Doubling farmers’ incomes was the policy objective behind farm reforms. However, the policy ambition had to confront the ‘Problem of Plenty’. Procurement at higher prices kept it attractive for many farmers to dispose of their produce to government agencies until a year ago.

Increased procurement ended up testing the mettle of the food storage system. Healthier procurement led to overflowing granaries and higher open storage that meant foodgrain wastage.

Augmented procurement led to higher storage of wheat (38 million tonnes) and paddy (21 mt) in end 2021. While some of these stocks get distributed through the public distribution mechanism, much of it has to be disposed of in the open market before it spoils.

MSP conundrum

What was kicked off as incentivising the farming economy through higher support prices to ensure food security eventually became a white elephant of the system draining the exchequer through mounting food subsidies. Thus, the higher support prices (higher than the market prices) continued to severely burden the exchequer besides stretching the storage capacity. However, the huge foodgrain stocks came in handy for supplying grain to the needy during the pandemic. FY21 also saw food subsidies peaking due to higher distribution to people hit by the pandemic. At the same time, global supply chain snarls allowed India to connect with other Asian nations looking for grain supplies.

Additionally, the supply shortages due to impaired weather/climatic conditions of a few Asian nations and the South American exporters augmented the demand for Indian grains. As the supply chain woes cleared up post the second wave, India's exports dwindled.

On the other hand, India's FY22 crude oil and natural gas imports moved north, pushed by global markets and a strong dollar. Grain prices also moved north after the Russian invasion of Ukraine. Stubborn energy costs and the halt of Russian supplies increased fertiliser costs as much of it was imported.

With fertilisers’ significant role in increasing crop productivity, it is time policymakers plan on sustainable exports of excess grains. The prices of fertilisers (with a high import content) have risen more sharply than those of wheat and rice, which implies that there should be no let-up in the effort to augment export of grain. In other words, higher exports will be needed to shore up the declining terms of trade of agriculture.

As nations dependent on Russia/Ukraine started looking for an alternative supplier of wheat, it was a blessing in disguise for India to enter new markets and consolidate grain exports in 2022. Wheat — the grain of temperate region — was the forte of Russia and Ukraine, which accounted for 28 per cent of global exports.

Flexible approach

Firstly, given the WTO commitments on limited procurement at fixed prices, India needs to adopt a flexible policy tied to domestic wheat price levels to allow private-sector exports.

Indian grain exporters must work with the respective Indian missions to promote and sustain exports in potential markets. Personnel at Indian missions abroad using their network of connections at the policy level could help exporters to connect with importers besides appraising the Indian exporters of local markets, trade policy, etc.

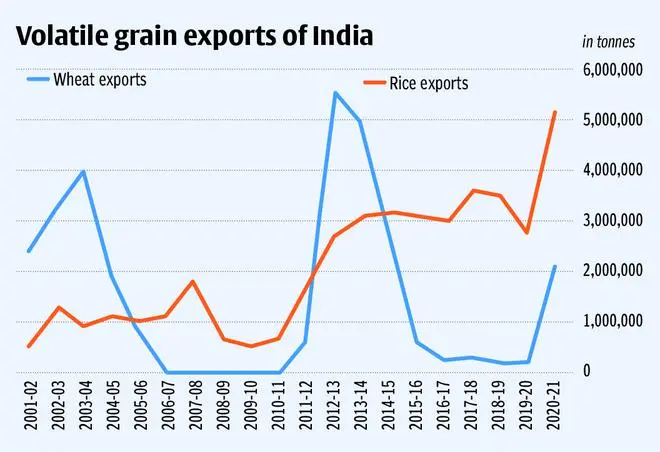

Despite the potential, India’s grains export performance has not been consistent in the last two decades as it has never been a vital part of trade policy. Our historical export performance indicates that to sustain India's agricultural exports, it's not mere government institutions or schemes that will help. Taking a cue from the experience of major farm goods exporters, growers must be organised under commodity boards/councils/committees empowering them to represent their interests.

Professionals funded by stakeholders should run such producer bodies. Their primary objective should be to ensure the economic well-being of their stakeholder growers through sustainable connectivity to markets — internal/external. They should also assist their stakeholders through appropriate negotiations on tariff/non-tariff barriers, export markets intelligence, and promotion.

Role for missions abroad

On the institutional front, all Indian missions located at the major agricultural export destinations should represent the Ministry of Agriculture/Animal husbandry and India's export interests appropriately. These missions must be asked to monitor issues in agricultural trade and collect critical market intelligence empowering Indian agricultural markets ecosystem stakeholders.

In addition, such a mission would remain a good connection for the Indian stakeholders at their destination and resolve trade issues cost-effectively. Further, Agriculture Ministry officials operating out of the diplomatic missions with the help of local employees can also collect market and competitive intelligence and share it periodically with our farmers.

Indian missions can also organise (reverse) trade missions to connect the local importers with the producer bodies to appraise the market terrain and help Indian exporters participate in local food fairs in the potential export markets.

Global agricultural trade has always been fickle. Concerns over phytosanitary issues make export of unprocessed agricultural commodities more sensitive. Identifying target importing nations and developing policy-level interactions and relationships will be critical to sustaining India’s exports.

More than that, the recent ban on wheat exports shows how volatile the situation is and underscores the need for planning.

How do we sustain our exports and safeguard our food security at the same time? Exports will help in reducing the procurement quantity, and hence the huge costs incurred in storing grains. They can reduce excess stocks, provided these become permissible under the WTO with respect to government-to-government transactions.

Sustainable and planned production will always create a surplus of foodgrains that can be exchanged with those in need and import those which can’t be grown economically in India.

The writers are with the National Institute of Securities Markets. Views expressed are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.