Against the backdrop of persistent inflationary pressure, in the recent past, sustained policy rate hikes have occurred across the world. But owing to the spate of bank failures in the US and Europe over the last few weeks, monetary policy design is faced with a difficult choice between price stability and financial stability.

The demand rebound after the pandemic, followed by the supply shocks caused by the Ukraine-Russia war, triggered global price surges. Initial signals of inflation were visible in early 2021 itself. Central banks were way behind the curve in recognising the threat of sustained inflationary headwinds.

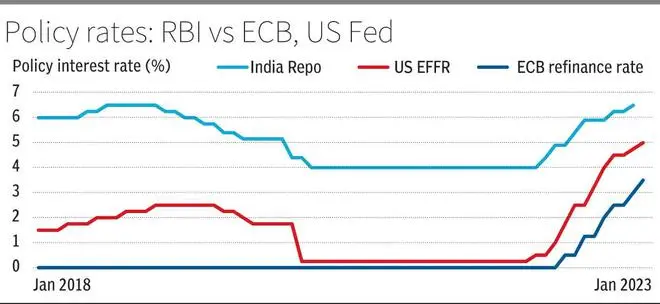

The rate hikes were highly synchronised in terms of size and pace across many regions, as shown in the Chart , which compares the actions of the RBI with the US Federal Reserve and European Central Bank (ECB).

Has the front-loaded and coordinated monetary tightening exercise been an effective and credible policy response to inflationary pressures? The year-on-year consumer price inflation numbers have started to soften in the latter half of 2022, though they are yet to align to central bank targets.

The extent of fall in CPI inflation from respective peaks in all three regions is broadly consistent with the potency of the rate hike relative to the cumulative price surge. One-year ahead inflation expectations have also begun to moderate, but haven’t yet anchored to policy goals. However, in the current environment, the goal for central banks is not only attainment of price stability. The challenges of a further increase in policy rates, in an emerging economy like India, are manifold:

Despite the apparent independence of monetary and fiscal policies, budget sustainability at a high cost of government debt will be a matter of concern. The task of smooth management of public debt may become more difficult for the RBI.

While India’s credit growth remains buoyant, higher cost of loans may create liquidity stress and default risk for private firms and households.

As yield curves harden, the mark-to-market losses on investment portfolios of banks will rise, erode capital adequacy and create fragility in the banking sector. The RBI may have to increase Held-to-Maturity (HTM) limits further, so that banks continue to buy government bonds without pressure on their profitability.

However, without a rate hike, the depreciation of the rupee may hurt capital flows, while costlier imports may force inflation to persist. The recent decline in import volumes may offset the burden on current account deficits, to a certain extent.

In March 2023, the central banks of major advanced economies administered one more round of interest rate increase, as they remain committed first and foremost to curbing inflation. The RBI has had to choose between alignment with global monetary policies and dissociation from the rest of the world, to navigate uncharted waters. It decided to keep repo rates unchanged in its April meet, even as it continues to remain vigilant about inflationary headwinds.

The writers are on the faculty of National Institute of Bank Management, Pune

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.