possible to dismiss the view that the RBI is behind the curve in tightening. Since the RBI did not expand the money supply as rapidly as other countries, it is justified in not tightening rapidly.

Two important caveats are in order here. First, we cannot precisely disentangle the demand and supply side impacts. Second, the analysis is based on the monetarist tool of money supply and not the neo-Keynesian tool of nominal rates.

We recognise that it is hard to measure the money supply in an economy precisely. Our choice is dictated by ease of comparison and availability of data.

Kuvalekar is with the University of Essex; Tantri is with the Indian School of Business,. Pratik Manikpuri provided research assistance

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.