El Nino is a term which sends jitters across the world. The reason is simple. El Niño is described by the FAO as “a naturally occurring phenomenon characterised by the abnormal warming of sea surface temperature in the central and eastern equatorial Pacific Ocean. On average, it occurs every two to seven years and can last up to 18 months”.

During these phases one can expect normal precipitation patterns to get disrupted, leading to extreme climate events. This can be in the form of droughts or even flooding. Experience in the past shows that globally agricultural production is affected; the impact is not localised to specific countries. Therefore, governments get concerned when there is talk of El Nino developing.

The last strong El Nino event was in the period 2014-16. There have, however, been less severe ones in this century after the strong event in 1997-98. We had a smaller event last in 2018-19. Given that the frequency can be between 2-7 years, the fact that it seems to be developing in the Pacific Ocean raises a red flag as it is around seven years since we had the last severe event.

Kharif crop prospects

The immediate issue of concern is the prospects of the kharif crop during an El Nino event. This is so because on an average around 60 per cent of the crop is rainfall dependent, and hence any deviation can harm prospects. This tends to be more significant for crops like pulses and oilseeds besides cotton where prices too tend to add to the vulnerability.

Rice could still be managed as the northern States of Haryana, Punjab and Uttar Pradesh do have access to irrigation. But not so for other States. As the kharif crop is approximately 50 per cent of total agricultural output, the magnitude is serious.

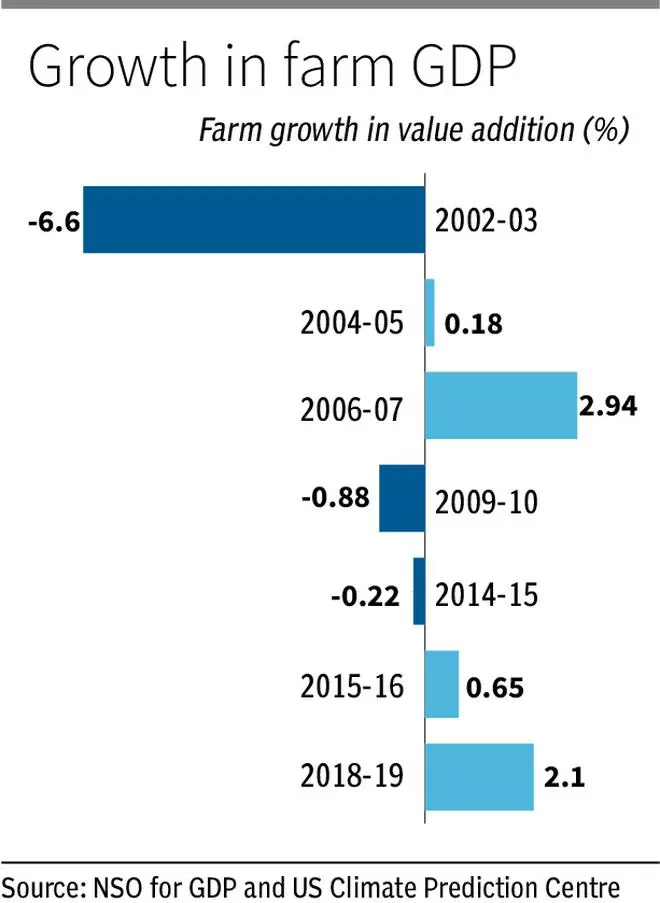

The accompanying table shows how agricultural production (as per GDP data) has moved when there have been episodes of El Nino, 2015-16 being the larger one.

It is clear that if there is an El Nino event, there is a significant likelihood of a decline or deceleration in agricultural production. In the last big event there was a decline in one year and low growth in the next one, hence impacting two years’ growth in value added in agriculture.

Foodgrains production remained largely flat in the years 2012-13, 2013-14 and 2014-15 at 128, 128.6 and 128 million tonnes respectively. Meanwhile, the fears of slowdown loom large; growth is expected to be in the region of 6-6.5 per cent in FY24.

Under normal monsoon conditions, it is assumed that agricultural growth would be at the trend rate of 3.5 per cent. If there is a shortfall, it will affect both supplies of farm products as well as demand from rural households thus pushing back overall growth.

The kharif season attains more prominence as the timing coincides with the festival season when typically there is higher spending on consumer products including automobiles post-harvest. So a poor kharif crop tends to slow down festival spending. Therefore, close monitoring of El Nino is important and the government should be prepared with a contingency plan.

Today, inflation is a tough nut to crack with core inflation being high. Food inflation has come down due to prices of horticulture products and edible oils easing significantly even while cereals have registered high inflation numbers. This trend can get exacerbated in the event of a sub-normal monsoon with pulses and oilseeds crops being affected. Further, concerns on the prospects of the wheat crop remain at this point of time, even though there has been a spell of rain in north India.

An unrelenting heat wave at this time in north India last year led to wheat output dipping to 107.7 million tonnes as against 109.6 million tonnes in 2021. This resulted in a sharp spike in the prices of wheat and wheat products. Wheat inflation has been high at 23 per cent going by the WPI for January with average inflation for the 10 months period being 15.9 per cent. Similar trends were witnessed in the CPI inflation numbers.

Government response

What can the government do in such a situation? An El Nino event is not a certainty, yet the government should be prepared for it. The IMD could study the past patterns and indicate the regions that would be most vulnerable. States should provide consultancy services to the farmers to be prepared for such an adversity and advise on cropping action.

Continuous weather and price signals need to be provided on a real time basis. For this to be effective, the ban on futures trading in certain farm products like rice, pulses, oilseeds needs to be removed so that proper signals are received. The market is the best indicator of perceptions and futures prices will indicate how much the crops would be affected. Or else one will have to rely on futures prices on global exchanges which is probably not the best option.

Further, to buffer against a possible shortfall in output of some prime commodities, there should be contingency plans in place such as sourcing imports. And finally the government needs to ensure that banks are sensitive to this issue so that credit flow to farmers remains uninterrupted.

The writer is Chief Economist, Bank of Baroda. Views expressed are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.