Milton Freidman famously said, “Inflation is taxation without legislation”. The impact of inflation — the overall increase in prices in an economy — is felt by everyone. High inflation adversely affects the poor, even making necessities unaffordable in certain situations. Individuals, therefore, form expectations about how prices will behave in the future to take precautions.

If they anticipate high inflation, individuals negotiate wages or rents to compensate against a potential fall in their purchasing power. Increased wages raise the cost of production, making expectations self-fulfilling and, therefore, playing a pivotal role in determining inflation.

High inflationary expectation can also harm the saving-consumption behaviour of individuals, having ramifications on their long-term wealth.

The RBI released the Inflation Expectations Survey of Households (IESH) for March on Friday. The results on the inflation expectations are based on responses from around 6,000 urban households in 19 major cities. The scheduled release coincides with the completion of two years from the period of the first Covid-induced lockdown.

Inflation and Covid

The last two years’ surveys, therefore, capture individuals’ perceptions during the three waves of Covid-19 and various phases and levels of lockdown. Against the backdrop of new empirical studies, the survey results viewed before and after the pandemic period present interesting behavioural insights, particularly from a gender perspective, for public policy.

Central banks raise interest rates to “anchor” high inflationary expectations primarily when temporary price shocks, on account of drought or disruption in global supply chains, entail the risk of getting transmitted into actual inflation. To what extent can a rise in interest rates reduce high inflationary expectations? One must cautiously examine factors behind inflation expectations since any misreading could lead to perverse policy decisions.

A significant factor shaping perceptions on inflation are the prices that individuals observe in their daily lives, originally posited by Robert Lucas in his seminal Islands model[1]. A recent study by Acunto, et al., 2020, validates that what agents frequently purchase, instead of the those purchased infrequently, shape their perception on the general level of inflation [2].

By their inherent nature, goods purchased frequently such as groceries and other daily needs tend to be low-priced and highly volatile in comparison to those which are bought seldom. In other words, the prices of the lower-priced potatoes, milk, or apples frequently purchased shape the aggregate inflation expectations more than that of infrequent purchase of a high-priced car or a washing machine, even though they constitute a substantial expenditure share of the individual.

Therefore, generalising aggregate inflation expectations for making general views of prices in the economy could be misleading. Instead, supply management of volatile goods purchased daily could be more effective in anchoring inflationary expectations than raising interest rates.

The gender angle

This insight has implications for gender-based differences in anticipating inflation in the future. Existing literature shows that women have systematically higher inflationary expectations compared to men. Economic theories explain this divergence by stating that women are “more pessimistic” than men, attributing the pessimism to the difference in their innate characteristics, lack of education, financial literacy, and preferences.

However, new studies reveal that it is not the innate characteristics as much as the traditional gender roles that explain this divergence! We live in a world where women, arguably homemakers, traditionally do more frequent grocery shopping than men.

To test its validity, trends of Inflation Expectations Survey of Households (IESH) before and after the Covid-induced lockdown period present themselves as a crude “natural experiment”. Natural experiments are real-life circumstances that can be studied to determine the cause-and-effect relationship among sections of people with different exposure levels to an assumed causal factor.

The authors hypothesise that if traditional gender roles are the primary reasons behind the gender inflation expectation gap, then lockdown imposed Work-From-Home (WFH) arrangements or loss of employment should close this gap. The logic is that during the lockdown, people from occupations in urban cities lost jobs or/and remained at home, spending sufficient time in household activities and taking a relatively equal share in the frequent day-to-day purchases such as grocery shopping.

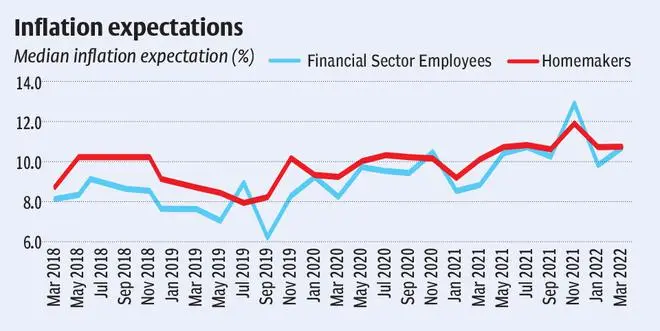

Two categories of occupation are studied here: Homemakers (assumed to be dominated by women) and financial sector employees (assumed to be dominated by men). Financial sector employees are also a proxy for financial literacy — a skill gap contributing to the “gender expectation gap”.

Looking at the median inflation expectation for one year ahead starting from March 2018, homemakers, on average, report higher inflation expectations than financial sector employees until March 2020, when the first lockdown was introduced. However, this gap narrowed thereafter and even converged in March 2022.

A possible explanation could be the gradual “experience effect” of male-dominated financial sector employees. Experience effect, contrary to rational expectations theory that assumes individuals base their decisions on the information available to them, is based on the premise that actual personal experiences shape behaviour more than being informed about the outcome of the event.

While the evidence may be preliminary, ‘reading the tea leaves’ from these observations could be interesting to revisit the assumptions of traditional economic theories.

Focus therefore, could be shifted more on the micro-foundations, i.e., understanding macroeconomic outcomes by studying factors that shape individual behaviour and decision making.

Kashyap is Assistant Director, NITI Aayog, and Mitra, Professor of Economics, Institute of Economic Growth. Views expressed are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.